- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: I'm using Turbo Tax Self-Employment because we started a business in 2020. Shouldn't income go under Schedule C? It's entering it as 1099-NEC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm using Turbo Tax Self-Employment because we started a business in 2020. Shouldn't income go under Schedule C? It's entering it as 1099-NEC.

If it is the IRS that is supposed to provide me with a 1099-NEC, how would they know what my income has been for the tax year? I paid estimated taxes. But I don't report to them the income that's associated with those estimated taxes.

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm using Turbo Tax Self-Employment because we started a business in 2020. Shouldn't income go under Schedule C? It's entering it as 1099-NEC.

If someone pays you $600 or more they are suppose to give you a 1099NEC. It used to be a 1099Misc box 7 but this year they moved it to 1099NEC box 1. Yes 1099NEC goes on schedule C line 1 as income. And any 1099NEC you give out goes on Schedule C line 11 as Contract Labor.

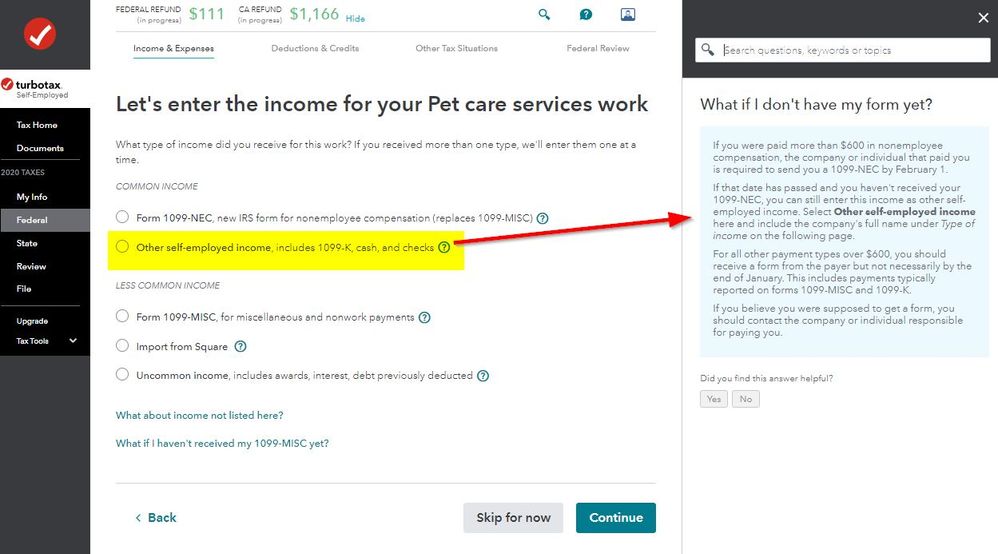

If you have the Online version or even in the Desktop program just enter your total business income as Other Self Employment Income or Cash or General. You don't need to enter the actual 1099Misc or 1099NEC. Only the total goes to schedule C line 1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm using Turbo Tax Self-Employment because we started a business in 2020. Shouldn't income go under Schedule C? It's entering it as 1099-NEC.

"we started a business in 2020." Who exactly are "we"? I ask because you might need to file a Partnership or other type of corporate tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm using Turbo Tax Self-Employment because we started a business in 2020. Shouldn't income go under Schedule C? It's entering it as 1099-NEC.

This is a one person owned/operated LLC in California. "We" is in reference to my attempt to help with his taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm using Turbo Tax Self-Employment because we started a business in 2020. Shouldn't income go under Schedule C? It's entering it as 1099-NEC.

If someone pays you $600 or more they are suppose to give you a 1099NEC. It used to be a 1099Misc box 7 but this year they moved it to 1099NEC box 1. Yes 1099NEC goes on schedule C line 1 as income. And any 1099NEC you give out goes on Schedule C line 11 as Contract Labor.

If you have the Online version or even in the Desktop program just enter your total business income as Other Self Employment Income or Cash or General. You don't need to enter the actual 1099Misc or 1099NEC. Only the total goes to schedule C line 1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm using Turbo Tax Self-Employment because we started a business in 2020. Shouldn't income go under Schedule C? It's entering it as 1099-NEC.

Thank you! So, the "income" that the program is soliciting for under the Income topic area, is in fact only supposed to be for income the business received?

I'm confused because the program appeared to be asking for the business's income (presumably in the form of sales). Is this not the correct place to enter income derived from the actual business itself?

(If it's not readily apparent, this is all very new to me! So yes, I don't know what I'm doing! 🙂

Thanks!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm using Turbo Tax Self-Employment because we started a business in 2020. Shouldn't income go under Schedule C? It's entering it as 1099-NEC.

Yes. Income the business received. What do you mean.."...enter income derived from the actual business itself?" The LLC is a disregarded entity and you file it on Schedule C in your personal 1040 return. Unless you elected to be a Single Member LLC and a S corp. Then you need to file a separate 1120 S Business return.

You are filling out Schedule C. You enter the gross income for the Business from all sources like sales, service, etc. Then you enter the business expense. Turbo Tax will calculate the Net Profit or Loss on Schedule C. Are you familiar with Sch C?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm using Turbo Tax Self-Employment because we started a business in 2020. Shouldn't income go under Schedule C? It's entering it as 1099-NEC.

Thank you. Yes, I am familiar with Schedule C in terms of reporting business income there.

Let me try asking my question a different way. I'm probably not being clear...

Why is the very first income topic asking for 1099-NEC income? Shouldn't I be being asked for the business income first? (I didn't receive any 1099-NEC and other than a commission income source, don't expect to). Is my mistake that I should not be reporting anything in the 1099-NEC section as income for the business, then?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm using Turbo Tax Self-Employment because we started a business in 2020. Shouldn't income go under Schedule C? It's entering it as 1099-NEC.

We don't know why it starts out asking for 1099NEC income first. Probably most people will get a 1099NEC. The program is trying to be very helpful and ask all the questions so nothing is missed. There might be a lot of spots you have to skip over and just keep going. If you miss something you can always go back and jump around. You can enter things out of order.

If you didn't get any 1099 forms just keep going. I know the screens are hard to find sometimes but you should come across that screen I posted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm using Turbo Tax Self-Employment because we started a business in 2020. Shouldn't income go under Schedule C? It's entering it as 1099-NEC.

Yes. I'm actually on it now.

Thanks very much! I appreciate your time!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm using Turbo Tax Self-Employment because we started a business in 2020. Shouldn't income go under Schedule C? It's entering it as 1099-NEC.

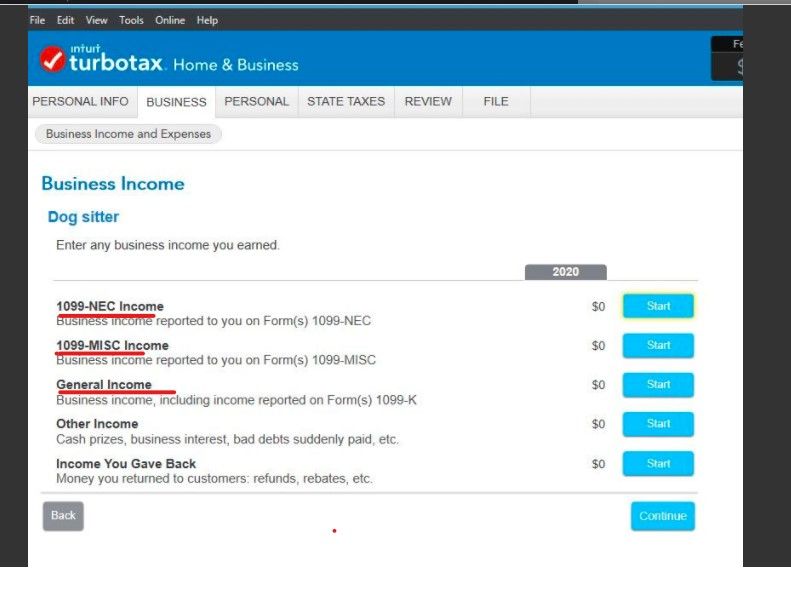

The total annual income on a Sch C is one amount on one line ... in the program this one amount is split into 3 categories ... use them or not it is up to you. If the program did not split it out it would confuse users and it they do split it out it confuses others. So you wish you can simply make one annual total in the general income section and skip all the rest.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ekudamlev

New Member

HNKDZ

Returning Member

kac42

Level 2

fkinnard

New Member

mellynlee1

Level 3