- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: What figure to enter from K-1 line 20 code Z stmt?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

I am trying to enter a partnership k-1 received with code z on line 20 that says stmt onto a 1065 return. Not sure what amount to use from the 199a stmt. There are three properties shown on the stmt, 2 have rental income figures and UBIA figures. The other one has a rental loss and 1231 gain only. I am using Turbo Tax Business. Any help would be greatly appreciated!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Enter the figures from your statement (Statement A) in Forms Mode directly on the K-1 you received.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Thank you. So, should I add the rental properties together that are listed on the stmt with the K-1 (total rental income, total UBIA, etc)? Should the property with the rental loss and 1231 gain go on there as well? I think those two items aren't eligible for QBI, correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

I keep getting a message that this is the only thing that I need to send in my taxes and that there will be a subsequent release or update to support this. When is that going to be?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

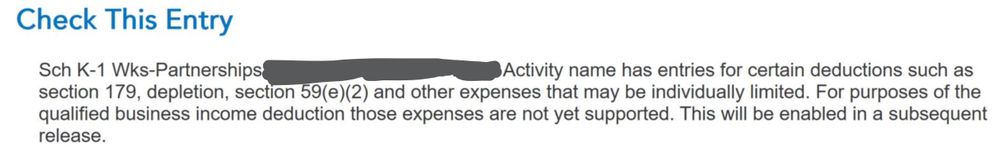

During review of my return, TurboTax is showing following error message regarding my K1 section. I have none of those listed expenses, other than normal business expenses (like travel etc.) for my LLC. Is there a new release coming? And if so when? your help is appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

I have a similar question but my statement is strictly business, no rental. The section 199A information lists 4 numbers: Ordinary income, self-employment earnings, W-2 wages and Unadjusted basis of assets. What number do I put in the box?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Are you saying you have four lines of 199A in line 20 with code Z?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

I'm saying that what is entered in box 20, code z, is:

* STMT

when I turn the next page of the K-1, it has section 199A information, box 20, code z, then under description, it lists ordinary income, self-employment earnings (loss), W-2 wages and unadjusted basis of assets.

Then it explains that these amounts are to be used in the calculation of QBI deduction, and to consult your tax advisor. Turbo Tax can't help me with this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Each K-1 usually comes with a disclosure statement so it is telling you that need to refer to the statement to look for the amount to report in Box 20. These statements are detailed and these amounts are easy to miss.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

I received Statement C as well. I don't see any information regarding that statement. My information seems to be working for statement A, but not statment C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Same on my K-1, Line 20 Code Z.

Supporting schedule says Statement A - QBI Pass-through Entity Reporting.

Has lines for Ordinary Income, Rental Income, Royalty Income, etc. It does not have Code Z amounts. Only filled in amounts are for Rental Income and UBIA of qualified property.

It is not printing Schedule K-1 - 199A Supplement (Line 20) like last year.

This needs to get fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Note that it is very important to Continue through the K-1 interview after you have entered your box 20 code Z. Enter the code Z when you enter the K-1, but you don't need to enter an amount. Continue on, and there is a screen near the end of the interview titled "We need some more information about your 199A income or loss". This screen must be completed in order for your box 20 code Z information to be correctly input into TurboTax.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

If the Statement C that you received with your K-1 has amounts related to qualified cooperative payments reported on Form 1099-PATR, there is a TurboTax screen to enter those.

Enter your Statement C the same way as a Statement A, by entering the code Z on the screen for box 20 (no amount needed here). Then Continue until you get to the screen "We need some more information about your 199A income or loss" screen. After you've entered any amounts that "fit" on that screen, Continue to the next screen to check the box for qualified cooperative payments on the "Let's check for some uncommon adjustments" screen.

Here is a screenshot of that "Let's check for some uncommon adjustments" screen:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

I did the TurboTax inputs just as you said, but when I try to e-file, I get a "check this entry" message about the code Z entry in box 20. The form looks correct, the numbers looks correct, but the message is "Box 20 Code Z has been seleceted but no Section 199A income has been reported in Statement A." I don't know what Statement A is, but there is no editable box in the tax form information shown below this message. TurbTax won't let me file with this is as is, if I just continue on it will bring me back this message if I try to file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

What is "Forms mode"? How do I get into this? I am using TurboTax on-line, Premier edition.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

delinah100

Level 2

mango45429

New Member

pinguino

Level 2

kaquisenberry

New Member

mlpinvestor

Level 3