- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- When should I submit W2/W3 for my business as the business is closing this month

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When should I submit W2/W3 for my business as the business is closing this month

Hi, I see the this quote from IRS site for the instruction of closing a business:

You should provide Forms W-2 to your employees by the due date of your final Form 941 or Form 944. Generally, you furnish copies B, C and 2 to the employees. You file Form W-3, Transmittal of Income and Tax Statements to transmit Copy A to the Social Security Administration.

It is quoted from this IRS link: https://www.irs.gov/businesses/small-businesses-self-employed/closing-a-business#File%20a%20Final%20...

My question is when should I submit W2/W3 for my S Corp business as I am closing the business this month and I am the sole owner/employee of the business. Is it by the due date of your final Form 941 (7/31/2022) as the above quote or 1/31/2023 as usual?

Thanks in advance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When should I submit W2/W3 for my business as the business is closing this month

First you are the only employee so does it really matter when you get the form? And the SSA will not expect it until Jan 2023 so sending it early is unneeded.

Next ... good luck finding the 2022 RED forms now ... if you can get them prior to the end of the year then file it now otherwise you can wait until January when the online system is operational for the 2022 forms and/or you can get them from the IRS. There is no penalty for waiting until Jan. NOTE in the instructions the word "should" is used not the terms "must" or "required". Most businesses that close before the end of the tax year don't want to be bothered next Jan with these admin tasks since there is no one around to do them but you will be. If you used a payroll company you would pay them for the final work in advance so that they would complete the year end payroll forms for you automatically. If you were to try to file them now you would have to use 2021 forms and cross off the 2021 and write in 2022 then mail them in to the SSA where they will be placed in a stack waiting for Jan 2023 to ring in and the 2022 program opens for data entry.

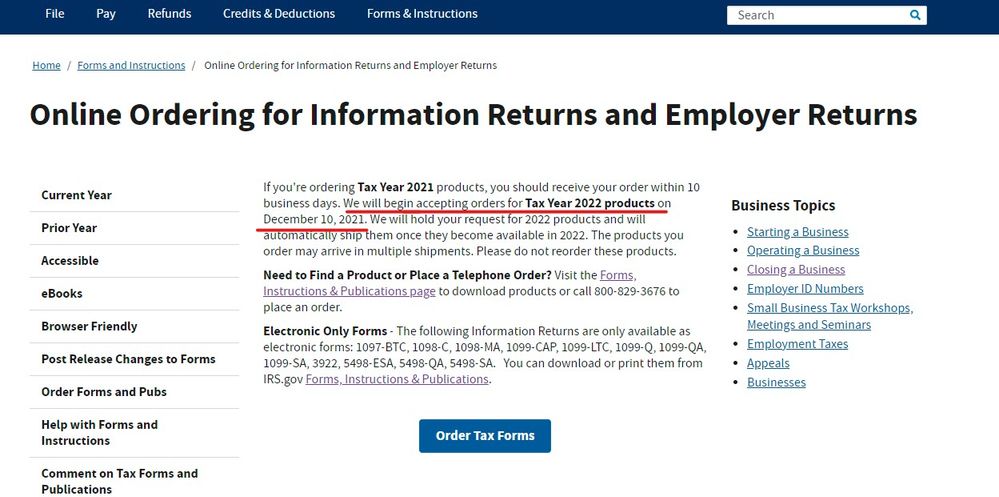

NOTE on the IRS website those 2022 forms will not go out until Dec at best so what is the rush ?

https://www.irs.gov/businesses/online-ordering-for-information-returns-and-employer-returns

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When should I submit W2/W3 for my business as the business is closing this month

You may file a final 941 before the end of the year but the final 940 & W-2/W-3 forms are not due until the end of January which makes it convient as that is when the forms are ready for filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When should I submit W2/W3 for my business as the business is closing this month

Thanks for the reply, @Critter-3. I saw several articles saying that I need to file W-2/W-3 by the due date of the final quarterly form 941, which is 7/31/2022. Can you show me where your information is coming from please? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When should I submit W2/W3 for my business as the business is closing this month

Follow the instructions here : https://www.irs.gov/businesses/small-businesses-self-employed/closing-a-business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When should I submit W2/W3 for my business as the business is closing this month

Yes, that's where I found the information saying that "You should provide Forms W-2 to your employees by the due date of your final Form 941 or Form 944. Generally, you furnish copies B, C and 2 to the employees. You file Form W-3, Transmittal of Income and Tax Statements to transmit Copy A to the Social Security Administration." as I mentioned in the original question. It seems to me saying that I need to file W2 before 7/31/2022 (deadline for 941 Q2). Is that correct? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When should I submit W2/W3 for my business as the business is closing this month

First you are the only employee so does it really matter when you get the form? And the SSA will not expect it until Jan 2023 so sending it early is unneeded.

Next ... good luck finding the 2022 RED forms now ... if you can get them prior to the end of the year then file it now otherwise you can wait until January when the online system is operational for the 2022 forms and/or you can get them from the IRS. There is no penalty for waiting until Jan. NOTE in the instructions the word "should" is used not the terms "must" or "required". Most businesses that close before the end of the tax year don't want to be bothered next Jan with these admin tasks since there is no one around to do them but you will be. If you used a payroll company you would pay them for the final work in advance so that they would complete the year end payroll forms for you automatically. If you were to try to file them now you would have to use 2021 forms and cross off the 2021 and write in 2022 then mail them in to the SSA where they will be placed in a stack waiting for Jan 2023 to ring in and the 2022 program opens for data entry.

NOTE on the IRS website those 2022 forms will not go out until Dec at best so what is the rush ?

https://www.irs.gov/businesses/online-ordering-for-information-returns-and-employer-returns

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When should I submit W2/W3 for my business as the business is closing this month

Does this still apply in 2024? I'm preparing to file my final 941 form and I'm closing my business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When should I submit W2/W3 for my business as the business is closing this month

I'm also searching for an answer. I found a page on the IRS website to order the 2024 forms, but the Form 940 form they mailed to me is for 2023 and the Packing Slip says that "Some items are backordered and will be sent when available."

Years ago, I had the same issue and was told by one of the IRS agents to just cross out the Year on the latest version of the form and to write in the year that the form is being filed for. I need to file year end forms for a client by July 31st of this year and can't find any information at all about what to do. I'm not sure if this is the correct way to file the forms but will just cross out last year on the forms and hand write this year. I also plan to mail a copy of the W-2s in January of next year since I know none of the employees will remember where they put the copy I'll mail soon.

Please post if someone finds a better answer!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When should I submit W2/W3 for my business as the business is closing this month

Per the IRS, if you terminate your business, you must provide Forms W-2 to your employees for the calendar year of termination by the due date of your final Form 941 or 944. You must also file Forms W-2 with the SSA by the due date of your final Form 941 or 944. If filing on paper, make sure you obtain Forms W-2 and W-3 preprinted with the correct year. If e-filing, make sure your software has been updated for the current tax year.

If filing on paper, I would recommend you wait to file the 940 when the correct form is available. You can still file a final 941 and issue the W-2's by July 31st.

You can also e-file. Click here for a list of 2024 providers.

@cere5

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17557136899

New Member

ej13722

New Member

a-bbook

Returning Member

TaxesForGetSmart

Level 1

jetblackus

New Member