- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PTP sale 1099B Box A and K-1 question

I am very confused after I received my 1099B form and K-1 for the purchase of BNO last year. I used Charles Schwab and Robinhood to trade BNO but I only received K-1 from Charles Schwab trade. Both of them marked as 1099B Box A checked. (Short term transaction reported to IRS)

My transaction is as follow in my 1099B (box A):

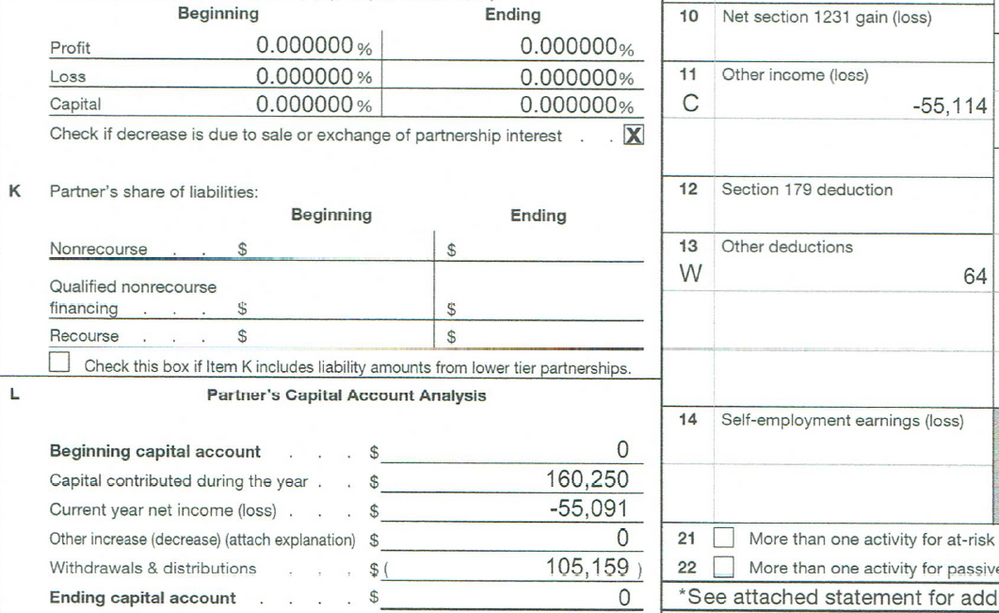

However, when I received my K-1, my K-1 read as follow:

1. I am totally confused why there is a net loss there? What is this $-55,091 cumulative adjustments to the basis?

2. How can I report K-1 and 1099B? These transactions are on 1099B box A (reported to IRS) so I am not sure whether I can change the cost basis to be the same as what was reported on K-1? If I can change, how can I do that?

3. How should I prepare my tax for this part? Should I report this huge loss even though in theory I did not loss any money??

4. Should I ask Robinhood to get K-1 from them since I traded BNO there before as well? even though it has also reported BNO on their 1099B (boxA checked) form.

This has been a huge confusion for me and any help will be appreciated!!