- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

It depends.

In addition to what Hal_Al stated above, make sure you meet the other requirements to claim the Lifetime Learning credit as shown in the link below.

Lifetime Learning Credit eligibility

You can review the results for your particular case by doing the following:

Go back into your federal interview section.

- Select Deductions & Credits

- Select Expenses and Scholarships (Form 1098-T)

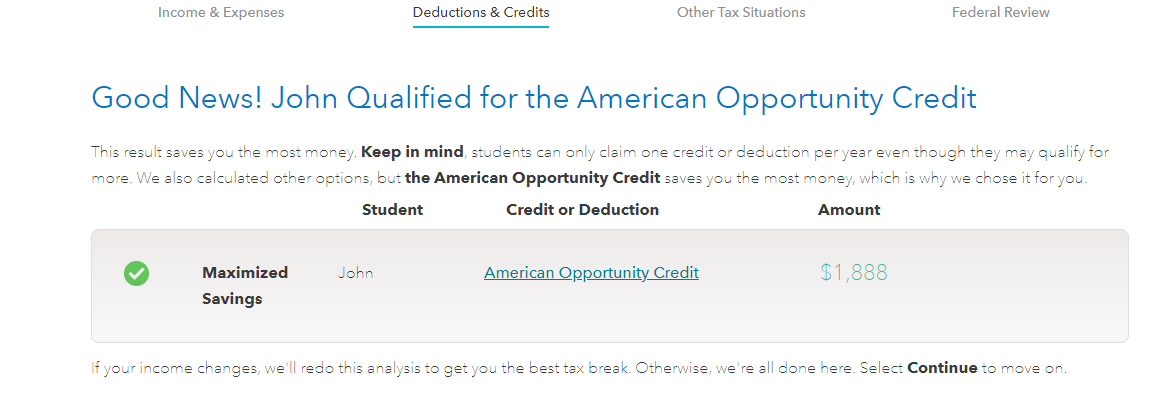

- Select Continue through the pages until you see Next, We'll See Which Deduction or Credit Will Save You the Most

- Select Maximize Your Tax Break

- You will see the following screen showing what you qualify for.

If you do not see any credit generated, review your input to ensure you entered all of your education expenses as reported on your 1098-T form.

- Go to the Federal section of the program

- Select Deductions & Credits

- Select Expenses and Scholarships (Form 1098-T) and click start

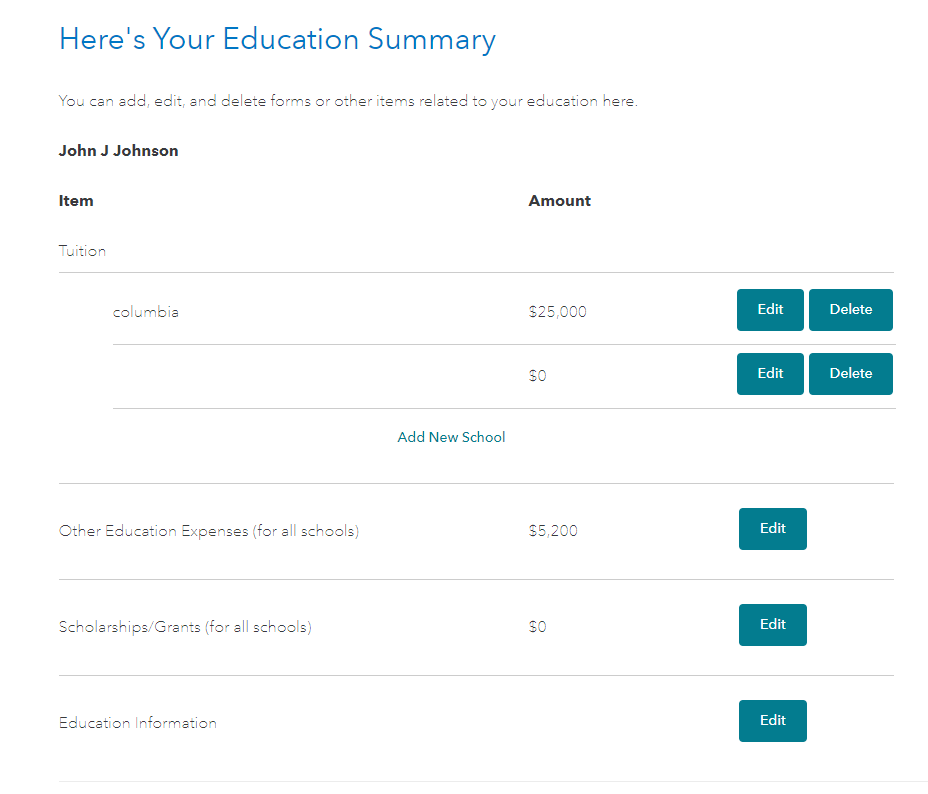

- Select Edit to the right of your student's name to review or input your information for the 1098-T

- Make sure the amounts entered match your form. Also, if you have additional expenses not listed on your 1098-T form, you can enter those under Other Education Expenses on the page titled Here's Your Education Summary.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 21, 2021

2:59 PM

514 Views