- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Filing W-2s online early due to closure of S Corp

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

I have filed W-2s for S Corp through TurboTax Business. Our S Corp is now closed and I need to file W-2s for 2021. It is only June 2021. What is the best way to file W-2s early and online?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

And you can get the RED forms by mail now for free : https://www.irs.gov/businesses/online-ordering-for-information-returns-and-employer-returns

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

Complete all the things on the IRS list that is applicable : https://www.irs.gov/businesses/small-businesses-self-employed/closing-a-business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

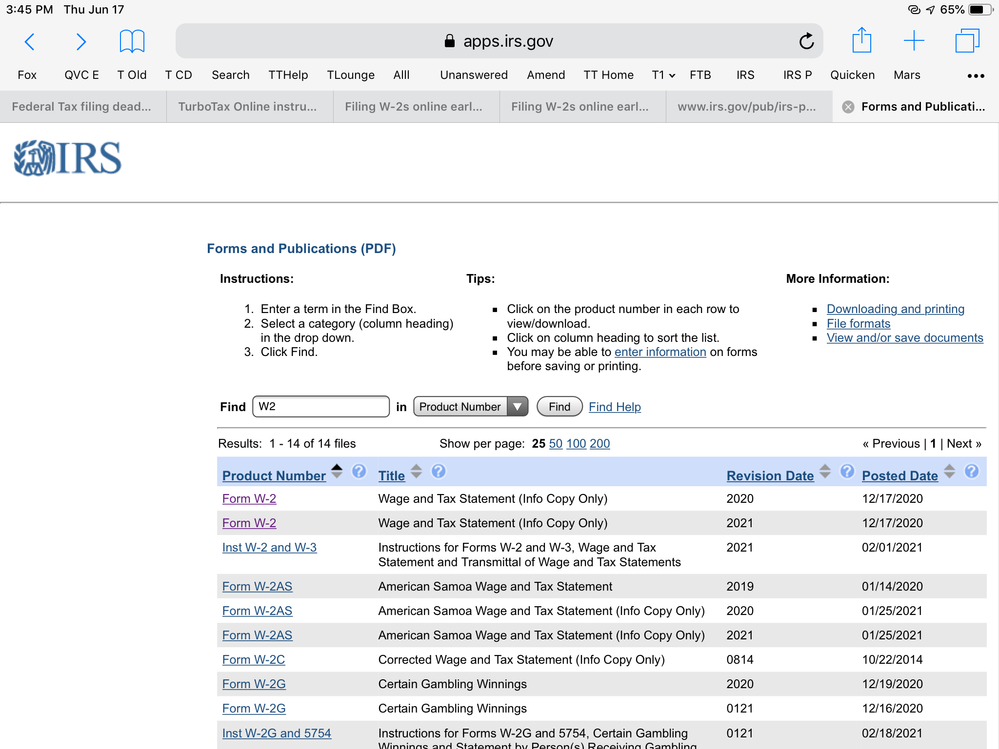

I previously checked out that website, https://www.irs.gov/pub/irs-pdf/fw2.pdf and the site does not allow 2021 W-2s to be filed online.

The following restrictions apply specifically to Forms W-2/W-3 Online:

- Do not use Forms W-2/W-3 Online if you are filing for a tax year other than 2017, 2018, 2019 or 2020.

Apparently, I will have to download the forms, fill out and mail. I was hoping to avoid the mailing step.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

You cannot efile 2021 forms until mid Jan 2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

I'm getting the run around with the SSA and IRS. According the IRS 2021 General Instructions for Forms W-2 and W-3, page 13 states:

Terminating a business. If you terminate your business,

you must provide Forms W-2 to your employees for the

calendar year of termination by the due date of your final

Form 941, 944, or 941-SS. You must also file Forms W-2

with the SSA by the due date of your final Form 941, 944,

or 941-SS. If filing on paper, make sure you obtain Forms

W-2 and W-3 preprinted with the correct year. If e-filing,

make sure your software has been updated for the current

tax year.

I have filed our FINAL Form 941, Employer's Quarterly Federal Tax Return

On page 14:

Failure to file correct information returns by the due

date. If you fail to file a correct Form W-2 by the due date

and cannot show reasonable cause, you may be subject

to a penalty as provided under section 6721. The penalty

applies if you:

• Fail to file timely,

• Fail to include all information required to be shown on

Form W-2,

• Include incorrect information on Form W-2,

• File on paper forms when you are required to e-file,

• Report an incorrect TIN,

• Fail to report a TIN, or

• Fail to file paper Forms W-2 that are machine readable.

The amount of the penalty is based on when you file

the correct Form W-2. Penalties are indexed for inflation.

The penalty amounts shown below apply to filings due

after December 31, 2021. The penalty is:

• $50 per Form W-2 if you correctly file within 30 days of

the due date; the maximum penalty is $571,000 per year

($199,500 for small businesses, defined in Small

businesses).

• $110 per Form W-2 if you correctly file more than 30

days after the due date but by August 1; the maximum

penalty is $1,713,000 per year ($571,000 for small

businesses).

• $280 per Form W-2 if you file after August 1, do not file

corrections, or do not file required Forms W-2; the

maximum penalty is $3,426,000 per year ($1,142,000 for

small businesses).

However, the SSA states I cannot file 2021 W-2s until December 15, 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

Terminating a business. https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

If you terminate your business,

you must provide Forms W-2 to your employees for the

calendar year of termination by the due date of your final

Form 941, 944, or 941-SS. You must also file Forms W-2

with the SSA by the due date of your final Form 941, 944,

or 941-SS. If filing on paper, make sure you obtain Forms

W-2 and W-3 preprinted with the correct year. If e-filing,

make sure your software has been updated for the current

tax year.

https://www.irs.gov/pub/irs-pdf/fw3.pdf

https://www.irs.gov/pub/irs-pdf/fw2.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

This tells me NOTHING. If you follow your links, the SSA doesn't have 2021 W-2 forms available yet. I called SSA and they will not be ready until December 15, 2021. However, I need to file in the next 30 days or risk a penalty from the IRS. I attempted to order the form W-2 through the IRS website and it is not available for order.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

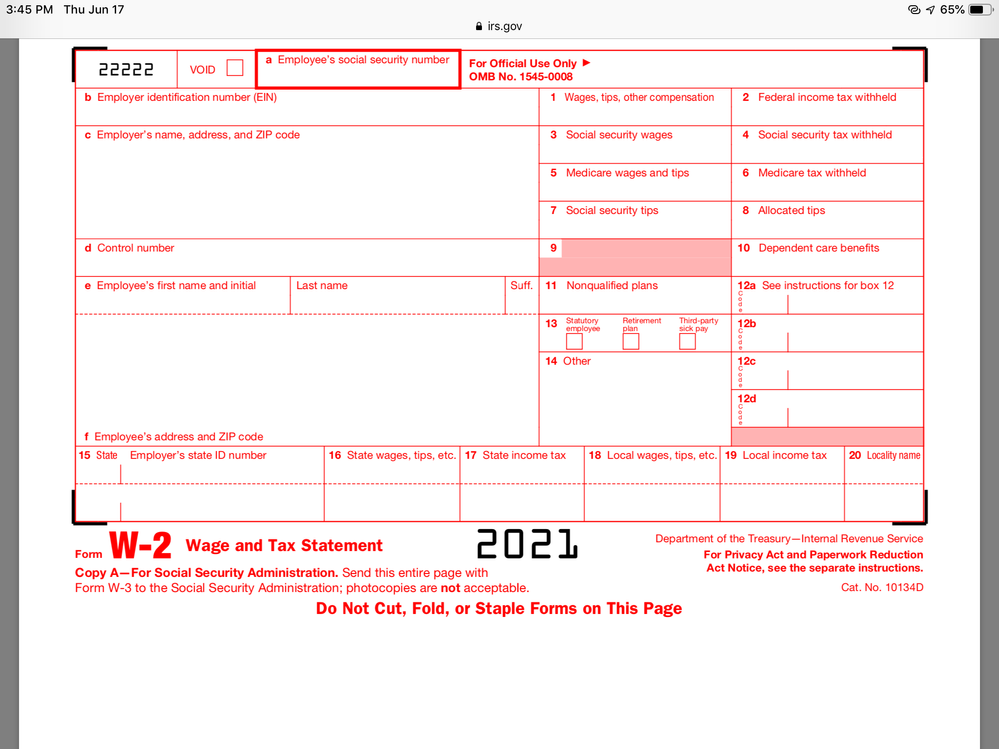

The IRS has it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

I'm sorry to tell you, the IRS does not have it. If you follow the link, you will see it is not there for 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

And you can mail regular Black & white forms ... I do it all the time without any reprisal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

Obviously, the links must be corrupted. As the link does not take me to 2021 W-2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

And you can get the RED forms by mail now for free : https://www.irs.gov/businesses/online-ordering-for-information-returns-and-employer-returns

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

Looks like 2021 to me

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kkrana

Level 1

ahkhan99

New Member

user17538710126

New Member

satyamps

New Member

aptcat93

New Member