- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Schedule K1 entry on personal return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entry on personal return

My CPA helps me with business taxes and I have K1 and in box 17, it has code V (check Section 199A Statement) and i dont know, what should amount should i enter in my turbotax? Thanks in advance

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entry on personal return

In addition to the K-1 you should have received a statement with the additional information needed for the 199A entries. Here's how to enter box 17,code V:

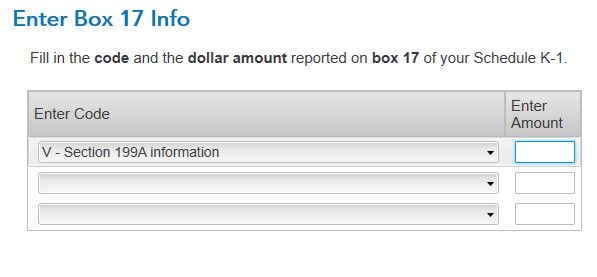

- When you are entering information from your K-1, on the screen, Check Boxes That Have an Amount, be sure you mark Box 17.

- On the screen, Enter Box 17 info select code V, but leave the amount box blank. Click Continue.

- On the screen. We need some information about your 199A income or loss, mark the boxes that apply.

- Each time you mark an item, a box will appear to enter the value for that item. Enter the value from your K-1.

- Continue through the rest of the screens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entry on personal return

So, I have this "Statement A-QBI Pass-Through entity reporting (Schedule K1, Box 17, CodeV)" and the only amount on that page is the "Ordinary business income (loss)"...is that the amount that goes in this box? See pic from Box 17

T

T.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entry on personal return

Yes, the Ordinary Business Income or Loss is the information that goes in the box.

As you continue through the screens you will be asked more questions about the Code V for Box 17. The information should be on a statement that came with your K-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entry on personal return

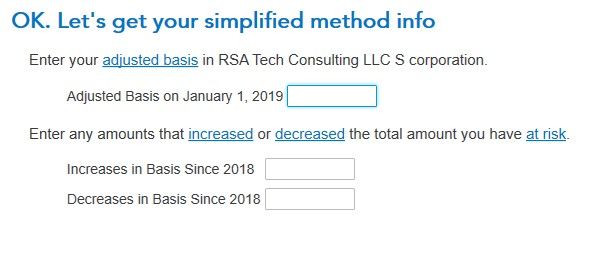

Thanks a lot. Now, it's this at risk that i had never seen before and i selected "simplified" option but don't know what amount goes in these boxes? Is this on my business taxes too?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entry on personal return

Your basis is basically what you spent to acquire the investment, plus income you reported from it over the years, less losses you reported, plus any additional money you put into it, less any distributions you took.

Increases in basis would be income you reported during the year plus any money you contributed to the company during the year.

Decreases in basis would be distributions you took from the company, plus losses reported.

You can see this article to learn more about basis:

https://taxmap.irs.gov/taxmap2016/pubs/p541-006.htm

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entry on personal return

I'm also working on Section 199A Box 17 Code V - I have a question, under comments for this box: Our Partnership has a loss -266. Where do I put this amount on the Corporation part of my Turbo Tax ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entry on personal return

Are you preparing a Corporate return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entry on personal return

This is hard to calculate. Can i leave these blank? If i do leave this blank, i noticed my deductible loss is down to 20% of what i reported and it's putting 80% under nondeductible which will be carried over to next year. Not sure how this works but maybe i need professional for my personal return too or someone who can come up with these numbers. Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entry on personal return

If you have a loss, you won't have a deduction for your QBI in the current year, but it will get carried over to the following year and affect your tax in that year. So, you do need to make the correct entries in the program this year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entry on personal return

Can i talk to live agent and have them help with these numbers? I dont mind paying someone for this service but is that an option? Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entry on personal return

A TurboTax professional can provide you with verbal advice and support in the form of reference materials, but we cannot actually do your calculations for you.

You can contact TurboTax while working on your program as follows:

https://ttlc.intuit.com/community/using-turbotax/help/what-is-the-turbotax-phone-number/00/25632

[Edited 4/5/20 at 5:26PM]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mikendamaddawg66

New Member

werty

Level 1

ken_311

Level 1

karlwchristensen

Level 2

DIY998

Level 2