- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Thank you very much @PatriciaV

I feel much relieved:)

Instructions on 1065x (i1065X) has the following:

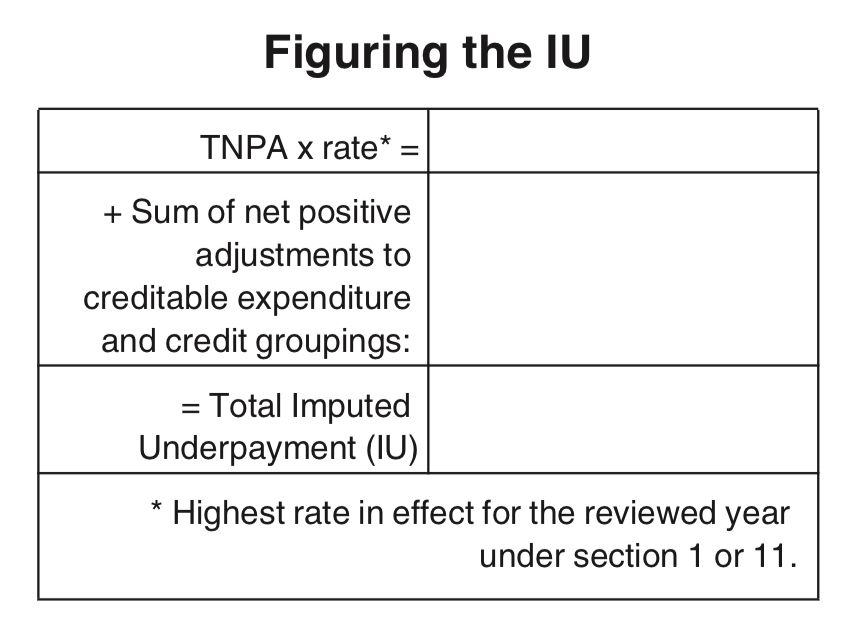

Part IV—Imputed Underpayment (IU) Under the Centralized Partnership Audit Regime

“BBA AARs must always include a computation of the IU (even when the IU is zero or less than zero or the adjustments do not result in an IU) as determined under section 6225(b). Where the adjustments do not result in an IU, the IU should be shown as zero. Documentation should be included with the AAR that supports the computation of the IU amount.“

while “What to Attach“ (page 2 of i1065X) did not ask for “computation of IU”.

in this case, should I attached a form with “0” in all the cells, or just ignore the “computation of IU”?

I have been so nervous on this tax. I am probably better off closing the business.

thank you all the people in this community!!