- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

If you entered the transaction in full in the vehicle section, you should use the steps below to handle both the vehicle section and the sale separately.

I would suggest you select it was sold/disposed of and then enter the date. Use the depreciation you have calculated using the depreciation portion of the standard mileage rate (chart attached below). Indicate that it was not sold, simply removed from service.

- Take down all business miles for all years.

- Take the total business miles divided by the total miles (all years both businesses) for the actual business use percentage.

- Multiply that percentage by the original full cost of the vehicle. This is the business portion of the original cost basis for the vehicle.

- Write down the total depreciation expense for all years. This is the total depreciation used on the vehicle.

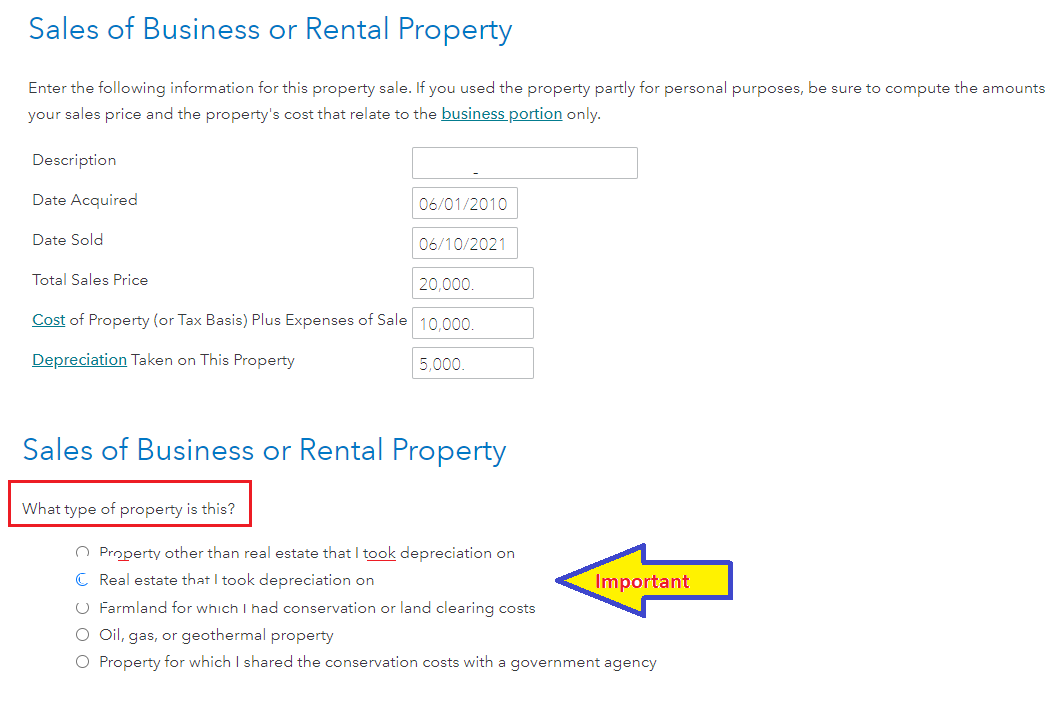

- Now you are ready to enter the sale of the vehicle under Sale of Business Property (not the business activities).

To record the sale of a business asset (vehicle) outside of the business/asset entry.

- Sign into your TurboTax account:

- Select that you disposed of the asset and answer the questions as though it was disposed of

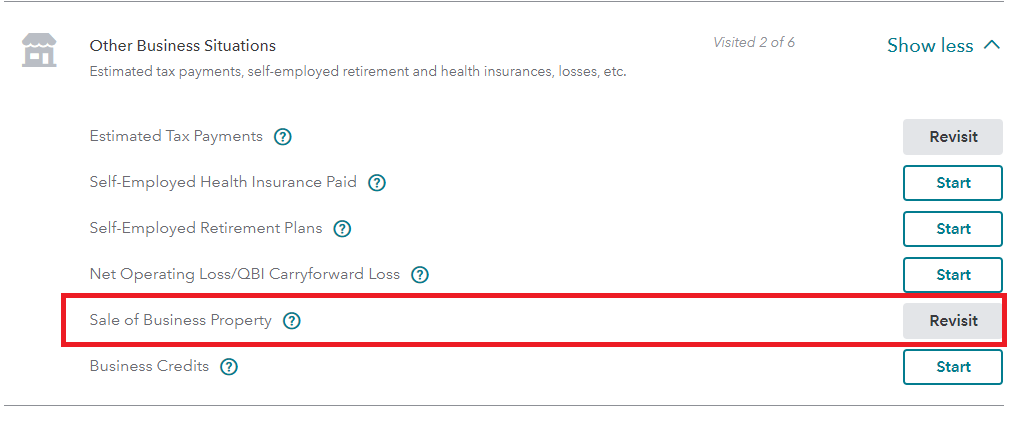

- Under Wages & Income >Other Business Situations > Sale of Business Property >Start or Revisit > Enter your sale

- See the images below for assistance.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 14, 2022

6:49 AM