- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Steve, thanks for taking time to write abt it. You are a lifesaver.

Only problem is that your response is totally different than what I had initially thought and filled 8990, that was ready to sent to IRS. Happy that I got your input before I mailed.

So, pls bear with me and guide thru this one more time. Appreciate your help again.

My case:

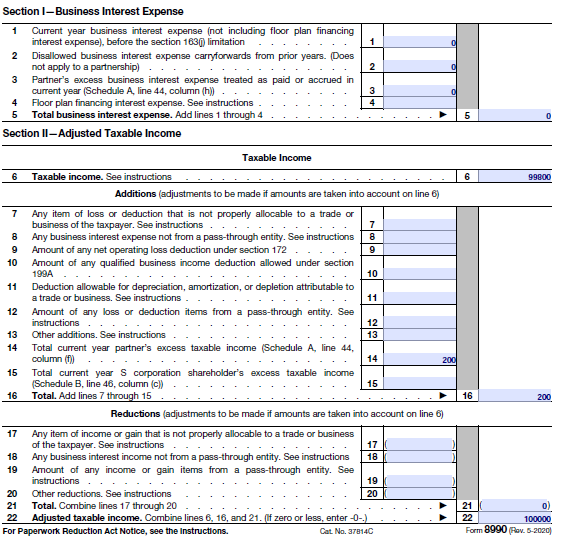

I am Individual Tax filer (1040, way less than 25 Mil, so 163j doesn't apply to me) and have 3 K1's that need to be brought into this 8990 context

1. First K1 (REIT - passive investment) - having a 13K (Excess Business Interest Expense of $100), triggering the need to do this 8990 form.

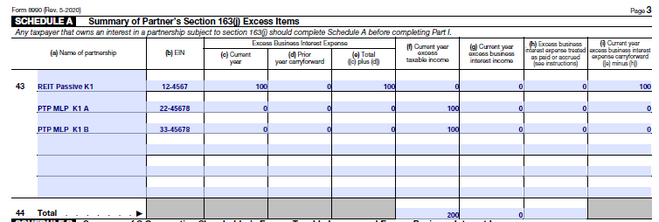

2. Second & a Third K1 (PTP MLP each) - and each has 20AE of $100 (Excess Taxable Income - Total of $200)

3. Let's assume my 1040 11b - Taxable Income is 99.8K (so it rounds off with above $200 (Taxable Income), to 100K)

I have constructed Schedule A as shown below.

Based on what you said I have filled

Can you pls let me know if it looks ok.

Only concern:

* In Part 1: I don't have the 'Excess Business Interest Expense' listed anywhere (not even line 3, as I am not sure when EBIE is treated as paid or accrued). Thats why I have Schedule A's 43-h as 0 as well.

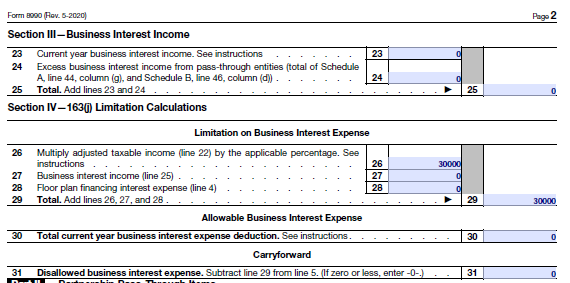

* Does Line 30 and 31 look ok. Should line 30 have current year's EBIE

* After doing 8990 form, should any deduction happen to Taxable Income (in 1040) - I assume not, meaning, even though it's allowed without being subject to 163j, we cannot take it as there is no 20 AE/20AF from that partnership.

Again, thank you so much for looking into this. I wish TT supported this for individual filers. Hopefully, this generic example with screenshot will help many people. Appreciate your time to help everyone here.

Thanks

Richard