- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: TurboTax labels returns and allowances as Rebates/refunds...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I put in Returns and Allowances for Schedule C after I have put in 1099s

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I put in Returns and Allowances for Schedule C after I have put in 1099s

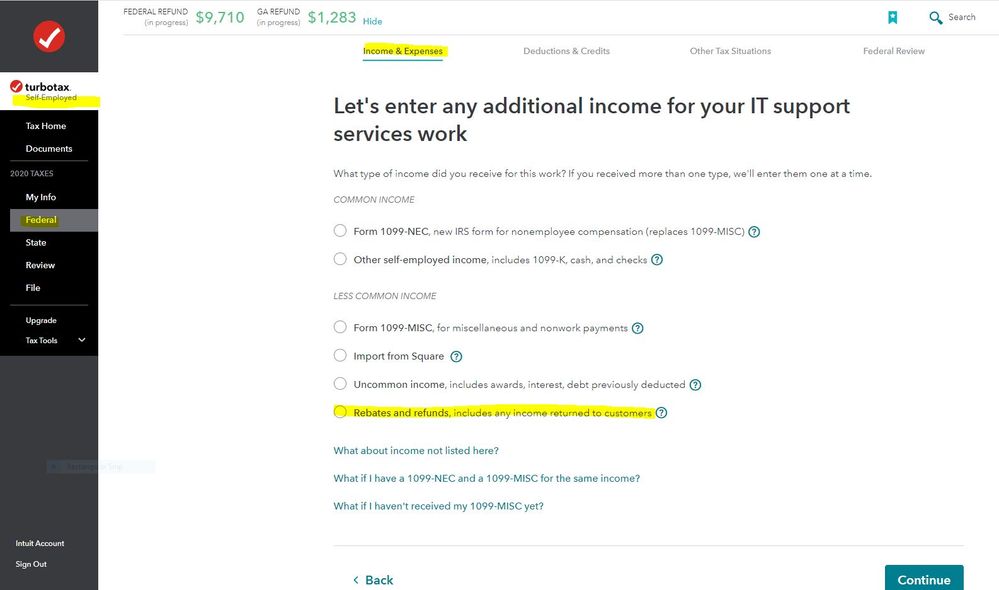

TurboTax labels returns and allowances as Rebates/refunds paid in TurboTax Online. Please review the following instructions to navigate to the relevant screen (attached screenshot titles in parentheses):

- Sign in to TurboTax and select Take me to my return.

- In the upper right corner, type "schedule c" in the Search box and then select the "Jump to" link in the search results.

- Select Edit on Line of work. (ttse_work_summary)

- Select Add income for this work. (ttse_add_income_expenses)

- Select Rebates/refunds paid. (ttse_rebates_refunds_paid)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I put in Returns and Allowances for Schedule C after I have put in 1099s

This doesn’t seem correct. I did exactly as follows but I don’t see anything that says rebates or refunds. Need some clearer directions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I put in Returns and Allowances for Schedule C after I have put in 1099s

@suzyq21075 wrote:

This doesn’t seem correct. I did exactly as follows but I don’t see anything that says rebates or refunds. Need some clearer directions.

Screenshot from the TurboTax online Self-Employed edition.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I put in Returns and Allowances for Schedule C after I have put in 1099s

Thank you for your response. I did exactly as you said. My screen looks exactly like your screenshot, EXCEPT it does not have the line for rebates and refunds. Someone help, PLEASE!!! This is the third day I am working on this. And the frustration level is through the roof.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I put in Returns and Allowances for Schedule C after I have put in 1099s

@suzyq21075 wrote:

Thank you for your response. I did exactly as you said. My screen looks exactly like your screenshot, EXCEPT it does not have the line for rebates and refunds. Someone help, PLEASE!!! This is the third day I am working on this. And the frustration level is through the roof.

If you are using the TurboTax Self-Employed online edition, then the software will have all the options for entering less common income for your business.

See this TurboTax support FAQ on how to contact Support - https://ttlc.intuit.com/community/using-turbotax/help/how-do-i-contact-turbotax/00/26991

Or -

Use this website to contact TurboTax support during business hours - https://support.turbotax.intuit.com/contact/

Or -

Support can also be reached by messaging them on these pages https://www.facebook.com/turbotax/ and https://twitter.com/TeamTurboTax

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Eddy-perez97

New Member

panr605

New Member

dougiedd

Returning Member

whnyda

New Member

ekudamlev

New Member