- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

@Mike9241

Hi Mike,

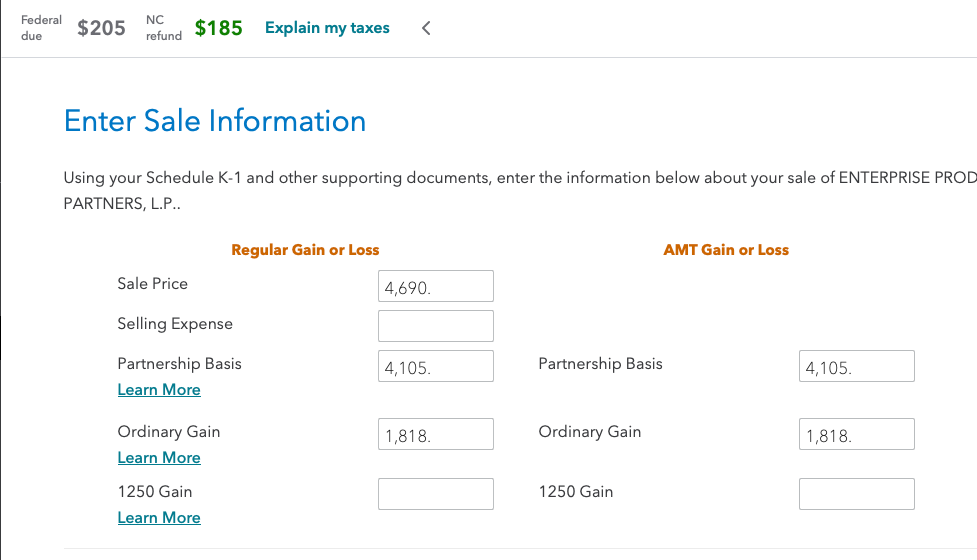

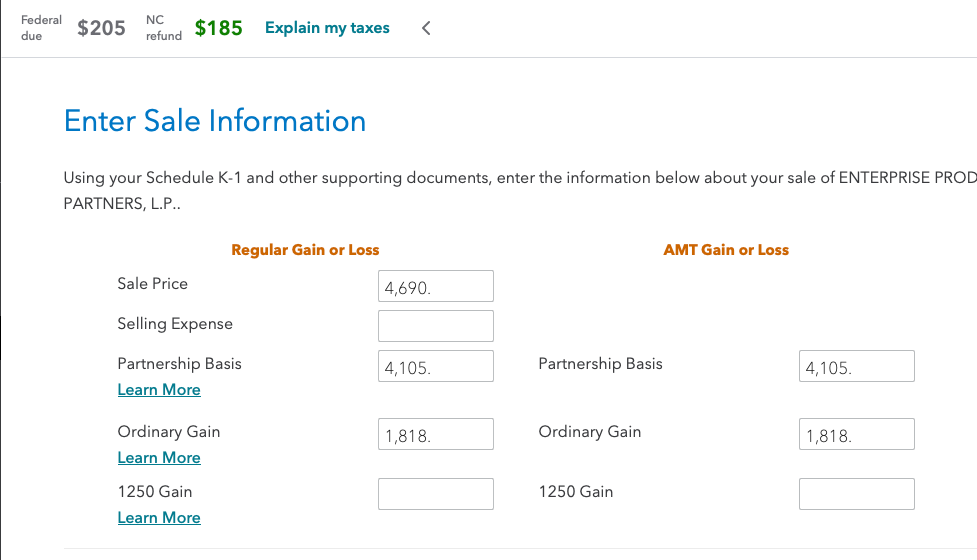

Can you verify I inputted the correct partnership basis? I don't understand why I'm seeing a gain and a loss on schedule D.

BACKGROUND

On 1099B, I sold 185 shares of EPD for $4690 w/cost basis of $3939 for a $751 gain.

The K1 Sale schedule lists:

Purchase Price: 3939

Adj to basis: -1652

Cost Basis: 2287

Ordinary Income gain 1818

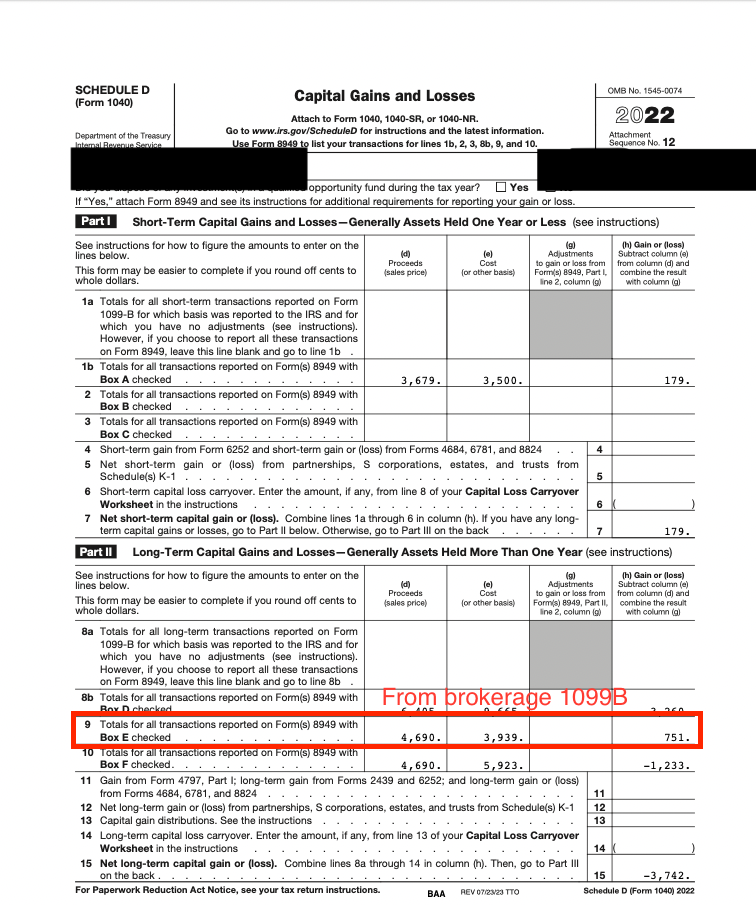

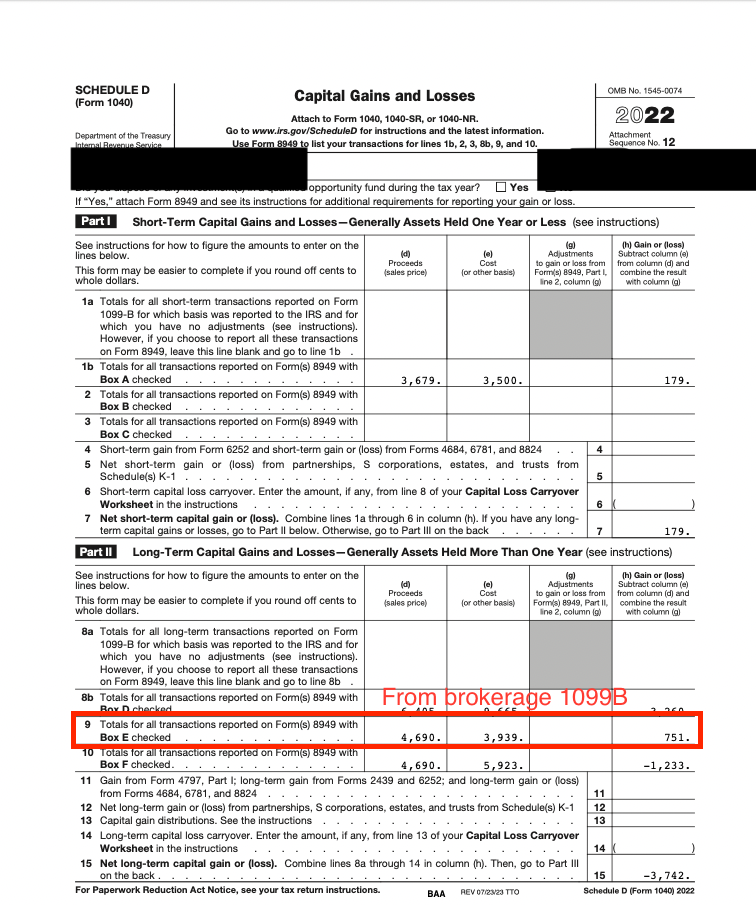

On my tax return the EPD transactions show as follows:

The 1818 is showing up on line 8 of the 1040

$751 is showing up on Sched D / 8949

-1233 (4690 - 5923) is showing up on Sched D / 894

I don't understand why the cost basis is $5923....

October 12, 2023

8:07 PM