- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

I don't know purchase price, only cost basis. I sold the entire position and read I have to report cost basis to IRS but if it's being reported on 1099 B then entering it in K1 section of TT would be double counting.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

HOPE THIS HELPS

MLP and PTP reporting k-1 and 8949

Please follow these instructions. Incorrect entries can result in entering the sale twice or otherwise incorrectly. Also see the sales schedule that was included with the k-1

Enter the k-1 info

Check the PTP box

If total disposition proceed as follows:

Check final K-1 (s/b marked on actual k-1)

Check sold or otherwise disposed of entire interest

On the k-1 disposition section for sales price use the ordinary income (sometimes you’ll see a column with the “751” or the words “Gain subject to recapture as ordinary income” or similar wording. This info comes from the supplemental sales schedule that should have been provided. It's also now on the k-1 box 20AB - no 20AB, no ordinary income column then then sales price is zero. The numbers I’m using represent the line numbers in forms mode (desktop only)

5. Sales Price = line 20AB (1065 k1)

6. Selling expenses = 0

7. Basis = 0

8. Gain is computed and should be same as the sales price.

9. Ordinary gain = enter same as sales price

This amount flows to form 4797 line 10 and is taxed as ordinary income. This step is necessary, so any suspended passive losses are now allowed.

10,11,12 should be blank

Now for the 8949.

The broker’s form is probably coded as B or E – sales proceeds but not cost basis reported to the IRS. This is because the broker does not track the tax basis. It used what you paid originally which is not correct.

The correct tax basis is:

What you paid originally, should be the same as what is on 1099-B as cost,

Then there is a column on the sales schedule that says cumulative adjustment to basis. If it’s positive add it to the original cost. If it’s negative subtract the amount.

Finally add the amount of ordinary income reported above, if any.

The result is your corrected cost basis for form 8949.

Some other things. Look at lines 20AB. That number should be added to the ordinary income above for reporting the 199A (qualified business income from the PTP). You don’t have to enter this but then you lose out on a tax deduction = 20% of this amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

Based on the information in this string:

- Your true overall gain is $2,403 ($4,690 less $2,287)

- Of this overall gain, $1,818 is reported as ordinary income (Section 751)

- This Section 751 is a recharacterization of the overall gain as a result of previously taking depreciation. As a result, the IRS wants the taxpayer to pick up ordinary income to offset any prior deductions from depreciation. This Section 751 gain is not added to the cost basis (tax basis); only a recharacterization.

- So once you have your overall gain of $2,403, subtract the Section 751 component of $1,818, leaves you the capital gain component of $585.

- That is why you have two components

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

your total gain is

4690 - (3939-1652)=2403 sales price less (purchase price reduced by adjustments to basis)

that's broken into two parts capital and ordinary

capital is 585 + ordinary is 1818 sum 2403 which magically is your total gain on sale

adjustments to basis are the sum/net of the following:

items of income - increases basis

items of losses and expenses - decreases basis

distributions - decrease basis

you could go through every k-1 over the years to see if the 1652 matches up but be wary certain lines on the k-1 don't affect basis because they are subcategories of other lines

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

HOPE THIS HELPS

MLP and PTP reporting k-1 and 8949

Please follow these instructions. Incorrect entries can result in entering the sale twice or otherwise incorrectly. Also see the sales schedule that was included with the k-1

Enter the k-1 info

Check the PTP box

If total disposition proceed as follows:

Check final K-1 (s/b marked on actual k-1)

Check sold or otherwise disposed of entire interest

On the k-1 disposition section for sales price use the ordinary income (sometimes you’ll see a column with the “751” or the words “Gain subject to recapture as ordinary income” or similar wording. This info comes from the supplemental sales schedule that should have been provided. It's also now on the k-1 box 20AB - no 20AB, no ordinary income column then then sales price is zero. The numbers I’m using represent the line numbers in forms mode (desktop only)

5. Sales Price = line 20AB (1065 k1)

6. Selling expenses = 0

7. Basis = 0

8. Gain is computed and should be same as the sales price.

9. Ordinary gain = enter same as sales price

This amount flows to form 4797 line 10 and is taxed as ordinary income. This step is necessary, so any suspended passive losses are now allowed.

10,11,12 should be blank

Now for the 8949.

The broker’s form is probably coded as B or E – sales proceeds but not cost basis reported to the IRS. This is because the broker does not track the tax basis. It used what you paid originally which is not correct.

The correct tax basis is:

What you paid originally, should be the same as what is on 1099-B as cost,

Then there is a column on the sales schedule that says cumulative adjustment to basis. If it’s positive add it to the original cost. If it’s negative subtract the amount.

Finally add the amount of ordinary income reported above, if any.

The result is your corrected cost basis for form 8949.

Some other things. Look at lines 20AB. That number should be added to the ordinary income above for reporting the 199A (qualified business income from the PTP). You don’t have to enter this but then you lose out on a tax deduction = 20% of this amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

Thank you so much!!

I see the calculations in the directions but don't understand what to input into Turbo Tax...

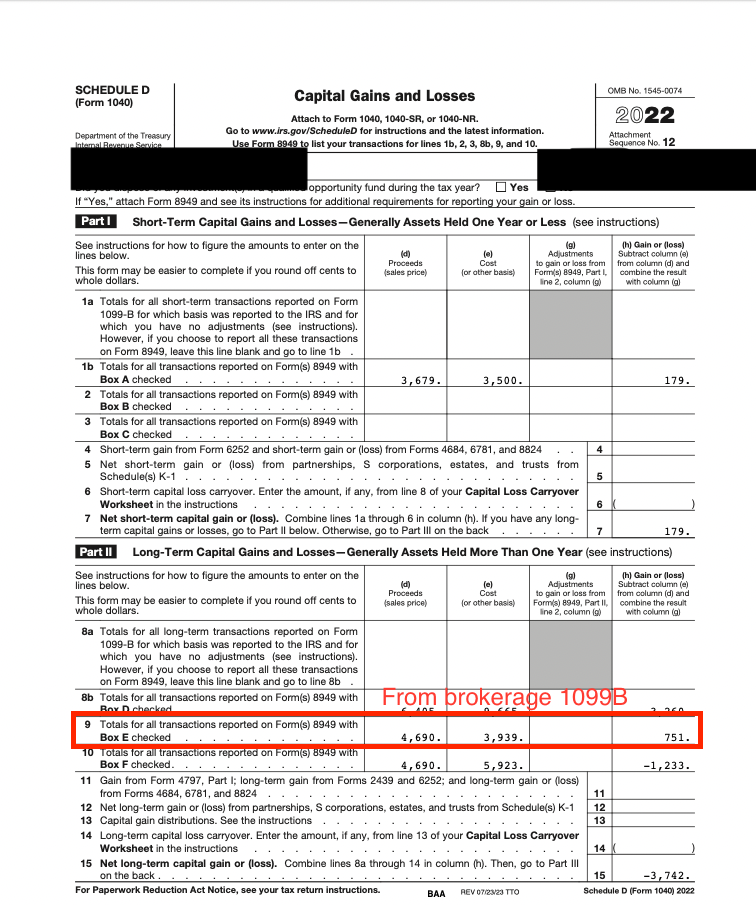

From brokerage

Cost basis (which is wrong) $3939

Proceeds $4690

Net gain $751

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

the question is does you state allow bonus depreciation according to federal tax laws? if it does ignore columns 10 and 11.

if it does not did you adjust the income/loss reported for the state for the unallowable depreciation for each year of ownership?

if you did then you have to take into account column 10 and 11 for the state amount (not federal) of capital gain/loss on sale and column 11 for (not for federal) the ordinary gain portion. If you need to do this, you will have to get help from other as to how to enter in Turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

@Mike9241

Hi Mike,

Can you verify I inputted the correct partnership basis? I don't understand why I'm seeing a gain and a loss on schedule D.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

wrong

basis

+3939 purchase price

-1652 adjustments to basis

+1818 751/ordinary gain

=4105 total basis for capital gain/loss

*4690 salrs price

=585 capital gain

line10 shouldn't be there since that says sales price and tax basis not reported to the iRS but it was reported so the type should be e

it would seem you enter the 1818 in the wrong place that only goes on the sale schedule for the k-1

only the 1818 goes on the k-1 sales schedule

since the sale is ewported on the 1099-B you have apparently reported the sale twice

the 8949 only shows the capital gain portion of sale type e since the proceeds are on the 1099-B

looking at what you did you reported everthing on the k-1 sales schedule which is wrong

only the ordinary gain is entered as the sales price with 0 as tax basis

so line 9 type e form 1099-B should show sales price 4690

you change the reported basis from that shown on the 1099-B from 3939 to 4105

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

You clearly know what you are doing. Thank your time and patience!

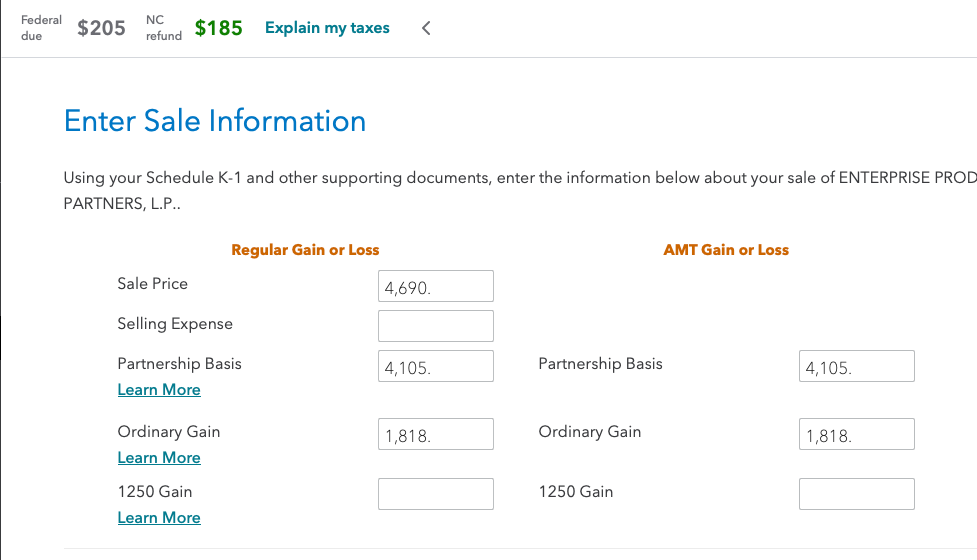

Can you please tell me what do I enter in the Turbo Tax Wizard screen? Each input results in an entry on the forms.

Can you tell me based on my schedules what entries I should have on the 8949 for this sale? I have two: 1) Type E for the 751 gain with the incorrect basis (which I can't change because it came from the 1099B) AND 2) whatever the Turbo Tax K1 screen creates. When I inputted the $1818 in the ordinary income field and zero as the basis (I believe those were your instructions) Turbo Tax created a Type F entry on 8949 for the sale with a -1703 loss. Is that right? or at least close????

Sales price field —> column d

Partnership basis —> column e

Ordinary income --> ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

I use desktop which does not have the wizard.

it's been reported by the broker. what's wrong is that the cost basis is wrong. it needs to be adjusted based on the calculation from supplemental sales schedule you got from EPD - only the capital gain - sales price and adjusted basis gets reported on the 8949. if held long-term the code should be E sales proceeds but not cost reported to IRS or Code B if a short term sale. the 8949/schedule D reporting is completely separate from the ordinary income reporting. if you report the sale through the k-1 sales schedule you will in fact being reporting twice if you entered the broker's report either through direct entry or import

only the ordinary income portion gets reported through the k-1 sales schedule and only there

to get back click on the wages and income tab

scroll down to business items and select "update" for the line that says schedules k-1

click tes when it asks about schedules k-1/Q

on the line that says partnerships select update

you'll be asked questions about 2022 k-1 for EPD select yes

select work on it now

select yes for review info

continue on

mark complete disposition and continue

mark sold partnership interest and continue

enter dates and continue

you are now on the sale info page

this is where the ordinary income and only the ordinary income gets entered

sales price = ordinary income

basis = 0

ordinary gain same as sales price

your done with entering ordinary income

for capital gain

again select wages and income tab

i choose what to work on

scroll down to investment income

on the line that says stocks etc select update

continue no need to update

select the broker and then edit

continue on

find the listing for EPD and select edit

on 1e change the cost or basis to what was calculated in the sales schedule

for sale category select the letter that matches the section the broker used most likely B or E

your done

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

@Mike9241

I think I fixed it so the capital gain is being captured once w/correct basis and the gain subject to recapture displays on my 1040 !!!

Here is what changed:

1. The EPD sale is showing ONLY ONCE on the 8949 with the $4105 basis (1099 basis - **bleep** adjustment + ordinary income) which reduced my capital gain to $585

2. The gain subject to capture as ordinary income is displaying on line 8 of 1040.

Did I (finally) get it right?

Btw, can I patreon you some beer money (or a steak dinner), you really went above and beyond....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

looks like you got it right. since it only shows once on 8949 with correct gain and ordinary gain is properly flowing to line 8 of 1040. actually it first flows to schedule 1 and the net of schedule 1 flows to line 8 of the 1040 thanks, but no thanks for your reward offer. making users happy to use Turbotax is what we do. However, you might want to think twice about investing in other PTPs. the k-1s can be a lot more complex not to mention the sales reporting but now you know how to enter sales info, so that only leaves the k-1 info

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

Last question:

If I only made a gain of $585 on the sale, why do I have to claim $1800 as ordinary income? I know for sure I didn't make a profit of more than $900 on the sale...I could understand taxing part of my gain as ordinary income but I'm paying capital gains on the entire profit and being taxed on $1800 I never made...

Dazed and confused

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

Based on the information in this string:

- Your true overall gain is $2,403 ($4,690 less $2,287)

- Of this overall gain, $1,818 is reported as ordinary income (Section 751)

- This Section 751 is a recharacterization of the overall gain as a result of previously taking depreciation. As a result, the IRS wants the taxpayer to pick up ordinary income to offset any prior deductions from depreciation. This Section 751 gain is not added to the cost basis (tax basis); only a recharacterization.

- So once you have your overall gain of $2,403, subtract the Section 751 component of $1,818, leaves you the capital gain component of $585.

- That is why you have two components

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

your total gain is

4690 - (3939-1652)=2403 sales price less (purchase price reduced by adjustments to basis)

that's broken into two parts capital and ordinary

capital is 585 + ordinary is 1818 sum 2403 which magically is your total gain on sale

adjustments to basis are the sum/net of the following:

items of income - increases basis

items of losses and expenses - decreases basis

distributions - decrease basis

you could go through every k-1 over the years to see if the 1652 matches up but be wary certain lines on the k-1 don't affect basis because they are subcategories of other lines

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MLP and PTP reporting K-1 and 8949. Do I report the sale of partnership stock (K1 sold all shares) if it was reported as a profit against my losses on my brokerage 1099B.

I sold 2 PTP stock this year NS & ET.

Is it correct?

I claim "non passive loss allowed" on Schedule E

Add all negative numbers on Schedule K-1 "Line 1 & Line 2" in 2 years

to offsets my gains from (sale stock + distribution).

NS turn out to be equally even. (Do not have Excess Business Interest Expense).

ET is $300 dollar more than I actuated get.

(Excess Business Interest Expense last year $419.00)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HNKDZ

Returning Member

yingmin

Level 1

Newby1116

Returning Member

Kh52

Level 2

ilenearg

Level 2