- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Where do I enter a K1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a K1?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a K1?

The schedule K-1 is actually created in TurboTax Business when filing a business return for your LLC, S Corp, C Corp or trust.

To enter a Schedule K-1 (If you already have received a K-1 and need to enter it )

- Click on Federal Taxes (Personal if using Home and Business)

- Click on Wages and Income (Personal Income if using Home and Business)

- Click on I'll choose what I work on (if shown) or Add more income

- Scroll down to S-corps, Partnerships, and Trusts, click show more,

- On Schedule K-1, click on the start or update button

Note: You may be prompted to upgrade to Premier, if you are using the Federal Free version of TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a K1?

The schedule K-1 is actually created in TurboTax Business when filing a business return for your LLC, S Corp, C Corp or trust.

To enter a Schedule K-1 (If you already have received a K-1 and need to enter it )

- Click on Federal Taxes (Personal if using Home and Business)

- Click on Wages and Income (Personal Income if using Home and Business)

- Click on I'll choose what I work on (if shown) or Add more income

- Scroll down to S-corps, Partnerships, and Trusts, click show more,

- On Schedule K-1, click on the start or update button

Note: You may be prompted to upgrade to Premier, if you are using the Federal Free version of TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a K1?

If I have 10 K-1s to enter for 2019 that were the same as ones from 2018, turbo tax prompts me for each one. Is there a way to skip to one I want to work on?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a K1?

@YahWehLikes68

If you wish to skip a schedule K-1, just click Continue until you get to the end the K-1 entry.

You can always go back and edit the skipped K-1 later.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a K1?

Which download version do I need to be able to enter my k-1 i received for 2020. Does the deluxe version let you enter k-1 you have received?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a K1?

The Desktop/CD version of TurboTax Basic or Deluxe will allow you to enter K1 income.

TurboTax online you will need Premier or above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a K1?

I read the replies posted here and they are confusing.

For tax year 2021 which Turbotax software version do I need to enter income from a K-1 form?

The replies to my question contradict each other. One states Premier, another states Deluxe, yet another state Home or Business.

Why does there need to be different version online that does the same as a desktop version?

I have struggled with this answer for years because Turbotax makes it too complicated to determine. Bad business!

Note I have been reading and searching online for over 30 minutes trying to determine this answer and still haven't found a solid answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a K1?

A Schedule K-1 can be entered into Premier or Home and Business. In the desktop version, you could also enter it directly in forms mode in Deluxe, but it is not recommended. There is no guidance in Deluxe for the Schedule K-1.

If you are looking for the interview mode, you can use Premier or Home and Business for the K-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a K1?

Thanks for the strong reply. Please clarify which "desktop " 2021 TurboTax software options work best for entering income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a K1?

That depends on your tax situation. Home and Business handles the most tax situations, so if you are going to deduct something like a self-employed retirement plan or self-employed health insurance, then Home and Business would be best for you.

Having a Schedule K-1, Home and Business may work best for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a K1?

Thanks for you fast reply.

The Home and Business software is the one I had purchased. Now I'm confident it's the one I need to complete my 2021 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a K1?

The Desktop Home & Business version is the highest version. It has everything all the other versions have. Actually All the Desktop programs have the same forms. You just get more help and guidance in the higher versions.

To enter a K-1 in the Home & Business version go to

Personal

Personal Income

Choose I'll choose what I work on

Then scroll way down to Business Investment and Estate/Trust Income

Schedule K-1 - Click the Start or Update button

Be sure to pick the right kind of K-1. There are 3 kinds, 1041, 1065 & 1120S

Enter each K-1 Separately.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a K1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a K1?

To enter a Schedule K-1 which you have received, in TurboTax Online:

- Click on the Federal, on the left, in the black toolbar

- Select Wages and Income or(Income and Expenses), at the top tab

- Scroll down and click on Show More for S-corps, Partnerships, and Trusts

- Click on Start or Revisit for Schedule K-1

Please be sure you select the correct type of K-1, as there are several forms with use them and the boxes are different in each one.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a K1?

This is my 1st year using turbo tax but I used quickbook online just to find out I need intuit desktop because I have an S Corp and had to use turbo tax business so the information in quicbooks is of no use to me and does not transfer over.

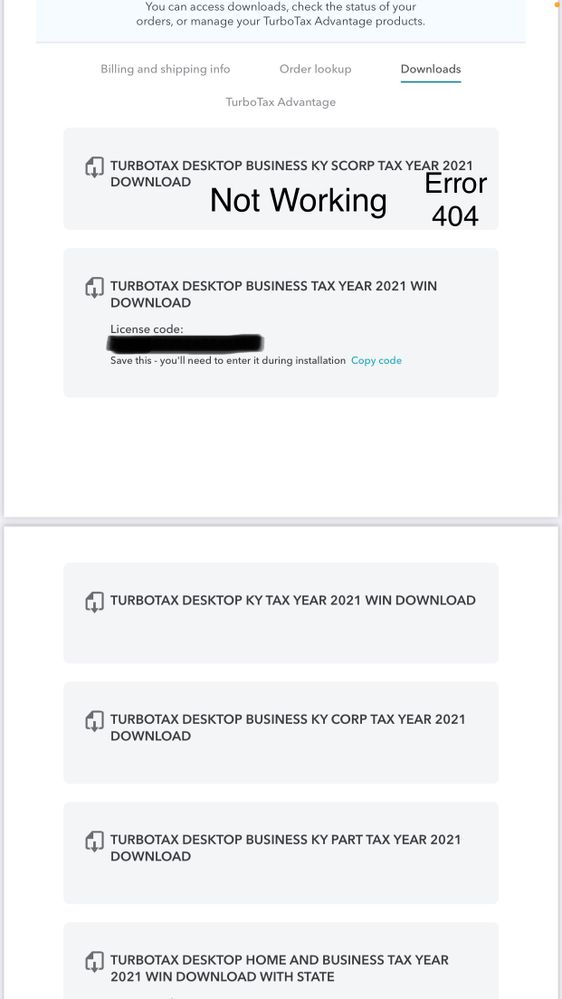

The sales representatives and product experts were unable to help me. I literally purchased like 5 products directly from the reps for S Corp and they were all wrong. Finally I purchased TurboTax desktop business and it worked but now they are having an issue with the Kentucky S Corp state which I purchased additionally, Error 404

Now I am here again confused because I am going to have to file my federal without my state for S Corp and I was told to use home and business for my personal tax return and I need to know where to enter the K1 because there are no prompts… I’ve been working on this for weeks trying to figure out what’s best.

One of the reps even told me to Google it. Definitely confused. I have talked to 7 or 8 TurboTax reps and product specialist but they didn’t seem any more knowledgeable than myself.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

fkinnard

New Member

john

New Member

rodiy2k21

Returning Member

dave-j-norcross

New Member