- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: LLC filing 1065 without ITIN, help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

LLC filing 1065 without ITIN, help!

I have prepared my 1065 for my LLC partnership, but on my schedule K-1 it asks for my SSN/ITIN.

As a non-resident alien, I don't have my ITIN yet. I will be applying for my ITIN when I go to the US in the end of April.

Do I need to file 7004 for an extension on the entire LLC's filing? If so, what happens to my partner's individual return? My partner is a general partner, and is also self employed on the side so needs to file his self-employment. Does he have to file for an extension on everything?

note in case it influences anything: we made an overall loss this year, it doesn't look like we're going to have to pay anything for our LLC activities.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

LLC filing 1065 without ITIN, help!

Yes, you need to file an extension for your partnership return this gives you until September 15 2020 to file the partnership return. You cannot file a US tax return without an SSN or an ITIN.

Your partner can also file an extension for his personal return which gives him until October 15, 2020 to file his return. He needs to pay any tax due by April 15, 2020. The extension is just an extension of time to file the tax return.

Then once you have your ITIN you can file the partnership and personal tax return. You do not need to wait until the extension date.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

LLC filing 1065 without ITIN, help!

Thanks for your response, is my partner obliged to file for the extension or is it optional? ie, can he file his schedule K-1 as per the normal deadline even if we have extra time to file the 1065?

Thanks again 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

LLC filing 1065 without ITIN, help!

The Form 7004 extension is for the partnership Form 1065. Only one extension is filed for the partnership, and it covers all partners on the tax return.

But, each of the partners will need to file an extension of their personal tax return (Form 1040 or Form 1040-NR), if the partnership return is not prepared in time for each partner to receive their K-1 to file with their personal tax return by 4/15/2020. The form for the automatic extension of the Form 1040 is Form 4868. You can file this Form 4868 extension from TurboTax Online or TurboTax Download/CD.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

LLC filing 1065 without ITIN, help!

Ok, thanks @DavidS127 , so to confirm, my partner has no choice and can not file his returns until the IRS has the 1065?

Because the only detail we are waiting for is my ITIN for my Schedule K1 and we have all of the information for his K1 already. Thanks 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

LLC filing 1065 without ITIN, help!

Yes, your partner cannot file a correct personal tax return until he has the K-1 from the partnership tax return. He does not have to wait for the IRS to process the return, he can file his personal tax return with the K-1 from the partnership as soon as the partnership files the tax return.

Note that you can print and mail your partnership Form 1065 with your application for an ITIN, according to the instructions for Form W-7, pasted below:

"Your original tax return(s) for which the ITIN is needed. Attach Form W-7 to the front of your tax return. If you’re applying for more than one ITIN for the same tax return (such as for a spouse or dependent(s)), attach all Forms W-7 to the same tax return. Leave the area of the SSN blank on the tax return for each person who is applying for an ITIN. After your Form W-7 has been processed, the IRS will assign an ITIN to the return and process the return.

Click these links for Form W-7 and Instructions for Form W-7.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

LLC filing 1065 without ITIN, help!

Thanks for your answer @DavidS127

My understanding is that I have to send my passport along with the W7 in order to get my ITIN (I'm not confortable with this), and the country in which I currently live has no certified acceptance agents! That Is why I plan to get it in person in the US.

Or am I able to not send the passport and just the W7?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

LLC filing 1065 without ITIN, help!

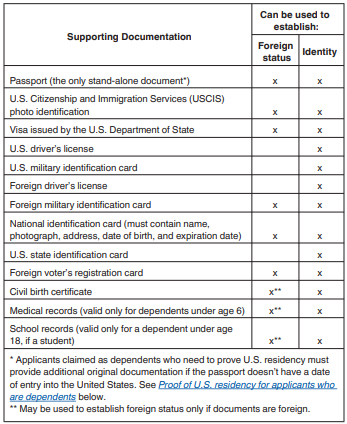

According to the IRS Instructions for Form W-7 on page 3 of the PDF at this link, you must provide either the original or certified copies of documentation to establish your identity and your connection to a foreign country. The Table on page 3 of that PDF shows the list of documentation that can be used to establish "Foreign status".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

LLC filing 1065 without ITIN, help!

We registered our LLC Partnership last year in USA.

This is the very first time we are submitting a tax file.Our partners are srilankan and they don't have SSNs or ITINs. Because of that issue,we can't fill the schedule - K correctly. What can we do about this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

LLC filing 1065 without ITIN, help!

Please read this IRS FAQ regarding foreign partners. They do need to have a SSN or ITIN for you to electronically file their return because a foreign partner needs to file a US 1040 NR return. If your partners do not have this, your return will need to be mailed in.

The partnership should notify any of its foreign partners without a valid TIN of the necessity of obtaining a U.S. TIN. An individual's TIN is the individual's social security number (SSN) or ITIN. To apply for SSN or ITIN, they need to contact their home country. Also they can apply for an ITIN by downloading and completing a form W7. Turbo Tax does not support this filing but here is a W7 copy that can be downloaded and signed by the partner.

Now when you mail in your return you will need to:

1. Attach a statement to your tax return, that states that one or more partners is a nonresident alien while your LLC is a US based company and that these partners do not have a TIN.

2. List the name, address, for all your partners. Include copies of the signed W7 applications in your tax return to show that a TIN is being applied for.

3. If the partners are applying for a SSN or ITN in their own countries, indicate this in the statement.

Please read this IRS website on where to mail your completed return in.

You also might consider this option in lieu of filing your return now. You can file an extension of time to file your 1065 return by completing form 7004. Please read this Turbo Tax post for more information on filing an extension. Filing an extension will give you extra time so your foreign partners can obtain their TiNS before your extension expires. The 7004 will need to be printed and mailed in but if you mail in before the due date of your return, you will be considered as filing this before the due date of the return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

LLC filing 1065 without ITIN, help!

Thank you very much for your support .

I have some questions more.could you please help me to solve it?

1.we haven't necessary time to mail tax return now.can we get permission to extension? What do we do for that?

2.Can we submit tax return online when we get the ITIN?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

LLC filing 1065 without ITIN, help!

Yes, to get permission for the extension, you will need to file a 7004 for your LLC and your partner's individual return. You may either fill out the form 7004 in accordance with the instructions given here, and then print and mail the form(s) to the address provided by the instructions. To be very clear, two form 7004's need to be generated. One from your LLC tax return and one from your foreign partner's tax return.

Since your partner is not a US citizen or resident alien, their return will be a 1040 NR return. Turbo Tax does not prepare non-resident returns but our affiliate at sprinttax.com does. You will need to contact them about the correct procedure for filing a form 7004 on a 1040NR return.

Once you receive an ITIN for your foreign partner, his return can be filed electronically online as well as your LLC/partnership return.

Be sure you mail the extension form's 7004 before the due date of your return, which is April 18.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

LLC filing 1065 without ITIN, help!

Thank you very much for your biggest support.

I have few more questions.

If I decide to mail the 1065 without getting any extension,

1.What are the requirements that want to attach with 1065?

2.Can I attach w-7 copies with it?

3.Can I apply for partners ITIN by attaching w-7 copies with 1065 ir is there another process for it?

4.To fill w-7 do partners want to contact IRS in their home country or no?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

LLC filing 1065 without ITIN, help!

When you select the file by mail option, TurboTax will include the forms you must mail with the 1065 form. You will also want to have the following forms included:

- Statement that one or more partners are nonresident aliens while your LLC is a US-based company and that these partners do not have an ITIN. The statement should include the following:

- List the name and addresses of all your partners.

- Include copies of the signed W7 applications in your tax return to show that a TIN is being applied for.

The W-7 application will need to be applied for separately from the 1065 filing by mailing in the W7 with proof of identity and foreign status documents to the following address:

Internal Revenue Service

Austin Service Center

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342

You can apply for the ITIN abroad by filing the form through a Certifying Acceptance Agent.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

LLC filing 1065 without ITIN, help!

Thank you very much for your support.IRS gave us an extension period to file the tax return. Could you please help me to solce the problems given below?

I want to know,

1.Can we submit W-7 as e-file?

2.Can we fill a copy of W-7 by downloading if we decide to mail it?

3.What are the other documents we should attach with w-7?

4.Are the other documents be certified copies or require orginal ones?

5.To where do we mail this file?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ravenmhug

New Member

djpmarconi

Level 1

pivotresidential

New Member

franadonis1

New Member

gerald_hwang

New Member