- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- What figure to enter from K-1 line 20 code Z stmt?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

This explanation solved my issue with my 2022 taxes. I simply hadn't completed the Interview wizard -- and it was maddening trying to resolve it during the Federal Review process. THANK YOU!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

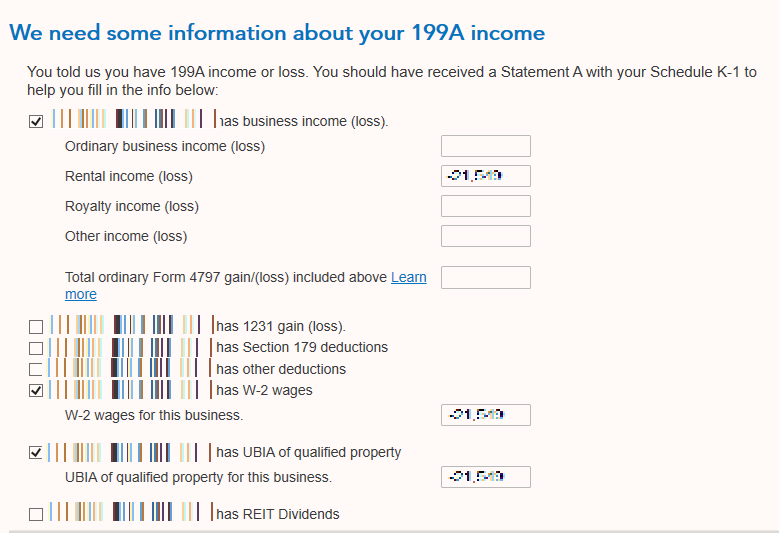

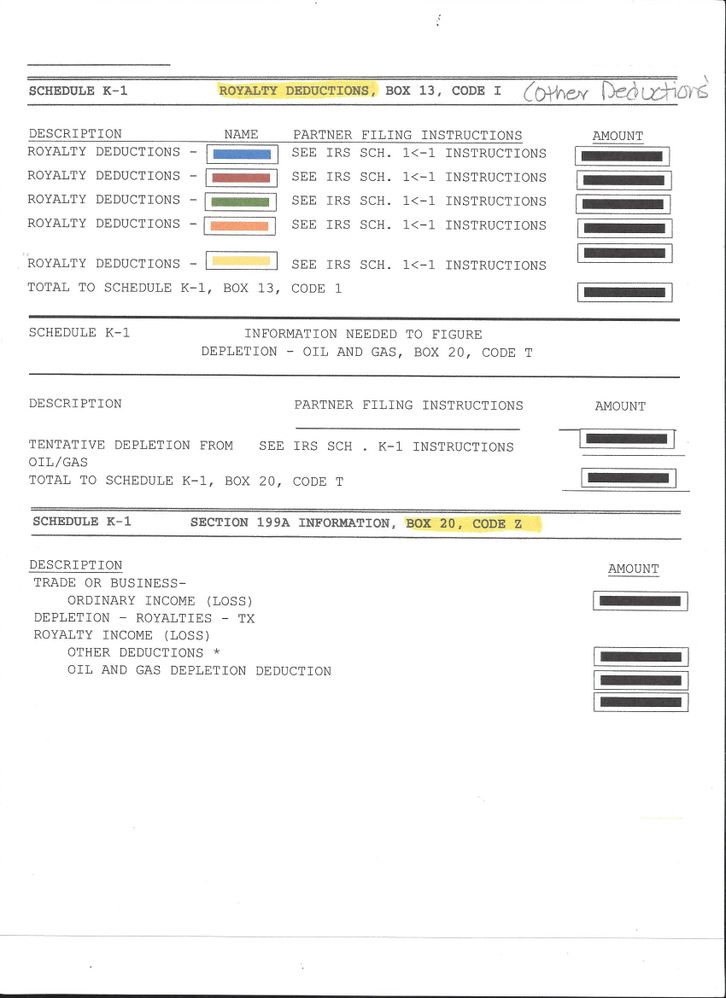

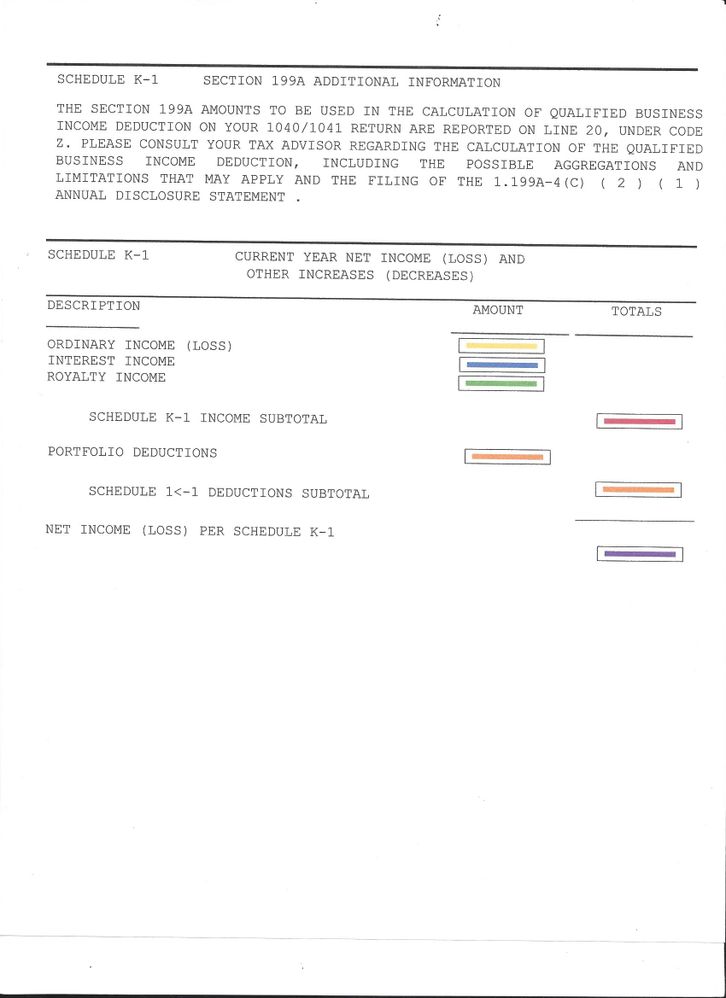

I need help filling out Turbo Tax online. I just received a K-1 and have information on Box 20, Code Z, that I don't know which figures to enter into the program. I am stumped on what amount to fill in on the section that says "Box 20 Information, Code Z" and "We need some information about your 199A". I am attaching my statements with the actual numbers blocked out. I just need to know what amounts to fill in on those sections. Thank you for any help you can offer. There

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

In the partnership K-1 entry screens, follow these steps:

- At the screen Enter Box 20 Info, select Z-Section 199A information. Leave Amount empty. Click Continue. This tells the software that Section 199A information will need to be entered for the income previously reported.

- At the screen We see you have Section 199A income, select the appropriate income description. Click How would I know this? for more information.

- At the screen We need some information about your 199A income, select the appropriate income description and amount from the 199A detail provided with the K-1.

You would enter Trade or Business - Ordinary Income (Loss) from this screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

I have a lost listed on ordinary business income (loss) and amount under w-2. Where I put this amount?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Assuming that you have a Schedule K-1, since you have posted on a discussion thread dealing with K-1 issues:

When you receive Schedule K-1, you need to enter all of the fields in TurboTax as prompted so the information will be included with your return. You will need to enter the information, but whether this results in additional tax depends on the type of items reported and the amounts. A Schedule K-1 is a document that partnerships, LLCs, S-corps, estates, and trusts use to describe to owners/shareholders what income they are receiving from the entity.

See this article for instructions to enter a K-1

See this article for more information on K-1s in general.

In TurboTax Online, go to Wages and Income, then scroll down to S-corps, Partnerships, and Trusts. Click Show More, then select Schedule K-1. Select the right type (Partnership, S Corporation, or Estates or Trusts.

Enter the information about the issuing entity in the fields provided. Follow the prompts in the program and enter information in all of the fields that have entries on your form.

Ordinary business income or loss is entered in Box 1 for a Partnership of S-Corp Schedule K-1.

If by "amount under W-2" you are referring to Code V under Other Information, Box 17 for S corporations:

W-2 wages.

The amounts reported reflect your pro rata share of the S corporation’s W-2 wages allocable to the QBI of each qualified trade or business, or aggregation. See the instructions for Form 8995 or Form 8995-A.

If you have questions about any of the information reported on Schedule K-1, see if there are other statements included that further explain the entries, or contact the issuer.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

I am in a similar situation as documented in this post (question 3). Only difference is that, as documented on that page, the amounts for each of the two properties that the partnership has invested in are shown in Column A and Column B respectively but not added together. Should I add the amounts under Column A and Column B (for each property) and enter it in the corresponding spot in Turbotax (e.g. Net Income (loss), or W-2 wages, etc.)?

Thank you for any input .

-Topperdude

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

If you received and entered two Schedules K-1 from this investment, the two columns for Section 199A should correspond to these to K-1s. TurboTax requests the QBI details for each K-1 at the end of the K-1 entry interview, which should allow you to enter each column separately for the related K-1.

However, if you have two investments but only one K-1, it is appropriate to add the two columns together for entry in TurboTax. Be sure to retain the K-1 supplemental information with your other tax paperwork for future reference.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Thank you so much for your response (especially since we - wife and I - are getting a bit anxious to find the right answer - specifically for entering the correct information in Turbotax - after several days of scrounging through the Internet (i.e. finding needle in a haystack) after we received the K-1s on April 1 (rest of the Turbotax returns data entry was already completed by Mid-March). We really appreciate your response.

To clarify things a bit more I just talked to the GP of the partnership and they confirmed that we received two K-1s because they correspond to the two separate (but equal) amounts we have invested in the partnership (i.e. two classes of investments in the same partnership). These classes of investments differ such that for classA, the distribution percentage is higher but percentage of profit shared with investor upon sale is lower. Similarly, for ClassB investment, the percentage of distribution is less but percentage of profit upon sale of property is higher.

So let's name the K-1s that we have received from the partnership as "ClassA K-1" and "ClassB K-1" respectively. In Turbotax, we have created two K-1 entries, one for "ClassA K-1" and another for "ClassB K-1" with different distribution amounts (reported under Line 19 Code A) corresponding to the two different investment classes with the partnership.

Now, in both of the K-1 forms, the Line 20 Box Z Section 199A Information is identical. Since the partnership invested in two different properties (e.g. PropertyA and PropertyB), the section 199A information is reported under two columns as shown below (Note: Not actual amounts from the K-1 ).:

PropertyA PropertyB

QBI or Qualified PTP Items

Net rental real estate loss 1,000 -30,000

…..

…..

W-2 Wages 2,000 1,217

Qualified Property 36,200 64,251

However, Turbotax only has one column for entering the amounts against “Net Rental real estate loss”, “W-2 Wages", "UBIA of Qualified Property" as can be seen in image below:

Which brings me to my question: Do we need to add the amounts in the two columns from the Schedule K-1s and enter it in the respective rows in Turbotax? If not, what is the correct way to enter the Line 20 Box Z Section 199A information from the two schedule K-1s into Turbotax?

Based on your response above, it sounds like we add the two columns and enter them for BOTH K-1 entries in Turbotax - is that correct?

Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

I had the same problem - a rental property that does pass-through taxation to my wife and me, and the error check of TurboTax Business coming up with missing info for Schedule K, Line 20, Code Z, which just said “STMT”. I eventually solved it this way:

(1) clicking “Forms” at upper right in TurboTax to enter Forms Mode,

(2) opening each Schedule K,

(3) finding Schedule K's line 20 information (with the Z entry) and below that some text “QuickZoom to enter Code Z Section 199A information” and clicking that QuickZoom button,

(4) scrolling down because the place it jumps to (Section D1, Qualified Business Income Deduction – Statement A Information) is placed at the very BOTTOM of the screen, and

(5) entering the Ordinary Business Income and Rental Income from the Schedule K's (even though these were entered elsewhere), and entering 0 for Section 199A Dividends.

This seemed to satisfy the error checker in TurboTax Business.

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

delinah100

Level 2

mango45429

New Member

pinguino

Level 2

kaquisenberry

New Member

mlpinvestor

Level 3