- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: How can I amend a 1065 return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

I am trying to amend a 1065 return under the BBA. According to Rev. Proc. 2021-29 the Partnership which I am trying to amend does not qualify to do so by marking the "Amended" Box on the return and K-1's.

I started doing the 1065-X but stumbled upon this intuit help article stating "Form 1065-X can't be used to amend a previously e-filed return". (Amending a partnership return in Lacerte - Intuit Accountants Community). I e-filed the return so, does that mean I cant file a 1065-X now? How should I amend the 1065 return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

The link you posted is for Lacerte (an Intuit product for tax professionals).

You cannot e-file a Form 1065X with TurboTax Business, regardless.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

Right, in the Windows Turbo Tax Business program Efiling the 1065X is unsupported, see this list

I don't know about the professional programs like LaCerte or PtoSeries.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

Form 1065X is printed and mailed.

An amended 1065 (with the amended box checked) can be e-filed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

I have a related question/ problem:

I filed 1065 and K1’s for the LLC owned by my spouse and me in MA.

(Later I found out we can probably avoid 1065 and file this business activity in our joint personal tax return).

there was a line 14a on page 4 of 1065 was NOT correct, and this error seems from Box G of Sch K-1 “information about the partner”: “General partner” should have been checked, but I checked “Limited partner” instead.

this further leads to missing of value in line 14 of Sch K-1(self-employment earnings), as far as I understand.

the above PE tax return has already been accepted by Fed and state of MA.

now can anyone advise how to correct the mistake? Should I do 1065X?

the PE tax was prepared using TurboTax business desktop version. Should I Amend , then print and mail?

thank you all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

Yes, you should amend the returns then print and mail them. In the meantime, you can file your personal return with the correct information, but be sure to mark the K-1 as "Amended".

@Zhzhaa

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

This tax thing is killing me:(.

Thank you AliciaP1 for the reply. @AliciaP1

A few follow-up questions:

The TBT business desktop leads directly to “Review Section 2”, with line A and B already having “NO” pre-checked.

It seems the key question is, what’s “Imputed Underpayment”.

My spouse and I are the only members/ partners of this LLC. We did small amount of activity with “0” on line 1-19 on 1065; (-1441) on line 1 of Sch K; 633 on line 2 of Sch K, and “0” on line 3-13 on Sch K.

I plan to make the following corrections:

1.

line 14a on page 4 of 1065 ————— should be -1441(was -720 on original 1065 filed)

2.

Box G of my Sch K-1 “information about the partner”: ——————“General partner” (was “Limited partner” ).

3.

line 14 of my Sch K-1(self-employment earnings), ————— -721(was 0).

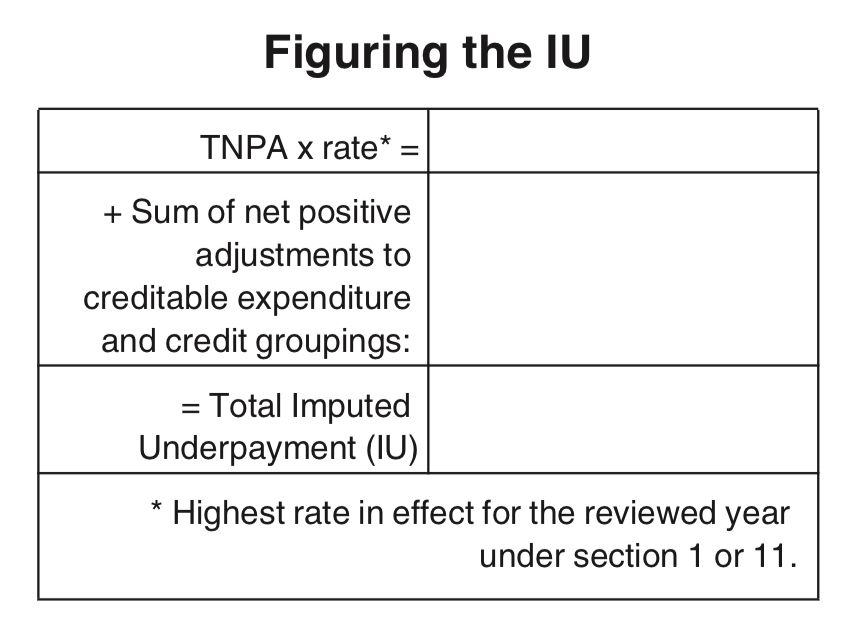

Can some expert kindly explain what’s “Imputed Underpayment”, and if “NO” is the correct answer for line B? (Do the adjustments on the AAR result in an imputed underpayment for the reviewed year?)

I have been reading The instructions for 1065X for 3 days, still no clue...

Thanks a million!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

An imputed underpayment is the tax due after adjustments are made, typically from an audit of a partnership return. This does not apply to you, since the amended return was not the result of an audit. So the correct answer to the question, "Do the adjustments on the AAR result in an imputed underpayment for the reviewed year?" is No.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

Thank you very much @PatriciaV

I feel much relieved:)

Instructions on 1065x (i1065X) has the following:

Part IV—Imputed Underpayment (IU) Under the Centralized Partnership Audit Regime

“BBA AARs must always include a computation of the IU (even when the IU is zero or less than zero or the adjustments do not result in an IU) as determined under section 6225(b). Where the adjustments do not result in an IU, the IU should be shown as zero. Documentation should be included with the AAR that supports the computation of the IU amount.“

while “What to Attach“ (page 2 of i1065X) did not ask for “computation of IU”.

in this case, should I attached a form with “0” in all the cells, or just ignore the “computation of IU”?

I have been so nervous on this tax. I am probably better off closing the business.

thank you all the people in this community!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

Does TurboTax complete the IU computation for you? If not, it's unlikely you need to include this computation with your amended return.

The Bipartisan Budget Act of 2015 (BBA) created many new regulations for partnerships, including the requirement for an administrative adjustment request (AAR) to adjust already-filed partnership returns (instead of an "amended" return). If you would rather not deal with this bureaucracy, you may benefit from the services of a local tax expert who would be more familiar with your complete tax situation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

I did not see TurboTax doing any IU computation in the original return or the “amend”.

thanks again for the information:)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

I have an llc partner and closed the business. I did a short year, now I need to add January-April 2022 and amend it to include all taxes and close the business. I used the TurboTax Business for partner LLC, how do I go about doing this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

what type of activity after it closed? it would seem that if you are the only one left any income or expenses would be solely yours - which would get reported on Schedule C or E (page 1) most likely depending on what the former partnership was engaged in.

.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

I opened a LLC in California with one partner, in Aug 2021. I planned to finish the year, but decided it was't worth it and closed my shop website. I sold beauty products untill the end of April, but I filed the taxes and form 1065 (fed)with schedule k (568)California from Aug to 12/31/21. But i didn't include January to April 2022. I need to include this and schedule a final return to close the business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

I used turbo tax business since its an llc partner and need to know what forms I need to send to get this completed for the update to close the business. Please help if you can. Thnk you! 🙂

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

raymond-leal60

New Member

Th3turb0man

Level 1

evanlalcouffe

New Member

rmm

New Member

norman422tobby

New Member