- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Entered 1099-NEC, but didn't result in SE form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entered 1099-NEC, but didn't result in SE form

I am helping a friend with her taxes. She received a 1099-NEC which we entered. We answered No to the question of "No, I don't have any expenses related to this income" because she has no expenses. When selecting this option, I notice that there are no self-employment taxes reflected in her tax return. Is this correct? If I enter "Yes, I have expenses to deduct", then it calculates SE taxes owed. But, she doesn't have any expenses to deduct. Is this a bug with TurboTax? Will it result in incorrect taxes if she selects "No, I don't have any expenses related to this income"? Please advise.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entered 1099-NEC, but didn't result in SE form

Delete your Schedule C and start over. Enter the 1099 on the Schedule C directly.

Here's the general procedure for viewing the forms list and deleting unwanted forms, schedules, and worksheets in TurboTax Online:

- Open or continue your return in TurboTax.

- In the left menu, select Tax Tools and then Tools.

- In the pop-up window Tool Center, choose Delete a form.

- Select Delete next to the form/schedule/worksheet in the list and follow the instructions.

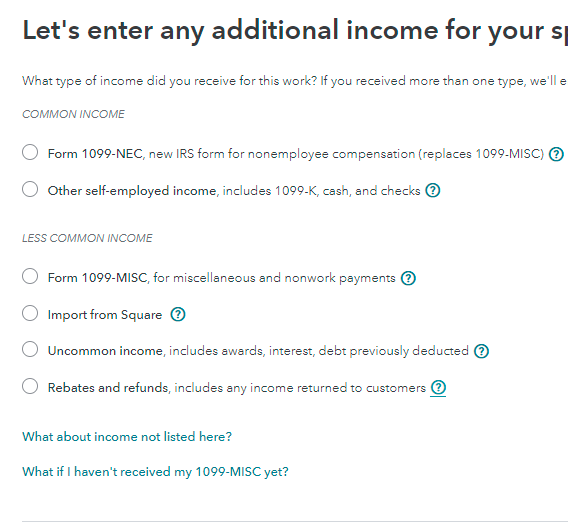

To set up your business:

- Open or continue your return.

- Search for schedule c and click the Jump to link in the search results.

- Answer Yes to Did you have any self-employment income or expenses?

- If you've already entered self-employment work and need to enter more, select Add another line of work.

- Follow the onscreen instructions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entered 1099-NEC, but didn't result in SE form

Thank you for this answer. But, I'm wondering why would TurboTax allow me to enter her 1099-NEC that way? It didn't even warn me that it was not the correct way to enter it - it just went along and would have let her continue and file her return incorrectly, leaving her vulnerable to an audit. I suspect tens of thousands of self-employed individuals have done the same thing, and will be audited. Am I seeing something wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entered 1099-NEC, but didn't result in SE form

There are three possible places to enter a 1099-MISC/1099-NEC in the TTX program. Where you enter it, depends on what box the income is reported in. With a 1099-NEC there's no doubt in your case, it's self-employment income. So it gets entered on SCH C. There are exceptions where the 1099-NEC could be for other than SE income though.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tcondon21

Returning Member

Bradley

New Member

fineIlldoitmyself7

Level 1

ARJ428

Returning Member

TheSchulteMeistr

Returning Member