- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Schedule C, Line 25 has data that cannot be edited or deleted, and the right click for "Data Source" is greyed out. Where does the data flow from so that I can edit this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C, Line 25 has data that cannot be edited or deleted, and the right click for "Data Source" is greyed out. Where does the data flow from so that I can edit this?

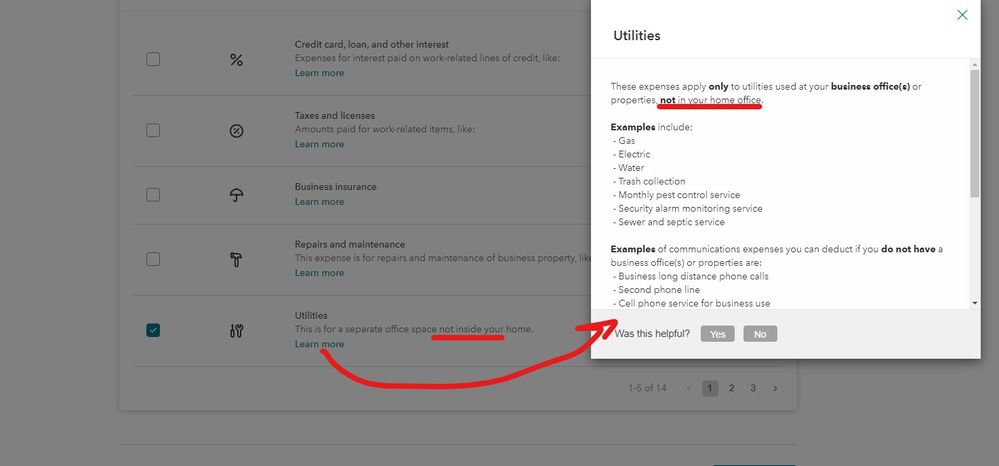

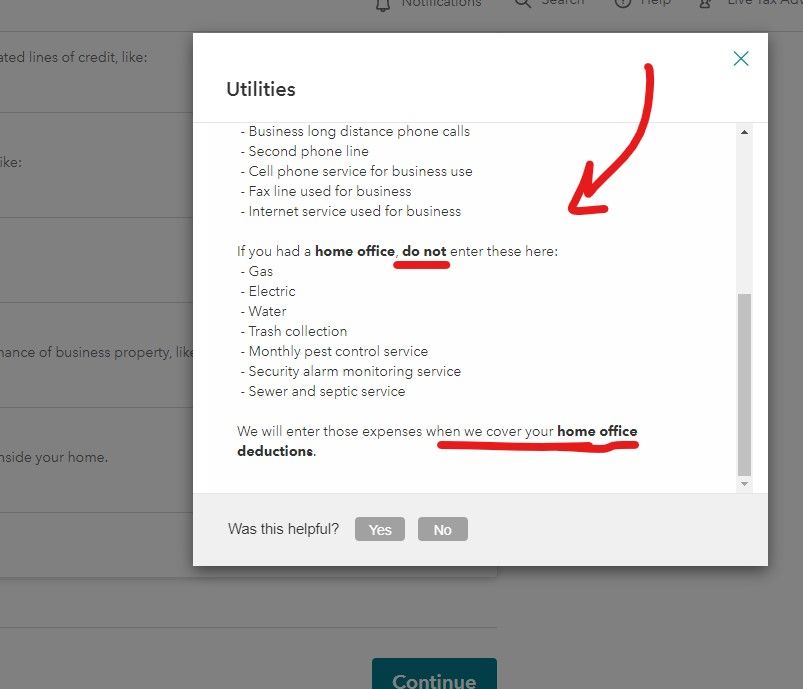

Line 25 on Schedule C is for Utilities, like a separate telephone line. In my return, there is an amount pre-filled and I cannot change or delete it, nor can I determine where it came from. It was not an imported amount from Quicken, and it did not transfer from last year's return. The right-click menu option for "Data Source" is greyed out. I need to edit this amount, and there is no way to do so.

**SOLVED**

TurboTax has created a form that I had not seen before, it is called "Schedule C Worksheet." Apparently this is where imported data goes, and the information form this worksheet flows to Schedule C. If you don't import from Quicken, then this form will not be used. However, TurboTax does not provide a "Data Source" link, nor does the Worksheet appear in your list of forms in use. This lack of cross-references is a bug that TurboTax needs to fix.

Thanks to TurboTaxDawnC's post https://ttlc.intuit.com/replies/6596496 which provided the solution here.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C, Line 25 has data that cannot be edited or deleted, and the right click for "Data Source" is greyed out. Where does the data flow from so that I can edit this?

Line 25 also includes Communications. Turbo Tax has separate entries for Communication and Utilities but they added together.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C, Line 25 has data that cannot be edited or deleted, and the right click for "Data Source" is greyed out. Where does the data flow from so that I can edit this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C, Line 25 has data that cannot be edited or deleted, and the right click for "Data Source" is greyed out. Where does the data flow from so that I can edit this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C, Line 25 has data that cannot be edited or deleted, and the right click for "Data Source" is greyed out. Where does the data flow from so that I can edit this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C, Line 25 has data that cannot be edited or deleted, and the right click for "Data Source" is greyed out. Where does the data flow from so that I can edit this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C, Line 25 has data that cannot be edited or deleted, and the right click for "Data Source" is greyed out. Where does the data flow from so that I can edit this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C, Line 25 has data that cannot be edited or deleted, and the right click for "Data Source" is greyed out. Where does the data flow from so that I can edit this?

I thought I would address a couple of issues in this string. The Schedule C Line 25 Utilities is indeed a sum of the Turbo Tax entries for utilities and communications. However, it is important to note that if you Work from Home (WFH) and have a home office, then your typical home utility expenses (electric, gas, water) are entered in the IRS Form 8829 and then are prorated for the % of your home that is used for business. Then, only any those utility expenses that are dedicated to your business, such as an additional dedicated land line or a % of your mobile phone cost, would be entered in Schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C, Line 25 has data that cannot be edited or deleted, and the right click for "Data Source" is greyed out. Where does the data flow from so that I can edit this?

Anyone who has a Sch C needs to understand all the rules and regs for that form ... Either by reading up on them, using a paid tax pro and/or just reading the DIY program screens carefully ...

If you are new to being self employed, are not incorporated or in a partnership and are acting as your own bookkeeper and tax preparer you need to get educated ....

If you have net self employment income of $400 or more you have to file a schedule C in your personal 1040 return for self employment business income. You may get a 1099-Misc for some of your income but you need to report all your income. So you need to keep your own good records. Here is some reading material……

IRS information on Self Employment….

http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Self-Employed-Individuals-Tax-Center

Publication 334, Tax Guide for Small Business

http://www.irs.gov/pub/irs-pdf/p334.pdf

Publication 535 Business Expenses

http://www.irs.gov/pub/irs-pdf/p535.pdf

Home Office Expenses … Business Use of the Home

https://www.irs.gov/businesses/small-businesses-self-employed/home-office-deduction

https://www.irs.gov/pub/irs-pdf/p587.pdf

Publication 946 … Depreciation

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anthony3180

New Member

gma2003

New Member

univ0298

Level 2

sbui102

New Member

bschwen2

New Member