- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: What figure to enter from K-1 line 20 code Z stmt?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Hi :

I don't know if this will help you or not, but number that I entered for "Z" was the rental income (loss), the same as in box 2 of the K1. I thought that was it, but every time I tried to finish and submit my return electronically, TT did its "one last check before you submit" and wouldn't let me continue. It said that I couldn't submit electronically and to submit by mail. That made no sense. I finally figured out that it wasn't looking for that number (box 2 of the K1) but the gross rental real estate income which I found on the K3 Part II, line 3A. Don't ask me why but as soon as I went back and put that number in, everything worked.

Good Luck!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

You don't have to enter anything in the code Z box - you can leave it blank - you will enter the details of code z (from your statement) on a later screen (the one that asks for the 199A details). @sssrandall

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Thank you!

now when reporting the details from the statement for line 20-Z, there are 2 companies listed with different EIN #’s. One is the EIN for the company that issued the K1, the 2nd is different and is a “pass through” company. How do I report the values for each??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

If your 'line 20-Z' information provides two EIN's, do your attachments also provide a breakdown of the other K-1 boxes by EIN?

It may be possible to enter two separate EIN entries for boxes 1 through 20 as if you received two separate K-1 forms. This would insure the proper cost basis for the assets and proper qualified business income deduction.

Original K-1 EIN 1 EIN 2

Box 1 $1,000 = $1,000

Box 2 $500 = $500

Box 4 $100 = $75 $25

Box 5a $200 = $150 $50

Box 5b $100 = $75 $25

W-2 wages $50,000 = $25,000 $25,000

UBIA $100,000 = $50,000 $50,000

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

I spoke to an advisor yesterday and was instructed to do a second dummy k-1 using the second EIN, same address, but not to fill out any information other than the data on line Z. It seemed to work, although I don't know if TT will kick it out when I go to file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

I have two K-1 - one as a Limited partner and the other as a General partner. I have attempted to enter the amounts of the respective Statement A Section 1231 Gain for line 20 Z=STMT. Ehile the amounts appear to show up correctly - the review keeps looping to this as the 2 errors. I have tried to manually enter in forms mode with the correct amoounts appearing on screen, but the review kicks me back out again and again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

You need to ensure you have reported the details of your Section 199A loss on the screen after your K-1 entry. In TurboTax Online you can do this by following these steps:

- Sign in and open your return by selecting Pick up where you left off under a section.

- Search for K-1 and select the Jump to link at the top of the search results.

- This will take you to the Schedules K-1 or Q screen.

- Answer Yes and follow the prompts.

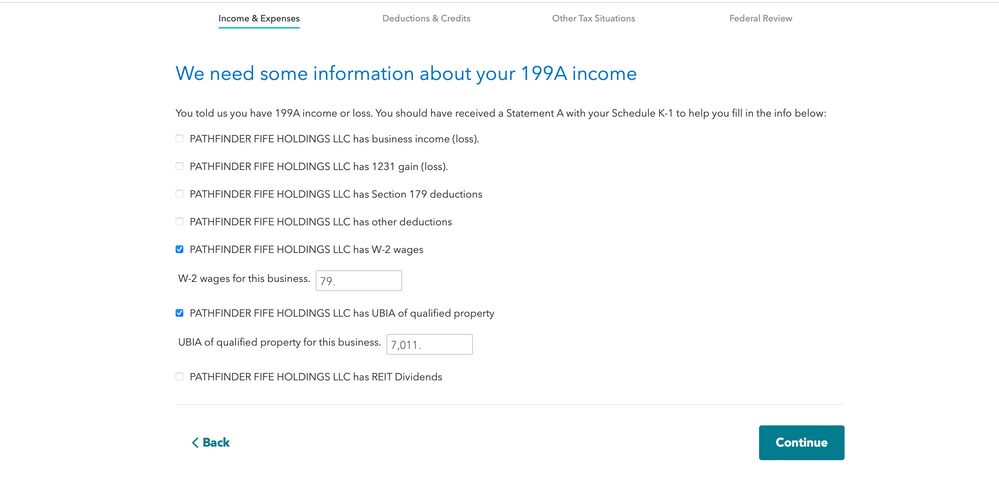

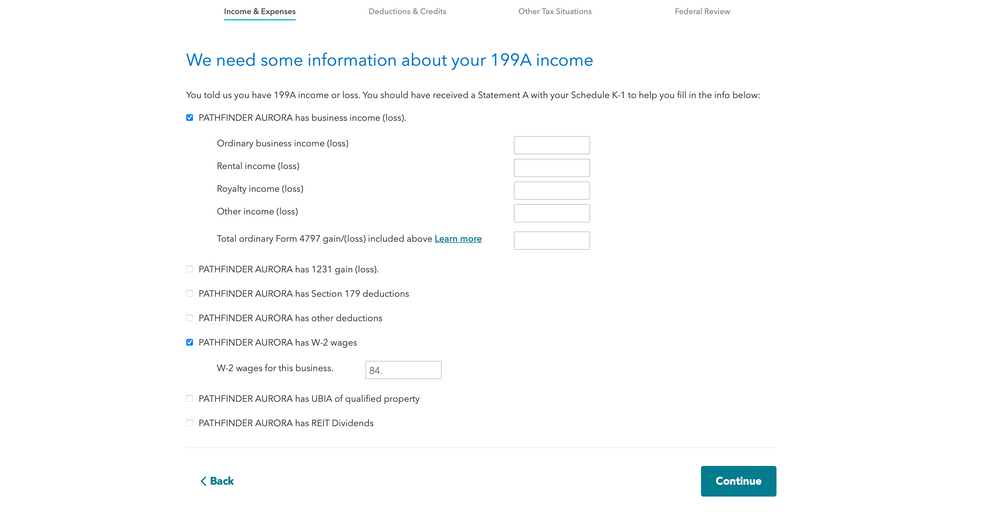

- Verify or answer the questions (leave box 20 amount blank) and Continue until you get to the W need some information about your 199A income screen.

- Check the box(es) that match the detail information you received with your K-1 and enter the associated amounts. List negative numbers as negatives in Turbo Tax.

- Continue through the rest of the questions.

Repeat this process for the second K-1 if it also has QBI details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Using turbotax online. Having the same problem as others. I have 1 K-1 with multiple entities in section 20Z. I made a separate K1 entry for the each entity. In Federal Review it says:

| Sch K-1 Wks-Partnerships (Pathfinder Access Fund, LLC): Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A. |

Following the instructions above, but my "We need some information about your 199A income or loss" screen is missing the entry for "Name of Business has rental income (loss)". It has all the others with boxes to check, but not rental (the one I need). See screenshot. So I cannot enter the rental income. What do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Called TT support and she helped me solve it. Apparently they changed the UI this year and you have to click on the business income (loss) radio button to expand the options. I don't go randomly clicking buttons, so I don't know how they expected me to find this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

The way you solve this problem is by entering the K1 multiple times, for each enter. You enter it once for box 1, then you enter it again for box 2, and soforth. So if you have 5 items, you would enter the K1 5 times, and on each time, you would enter one piece of information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

hi all, I am stuck in the error fixing loop in TurboTax online regarding Box 20 code Z and "no Section 199A income has been entered on Statement A."

I'm unable to switch to forms since I'm on the online version. TT won't let me e-file until i fix this problem.

Do I have any other options besides buying the desktop version (Mac) or printing/mailing?

thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Same problem here. Line 20 with STMT. Statement A instructions: "Section 199k information is entered in Section D1 & D2 of this K-1."

THERE IS NO SECTION D1 & D2 IN THE K-1. There are two entries on the "Statement A...". One is $-191 in Ordinary business income (loss). The other is $509 in UBIA of qualified property. Neither is accepted by Turbo Tax. No additional incite found in "Forms View". Guidance, more that appreciated--this is October.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Thanks but do not have a K-3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

This actually worked!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

delinah100

Level 2

mango45429

New Member

pinguino

Level 2

kaquisenberry

New Member

mlpinvestor

Level 3