- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: How to enter information on Form 8990 (triggered by K-1 Box 13 Code K) properly as individual taxpayer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

Form 8990 is prompted on a 1065 Partnership return by the answers to question 24, and an 1120S S Corp by the answers to question 10. For a personal 1040 return it’s prompted by your K-1 entries, specifically Line 13, Code K, Excess Business Interest Expense, Line 20 AE, Excess Taxable Income, and Line 20 AF, Excess Business Interest Income. These codes are generated when the business you got the K-1 from was limited in their full deduction of Business Interest Income by the Section 163(j) limitations in the new tax code. Most likely, they made over $25 million in gross receipts, but there are other criteria.

The important one to you especially is Line 13 Code K, Excess Business Interest Expense. This is your share of what could not be deducted this year by the partnership. It passes through to you this year, and reduces your basis, but it is carried indefinitely forward to a future year by you, not the partnership, when Excess Taxable Income or Excess Business Interest FROM THE SAME Entity can be used to offset all or a portion of the amount that you are carrying forward. So don’t ignore the form or you’ll lose that amount, or have to file an amended return.

The amounts in Line 20 AE and AF are used in the calculations to see if you are further limited in the deductions of your own business interest expense this year. Those amounts do not carry forward, other than into your three year average. If you grossed less than $25 million it’s unlikely, but again, there are other criteria so check closely.

You should only get one of the three codes from an entity subject to the limitations in a given year. From entities not subject to the limitations, you may get these numbers that will be used in your own limitations calculations, so read the additional sheets of your K-1 carefully.

Caveats: I am not a CPA or tax professional, but a user of TurboTax since the early days. I have interests in partnerships that are generating these codes, and have had to read the tax code and everything I could find to understand it. If you work through the 8990 form carefully, it will become very clear what the form does, and what is happening. If you’re at all in doubt, get a CPA or Tax Pro to do your taxes.

The 8990 form is new this year, and is not supported by the 1040 desktop versions of TurboTax. It’s a simple form and calculation, so hopefully they’ll include it in the future, if you need it, get it from the forms page at irs.gov/forms you’ll have to fill out the form, and file your return by mail this year.

If I have anything wrong in my conclusions, please let me know. That’s what makes Answer X-change work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

@Smarc- I've been searching all over the internet on the topic and your answer above is the best to explain what Box 13 Code K on schedule K-1 means and what to do with it. I'm trying to work through From 8990 and hoping to get some further guidance from you. The only thing looks certain to me is to take the amount to Form 8990, line 43, column (c), but how to complete Part I as an individual taxpayer remains unclear to me. I'm a W-2 worker and a limited partner in a partnership that generated this K-1. Do I have any "Business Interest Expense" and "Business Interest Income" in Section I and III on Form 8990? How should I come up with "Adjusted taxable income", from my 1040? And may I assume there is 0 "Allowable Business Interest Expense" on line 30 and my K-1 amount should somehow end up in line 31, "Disallowed business interest expense" for "Carryforward"? I sincerely apologize for so many questions, as a new investor in limited partnership, there is quite a bit learning for me to do, so any help and/or insight you can offer would be greatly appreciated. Thx!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

@Smarc - I have been searching all over the internet on this topic and your answer is the best I came across to explain schedule K-1, Box 13 Code K and what to do with it, thank you! I'm a W-2 worker and a limited partner of a partnership that produced such K-1 with Box 13 Code K amount, and I'm hoping to get some guidance from you on completing Form 8990 properly. The only thing looks certain to me is to take the amount to Form 8990, line 43, column (c), but how to finish Part I as an individual taxpayer remains unclear to me. Do I have anything to report in Section I (Business Interest Expense) and Section III (Business interest Income)? How should I go about Section II (Adjusted Taxable Income) based on my 1040? May I assume "zero" on line 30 and most of all, should the amount from K-1 somehow end up on line 31 for "Carryforward"? I apologize for so many questions, as a new investor in limited partnerships, there is quite a bit learning for me to do, so any help and/or insight you can offer would be greatly appreciated. Thx!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

@Smarc Can Mark or anyone pls answer this, I am unable to find this info anywhere? I am in same situation. Individual 1040 filer, with a K1 in PTP MLP, that has 13K - excess business interest expense. TT is not generating 8990, so have to manually fill them. I am certain about Schedule A (line 43 & 44), listing the K1 with 13K and two other K1 that has 20 AE (Excess Taxable Income). Should Part 1,II, III be filled for individual K1 (that has 13K in the past). So that 13K offsets only the income FROM THAT partnership, as opposed to any partnership. So they will all be 0 for this year, but at later year we do for each K1 (meaning separate 8990 for each K1) that had 13K in the past and now with 20AE/20AF in that year.

Understand that Part1 item 14 - asks abt overall 20AE/AF (from Section A, line 44, column f) - but I believe it should be filled only on the year when the K1 (that had 13K) has 20AE/20AF. So this year this will all be 0. Am I correct?

If thats the case - Line 31 carryforward - would also be 0 (instead of whats in 13K) - Again, I believe 0 is correct, as the real carry fwd for a particular K1 is from Schedule A - line 43- column d. Line 31 is only for partial carry fwd when the specific K1 (that has 13K) has 20AE/AF and partially take away the prior 13K amount (remaining gets carried fwd). Can someone confirm this.

It's not easy to decipher others' tax situation. Appreciate anyone taking time to answer this, esp when the software is not supporting 8990 filing & COVID doesn't help stopping by a tax preparation center to ask some question face to face (to my surprise, not many know how to handle K1s)

Thanks

Richard

"I'm a W-2 worker and a limited partner of a partnership that produced such K-1 with Box 13 Code K amount, and I'm hoping to get some guidance from you on completing Form 8990 properly. The only thing looks certain to me is to take the amount to Form 8990, line 43, column (c), but how to finish Part I as an individual taxpayer remains unclear to me. Do I have anything to report in Section I (Business Interest Expense) and Section III (Business interest Income)? How should I go about Section II (Adjusted Taxable Income) based on my 1040? May I assume "zero" on line 30 and most of all, should the amount from K-1 somehow end up on line 31 for "Carryforward"? I apologize for so many questions, as a new investor in limited partnerships, there is quite a bit learning for me to do, so any help and/or insight you can offer would be greatly appreciated. Thx!"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

HI,

sorry I didn't see this until today!

In Part 1 line 1 you'll take any other business interest expense you have reported on your other K-1's, if you don't have any, then that line will be zero. If you have any carry forwards from last years Form 8990, those go on line 2, and the current year excess business interest goes on Line 3. Add those up on Line 5.

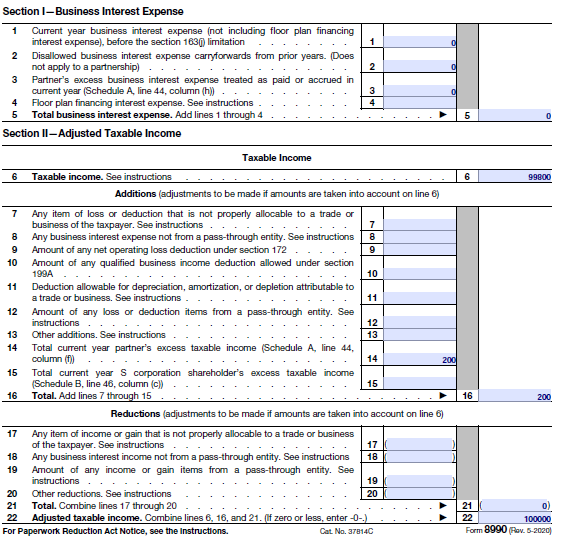

Line 6 is your Adjusted Taxable Income (Line 11b on your 1040).

In additions they want any excess taxable income from your other K-1's, again, if you don't have any, or any of the other additions, this will all be zero. Same for reductions.

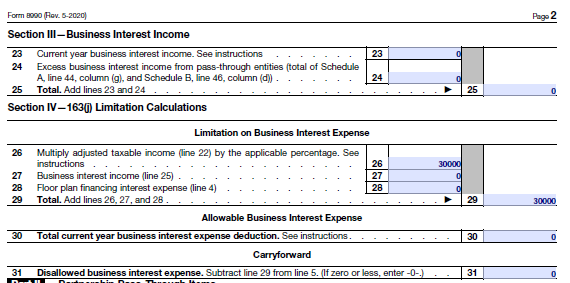

Then when you get to Line 20 you're just taking 30% of your taxable income, and seeing if the current year business interest expense deduction exceeds that amount, where it would be further limited. Most likely, it's not.

All of these other entries you're asking about usually feed in from other K-1's. For example, one K-1 may have excess taxable income, but won't reporting any excess business interest expense (otherwise, it would be deducted in the current year). So in your case with one K-1, you'll carryforward the excess business interest expense until a year when THAT entity has excess taxable interest that it can be deducted against.

Steve

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

Hi Richard,

You're correct on most of it. Part 1 of the 8990 is going to current year business interest expense from all K-1's from this year, disallowed carry-forwards, and the amounts that are excess business interest expense this year. Similarly, the additions and reductions sections will add excess taxable income from any K-1. Those sections are how they look at your income to see if combining all of those makes you subject to the Section 163(j) limitations, and thus potentially further limiting your deductions. Since you're doing your own taxes, and it's not team of accountants asking the question, you're likely not making $25 million-ish and not going to be affected.

So for you, the important section is Schedule A for Partnerships, or B for S Corporations. You don't need a separate sheet for each K-1, in fact you really don't want that, because the totals from the columns feed in to the numbers they are looking for in Part 1. The ONLY number that carries forward is going to be excess business interest expense, and it carries forward until it can be deducted by the entries from that same entity in a future year.

So direct to some questions you had: Part 1 Item 14 would have the amounts from your K-1's that had excess taxable income. You won't have a K-1 with both excess taxable income, and excess business interest expense, because it would be deducted in that year. These amounts are used in the calculation to see if your current year business interest deduction will be further limited.

Line 31 would be zero most likely, unless you made a **bleep** ton of money. In that case, tell your accountants to figure out the form!

So if this is your first year with a reported Line 13K Excess Business Interest expense your carryforward amount for Part 1 line 2 is zero. For Line 31 it's also zero (again caveat above) and your carry forward to next year will be the amount on your K-1 with Line 13k. That amount will be carried forward, and maybe added to in future years, until it can be offset by excess taxable income or excess business interest income from the SAME K-1 entity with Line 13K entry.

Steve

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

Steve, thanks for taking time to write abt it. You are a lifesaver.

Only problem is that your response is totally different than what I had initially thought and filled 8990, that was ready to sent to IRS. Happy that I got your input before I mailed.

So, pls bear with me and guide thru this one more time. Appreciate your help again.

My case:

I am Individual Tax filer (1040, way less than 25 Mil, so 163j doesn't apply to me) and have 3 K1's that need to be brought into this 8990 context

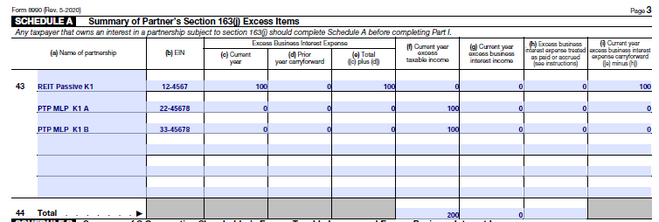

1. First K1 (REIT - passive investment) - having a 13K (Excess Business Interest Expense of $100), triggering the need to do this 8990 form.

2. Second & a Third K1 (PTP MLP each) - and each has 20AE of $100 (Excess Taxable Income - Total of $200)

3. Let's assume my 1040 11b - Taxable Income is 99.8K (so it rounds off with above $200 (Taxable Income), to 100K)

I have constructed Schedule A as shown below.

Based on what you said I have filled

Can you pls let me know if it looks ok.

Only concern:

* In Part 1: I don't have the 'Excess Business Interest Expense' listed anywhere (not even line 3, as I am not sure when EBIE is treated as paid or accrued). Thats why I have Schedule A's 43-h as 0 as well.

* Does Line 30 and 31 look ok. Should line 30 have current year's EBIE

* After doing 8990 form, should any deduction happen to Taxable Income (in 1040) - I assume not, meaning, even though it's allowed without being subject to 163j, we cannot take it as there is no 20 AE/20AF from that partnership.

Again, thank you so much for looking into this. I wish TT supported this for individual filers. Hopefully, this generic example with screenshot will help many people. Appreciate your time to help everyone here.

Thanks

Richard

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

@Smarc or anyone who is aware of this form 8990 comment (on above post), please. Appreciate your help. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

Bumping up to see if Steve @Smarc or anyone can help. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

Hi Rich,

Sorry for the delay, I was busy all morning and couldn't see the attachments on my iphone, and had to wait until I got home.

Your forms look 100% correct to me. So what you are doing is carrying that $100 excess business interest forward to a future year.

Steve

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

@Smarc Steve, Thanks a lot for confirming. Lifesaver. I can only imagine how busy you would have been during this busy time. Thanks for helping others in between. Sorry that I bothered few times and asked multiple times, as I didn't want to miss the filing deadline.

This packet is going out tomorrow. I am not going to look at it again. I am done. Wish we can e-file with form 8990. Strangely TurboTax (Deluxe desktop version) is not blocking, but silently not taking 13K number into effect (I saw in the forms mode - that 13K item carries asterisk saying - not supported). I found out thru the forum that I need to file 8990. Then found you. Thanks again.

Hopefully, IRS will process paper filing - saw in the news that they are way too backlogged this time (I can only imagine).

Thanks again Steve. Stay safe. Appreciate all your comment & sharing your knowledge on 8990.

Regards,

Richard

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

Hi Rich,

Happy to help. Well you could still e-file without the Form 8990, since this year it makes no difference in your taxes, and you have nothing you are carrying forward from last year for use this year. Then you could do an amended return with just the Form 8990. Nothing else would change.

My caveats, I’m an engineer, not a tax professional, but I had to educate myself on the Section 163(j) issues because I have K-1’s from six different states, with small amounts, so I’m not further subject to the limitations either. I do wonder if the IRS would even care if you ignored the 8990 and the carry forward. If you don’t track the amount to carry forward, the IRS probably won’t care, because you won’t be able to deduct it in the future, and more money for them.

Steve

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DFH

Level 3

Failte

New Member

MaxRLC

Level 3

jeangould638

New Member

harborhits1

Returning Member