- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

First you are the only employee so does it really matter when you get the form? And the SSA will not expect it until Jan 2023 so sending it early is unneeded.

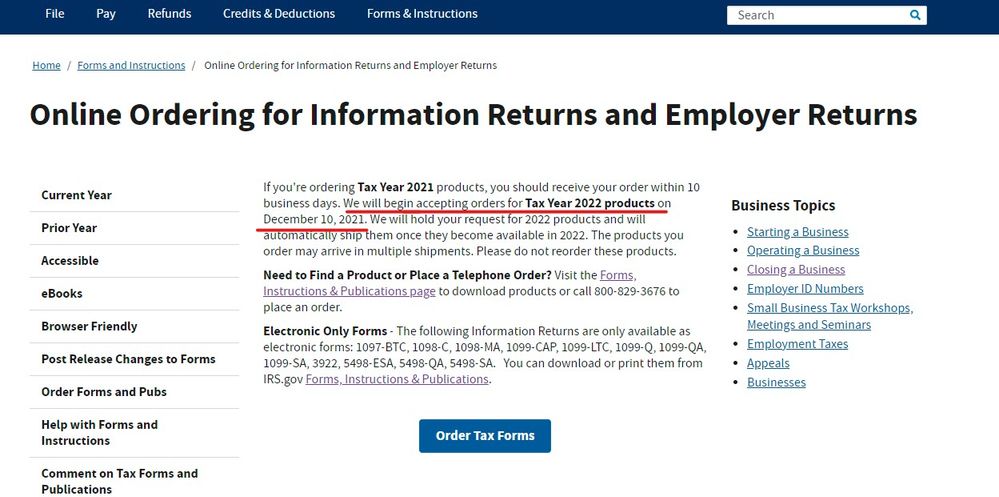

Next ... good luck finding the 2022 RED forms now ... if you can get them prior to the end of the year then file it now otherwise you can wait until January when the online system is operational for the 2022 forms and/or you can get them from the IRS. There is no penalty for waiting until Jan. NOTE in the instructions the word "should" is used not the terms "must" or "required". Most businesses that close before the end of the tax year don't want to be bothered next Jan with these admin tasks since there is no one around to do them but you will be. If you used a payroll company you would pay them for the final work in advance so that they would complete the year end payroll forms for you automatically. If you were to try to file them now you would have to use 2021 forms and cross off the 2021 and write in 2022 then mail them in to the SSA where they will be placed in a stack waiting for Jan 2023 to ring in and the 2022 program opens for data entry.

NOTE on the IRS website those 2022 forms will not go out until Dec at best so what is the rush ?

https://www.irs.gov/businesses/online-ordering-for-information-returns-and-employer-returns