- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: PTP sale 1099B Box A and K-1 question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PTP sale 1099B Box A and K-1 question

I am very confused after I received my 1099B form and K-1 for the purchase of BNO last year. I used Charles Schwab and Robinhood to trade BNO but I only received K-1 from Charles Schwab trade. Both of them marked as 1099B Box A checked. (Short term transaction reported to IRS)

My transaction is as follow in my 1099B (box A):

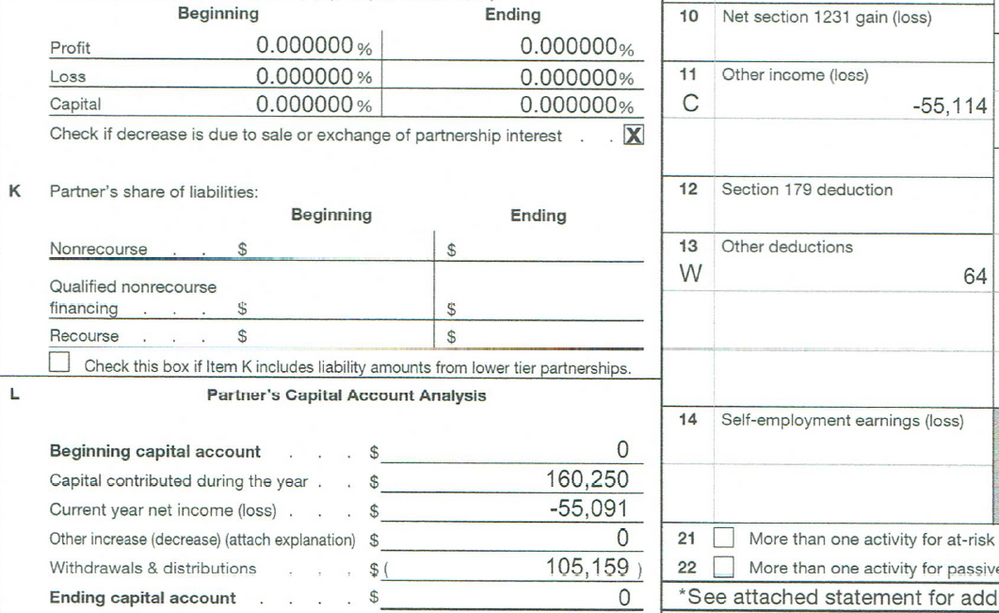

However, when I received my K-1, my K-1 read as follow:

1. I am totally confused why there is a net loss there? What is this $-55,091 cumulative adjustments to the basis?

2. How can I report K-1 and 1099B? These transactions are on 1099B box A (reported to IRS) so I am not sure whether I can change the cost basis to be the same as what was reported on K-1? If I can change, how can I do that?

3. How should I prepare my tax for this part? Should I report this huge loss even though in theory I did not loss any money??

4. Should I ask Robinhood to get K-1 from them since I traded BNO there before as well? even though it has also reported BNO on their 1099B (boxA checked) form.

This has been a huge confusion for me and any help will be appreciated!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PTP sale 1099B Box A and K-1 question

For some reason, the transaction photo did not show up. Let me type it here: This is on my 1099B (Box A checked)

Unit: 17,000 Ticker: BNO Date Purchase: 3/15/2020 Date Sale: 4/3/2020 Proceeds: $173,396.16

Cost: 160,250 Realized gain: 13,146

So all this was reported on my 1099B (box A checked) form, which is the same as what I have transacted on. However, it is vastly different from K-1 that I received. So I am confused and have questions above.

Thanks!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PTP sale 1099B Box A and K-1 question

Because this investment is structured as a partnership it pays no taxes. Instead, it issues a K-1 which passes all the Partnerships taxable entries to you. You handle this at tax time by

- Going through the TT K-1 interview, entering all the info provided

- Dealing with the complexity of correctly accounting for Cap Gains / Losses.

To answer your questions below:

- The -55,091 -- cumulative adjustments to basis -- is the total of all the taxable entries the Partnership is passing to you. In this case, its 11C - 13W (edit to add + $87 that must be shown somewhere on the K-1 that wasn't part of what was pasted here) . When you enter those into TT, those losses / deductions will be reported on your tax return. BUT, because you didn't actually experience those losses -- they're basically just on the K-1 -- your basis in the investment changes. Instead of having a basis of 160,250 you add in the "cumulative adjustments" to get a new basis of 105,159. So when you sold, your Cap Gain just got $55,091 larger. That obviously offsets the other losses you're entering, but you still have to go through the reporting because the tax rates on all the bits and pieces can be different.

- When you enter the K-1, it will ask you about the details of your sale. Simplest approach is to enter 0 for sales and 0 for basis (in the K-1 interview). Doing that will prevent TT from doing anything to your 1099-B. Then, even though the 1099-B is box A (reported to the IRS), you CAN change the basis. The interview will give you this option and you simply check the box that the "basis is incorrect" and enter the correct one. Its always possible that the IRS could ask for justification for doing this, but your K-1 is the justification: the broker shouldn't have used the incorrect $160,250 basis, and the IRS won't have any reason to argue with that.

- Yes, as explained above. The huge loss will be completely offset by the increase in Cap Gain.

- Yes. Since it looks like the Schwab K-1 only covers the Schwab 1099, you'll need something similar from Robinhood.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PTP sale 1099B Box A and K-1 question

The pieces of information provided don't seem to gel at this point:

- Based on the information provided, it appears you purchased the BNO and sold it in the same year.

- If that assumption is correct, the pieces don't fit.

- It appears that you contributed the $160,250. This is confirmed on the K-1 and also the brokerage account for cost basis.

- You have K-1 activity, however, it appears that there must be $87 of income somewhere else on the K-1 to arrive at the cumulative amount of $55,091 (loss of 55,114 + other deductions of 64 = a loss of $55,178).

- We will continue on using the $55,091 figure. Using this, your basis in this investment is now $105,159.

- Here is where the confusion begins. The K-1 appears to show that you received a distribution of $105,159? Is that correct? You then state that the brokerage statement reflects proceeds of $173,396.16. These two "distribution" amounts don't reconcile.

- In most cases you should be able to reconcile the K-1 information to the brokerage statement; while reflected differently, at least they should reconcile once adjusted. In this case, I don't see the pieces fitting together.

- What was the actual proceeds / distribution you received?

- Need to understand the interplay of this transaction between Robinhood and Schwab.

- Need to understand if the $160,250 represents the entire purchase.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PTP sale 1099B Box A and K-1 question

To clarify a couple things before things get more confused:

- 'Withdrawals and Distributions' in Section L does not have anything to do with the proceeds received from a sale. It will match the basis of any shares sold, plus any distributions received from the partnership. The only place that the actual revenue from a sale would show up is on the 1099-B. So the $173k shown on the 1099-B is unrelated to the 'Withdrawal and Distribution' line.

- Since the $160,250 shows up on the Schwab K-1 as Capital Contributed, and also shows up on the Schwab 1099-B as 'Cost Basis' for the complete distribution, its safe to assume that any Robinhood activity isn't reflected here.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PTP sale 1099B Box A and K-1 question

Thank you very much for this detailed explanation! It was very helpful! I did forget to mention a few other boxes in my K-1 as well. (You already knew that :)) Here is a total full picture of my K-1 part III:

5 Interest Income: 56

6a ordinary income: 31

11 Other Income(loss): C -55,114

13 Other Deductions: W 64

20 Other Information: 87

I think after I calculate all these numbers, the K-1 reconciled. -55114-64+56+31= -55091 (it should be my cumulative adjustment to basis)

I found the place in TT 1099B interview to adjust the cost basis to increase my capital gain (which should offset by the K-1 loss).

However, I am confused by this " When you enter the K-1, it will ask you about the details of your sale. Simplest approach is to enter 0 for sales and 0 for basis (in the K-1 interview). Doing that will prevent TT from doing anything to your 1099-B. "

I thought I will just enter whatever on my K-1 since I already adjust my 1099B basis to have a large capital gain to cancel the loss in K-1?

Should I change any number on my K-1 input on Turbo Tax?

So now, I will just change my 1099B cost basis on TT and I have inputted the same number as shown K-1. Let me know if there is anything else I need to do. I really appreciate your help!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PTP sale 1099B Box A and K-1 question

@guohaiyi0527 You've done everything right except perhaps one part of the K-1 entry.

When you enter the K-1, on the screen that says "Describe the Partnership", you'll want to check the boxes "This Partnership ended..." and "Disposed of a portion..." (as well as the top box "This is a publicly traded partnership").

You want to check those off so that TT doesn't prompt you about the K-1 next year, and because some elements of the K-1 can be handled differently when you sell vs when you just hold.

But as a result of checking those boxes, TT will ask about the sale itself. This is where you'd give it 0 for proceeds and 0 for basis. Otherwise, if for example you gave it the info on the 1099-B, it will create its own 1099-B and double count what you've already done.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PTP sale 1099B Box A and K-1 question

@nexchap Thank you so much! You much be a CPA or someone really understands this! Here are a few other questions I have regarding this and hope you may be can help to answer.

1. I selected the K-1 ended in the 2020 box after you suggested it and it did pop up additional sections for me to fill out. I tried to make it simple last time so I just write one purchase and sell transaction but the reality is actually as below.

BUY 3/9/2020 2000 (unit)

BUY 3/12/2020 4000 (unit)

BUY 3/19/2020 4000 (unit)

BUY 3/25/2020 3000 (unit)

BUY 3/26/2020 4000 (unit)

SELL 4/3/2020 -15000(unit)

SELL 4/6/2020 -2000 (unit)

So after I selected the box of "this partnership ended in 2020" there were additional boxes show up. FOr example, it asked me

1. Enter purchase and sales date, which only have one box. How should I enter that?

2. The next page is the page I think you mentioned above. What do you think I should enter here?

Regular Gain or Loss

Sale Price:

Selling Expense:

Partnership Basis:

Ordinary Gain:

1250 Gain:

AMT Gain or Loss

Partnership Basis:

Ordinary Gain:

1250 Gain:

Really appreciate your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PTP sale 1099B Box A and K-1 question

@guohaiyi0527 On your questions:

- Just type 'various' for both purchase and sale dates: TT only cares about this if you were going to use the K-1 interview to create a brand new 1099-B (code C or F) since it would need to know short or long term. But since you don't want a brand new 1099-B, 'various' will get you through the interview.

- In your case, 0 or blank everywhere. TT will then calculate $0 for Cap Gain/Loss (for the purposes of the K-1 interview), realize that you don't need a new 1099-B, and will be satisfied.

It seems pointless, but this is the mechanism to let TT know that you've sold/ended the partnership AND to prevent TT from creating additional 1099-Bs.

If you continue to invest in partnerships, particularly any that report Ordinary Gains at time of sale, this longer thread may be good background: https://ttlc.intuit.com/community/investments-and-rental-properties/discussion/how-i-report-the-sale... Your situation is a simplified version of the more complex scenario that thread discusses.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PTP sale 1099B Box A and K-1 question

In reviewing the follow-up responses and giving this some thought, this all does in fact gel. As this is a PTP, the "sale" component is separated from the partnership.

Follow-up comments:

- Several questions were not answered, but based on what is being stated, at the end of the day, you should be reporting a gain on this sale.

- The K-1 reflects losses passing out to you in the amount of $55,091 as discussed previously.

- As a result of the losses, your basis in this investment is now $105,159.

- So if you received $173,396 in proceeds with a basis of $105,159, you have a gain of $68,237; this gain needs to be reported on Schedule D and form 8949.

- When you net the gain of $68,237 with the losses taken in your return ($55,091), you end up with a net overall gain of $13,146 which is what the brokerage statement is reflecting.

- You can either handle the gain calculation through the interview process, or show zero in the interview process and enter the gain manually.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PTP sale 1099B Box A and K-1 question

@nexchap Thank you very much! There is one other question that I have is since I bought these securities, not in one day when I report in 1099B, there are actually several entries to break out the whole (17000 unit ) volume I have. How can I allocate the cumulative adjustment to the basis of each lot? Or simply I just average them out?

For example, on my 1099B, there are a few different entries with different dates and I need to change the basis for each lot. What do you suggest me to change? Since my total adjustment is -55091 and I have 17000 units in total so each unit is about -3.24? and I just multiply by the unit in each lot??

I tried to open the link you suggested above, but for some reason, I could not open it. Appreciate your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PTP sale 1099B Box A and K-1 question

Retrying the link: https://ttlc.intuit.com/community/investments-and-rental-properties/discussion/how-i-report-the-sale...

On allocating the adjustments: if the partnership didn't provide any lot-by-lot info, then doing it as you described (proportionally) is fine.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PTP sale 1099B Box A and K-1 question

Thank you!

Sorry, there is another question that comes up ( hope this is the last one LOL)

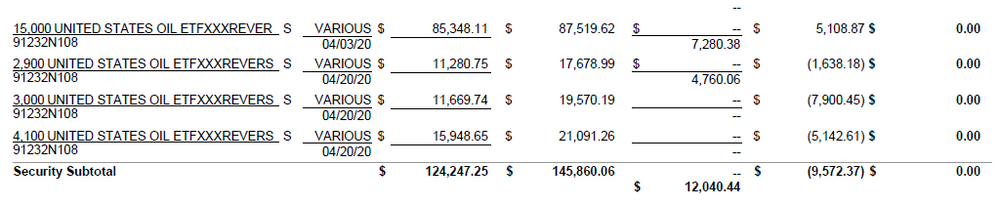

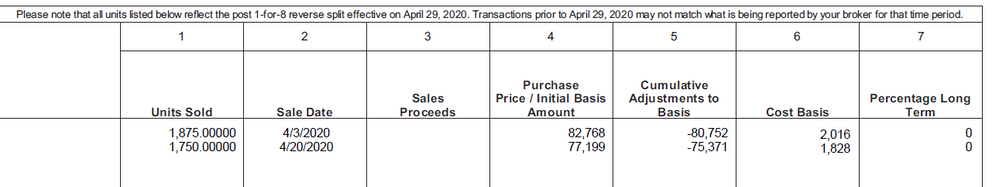

I also bought USO at that time and my USO transaction is as follows.

However, my K-1 shows like this

The unit number does not match at all. Do you know why this happened and can I still use the cumulative adjustment to the basis number? Since there are three lots that were sold on 4/20/2020, can I just select one lot and apply the cumulative adjustment to basis? What is your suggestion?

Thanks a lot!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PTP sale 1099B Box A and K-1 question

@guohaiyi0527 There's some fine print at the top of your 2nd picture saying that the units reflect a 1 for 8 stock split. So I think the units work. As for applying the adjustments to basis, applying to one lot works too (as long as it doesn't drive the cost negative). Just keep records so you can explain the approach if ever asked years from now.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

starkyfubbs

Level 4

billdayreef

Returning Member

spartanusm

New Member

Av74O0OhzB

Returning Member

HollyP

Employee Tax Expert