- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- TurboTax Desktop - Form 4797 Issues

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop - Form 4797 Issues

I'm struggling to get an accurate value into Form 4797 using turbtax desktop.

Here is the scenario - sold a vehicle partially used for business in 2021.

- Purchased new in 2018 for 25k and used standard mileage rate the first year, actual expenses for 2019\2020.

- Depreciation taken 2018 - 2020 = $4040 (including the calculated depreciation from 2018 standard miles)

- Business Usage for life of vehicle = 23% (based on logged miles annually)

- On the 2021 Return I'm using standard mileage deduction in the amount of $120 for 215 business miles of 7927 total miles.

- Sold in 2021 for 25.5k. Business proceeds = 25.5k*23% = 5.8k

With the above in mind, my understanding is that the gain generated here would be on the business portion of the vehicle using an adjusted cost basis to account for the accumulated deprecation.

Cost Basis: $5750 (25k*23%)

Proceeds: $5865 (25.5k*23%)

Depreciation: $4096 (2018-2020: $4040, 2021:$56 or .26 per mile on 215 miles)

Adjusted Cost Basis: $1654

Gain to report: $4211 ($5865-$1654)

Is this correct?

When I enter these values into TurboTax I get a gain of $5865 which makes no sense to me.

Form 4797 is showing odd values:

Line 20 (Proceeds) - $5865

Line 21 (Cost basis) - $678

Line 22 (Depreciation) - $678

Line 23 (Adjusted Basis) - $0

Line 24 (Total Gain) - $5865

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop - Form 4797 Issues

If you entered the transaction in full in the vehicle section, you should use the steps below to handle both the vehicle section and the sale separately.

I would suggest you select it was sold/disposed of and then enter the date. Use the depreciation you have calculated using the depreciation portion of the standard mileage rate (chart attached below). Indicate that it was not sold, simply removed from service.

- Take down all business miles for all years.

- Take the total business miles divided by the total miles (all years both businesses) for the actual business use percentage.

- Multiply that percentage by the original full cost of the vehicle. This is the business portion of the original cost basis for the vehicle.

- Write down the total depreciation expense for all years. This is the total depreciation used on the vehicle.

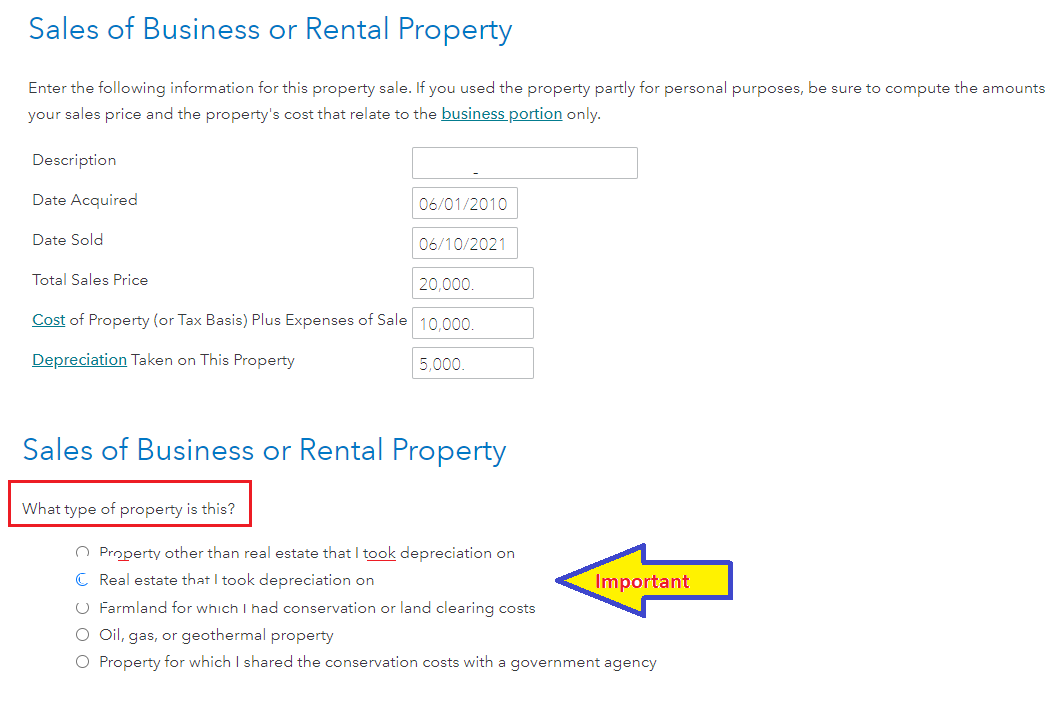

- Now you are ready to enter the sale of the vehicle under Sale of Business Property (not the business activities).

To record the sale of a business asset (vehicle) outside of the business/asset entry.

- Sign into your TurboTax account:

- Select that you disposed of the asset and answer the questions as though it was disposed of

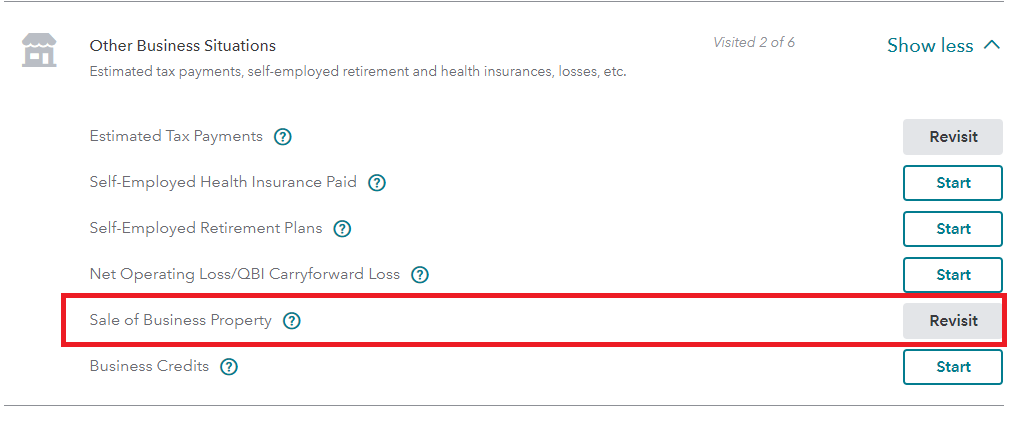

- Under Wages & Income >Other Business Situations > Sale of Business Property >Start or Revisit > Enter your sale

- See the images below for assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jmann7

New Member

doanmr3

New Member

SB2013

Level 2

steve-knoll

New Member

bees_knees254

New Member