in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Claiming Lifetime Learning Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming Lifetime Learning Credit

I was told that I could claim it.

I was a graduate student in 2020, received scholarships/grants to cover tuition and other educational expenses. This includes room & board. I also received loans. In the grand scheme of things, I just paid what I needed to pay, so I am not sure which "money type" went towards room & board vs tuition. All I know is that all the scholarships/grants I received went towards my educational expenses. When I ran the numbers through Turbotax without selecting room & board, it said I did not qualify. Am I missing something here?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming Lifetime Learning Credit

Only tuition and fees are qualified educational expenses (QEE) for the Lifetime Learning Credit (LLC). Room and Board, books and computers are not. Usually the box 1 amount, on form 1098-T, is the all qualified expenses for the LLC (the AOTC is a little different)

How you do this may be best explained by example: You have a 1098-T with $15,000 in box 1 and $8000 inbox 5. You need $10,000 of QEE to get the maximum $2000 LLC. That leaves only $5000 of expenses to be covered by the scholarships on a tax free basis*. In order to claim $10,000 of qualified expenses, you must claim $3000 of your scholarship as taxable income. In TurboTax, you do this by designating $3000 of the scholarship for room & board.

*Books, computers and other required course materials are qualified expenses for tax free scholarships, but not the LLC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming Lifetime Learning Credit

It depends.

In addition to what Hal_Al stated above, make sure you meet the other requirements to claim the Lifetime Learning credit as shown in the link below.

Lifetime Learning Credit eligibility

You can review the results for your particular case by doing the following:

Go back into your federal interview section.

- Select Deductions & Credits

- Select Expenses and Scholarships (Form 1098-T)

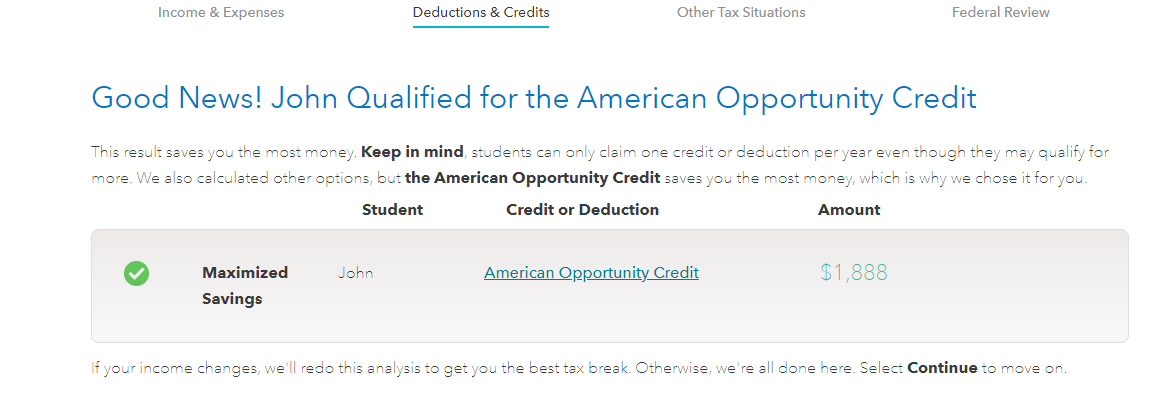

- Select Continue through the pages until you see Next, We'll See Which Deduction or Credit Will Save You the Most

- Select Maximize Your Tax Break

- You will see the following screen showing what you qualify for.

If you do not see any credit generated, review your input to ensure you entered all of your education expenses as reported on your 1098-T form.

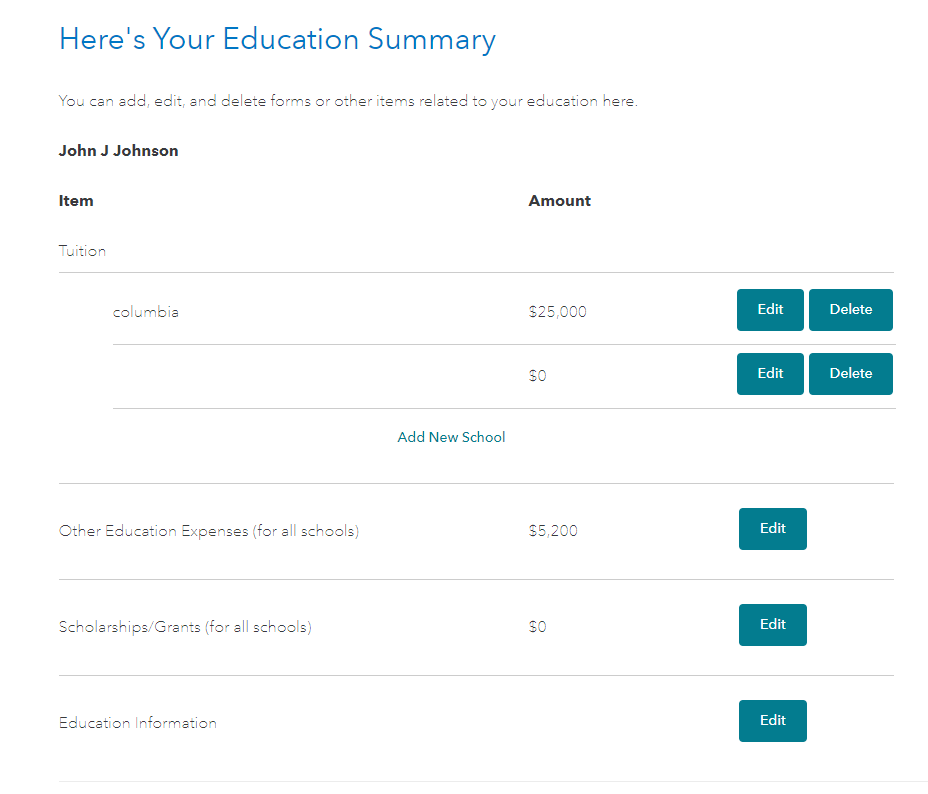

- Go to the Federal section of the program

- Select Deductions & Credits

- Select Expenses and Scholarships (Form 1098-T) and click start

- Select Edit to the right of your student's name to review or input your information for the 1098-T

- Make sure the amounts entered match your form. Also, if you have additional expenses not listed on your 1098-T form, you can enter those under Other Education Expenses on the page titled Here's Your Education Summary.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming Lifetime Learning Credit

Thank you for your responses. Is it worth it to claim the credit? My box 5 is greater than box 1 on my 1098-T. I could allocate some amount as room and board.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming Lifetime Learning Credit

The LLC is 20% of tuition. If you're in the 12% (or less) tax bracket, you ostensibly come out ahead. Unfortunately taxes aren't that simple. Adding income could, for example, make you eligible for less Earned Income Credit. The only way to be sure, is prepare taxes both ways and compare.

This tool may be helpful: https://turbotax.intuit.com/tax-tools/calculators/taxcaster/?s=1

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Dave183

Level 2

QRFMTOA

Level 5

in Education

jschoomer

Level 3

ldlicardi

New Member

00-t-burke

New Member