- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Computer Purchase

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computer Purchase

HI I purchased a new computer for business, its used in 2 businesses and personal, do I write off the computer based on % in both businesses for the current year? The amortized option has over 15 years and computers don't last that long, I typically upgrade every 4-5 years.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computer Purchase

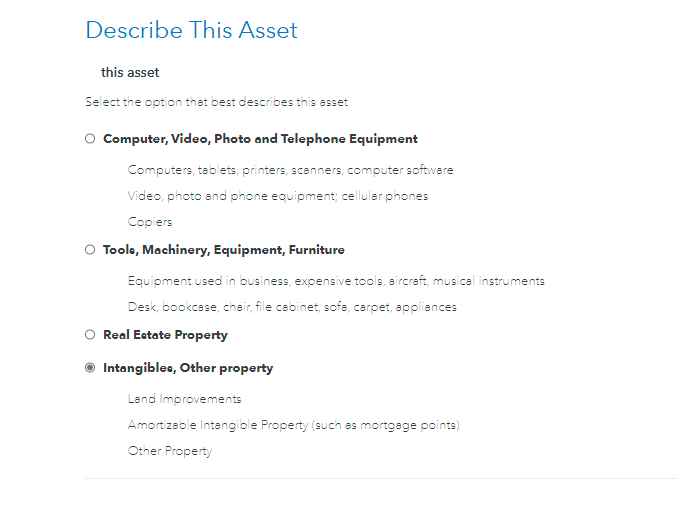

Computers are 5 year property. First, you will need to allocate the total cost to all activities that benefit from the asset. Then enter the allocated portion to each activity as is appropriate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computer Purchase

Computers are 5 year property not 15 year property.

Assuming you made no other asset purchases you could deduct the computer purchase (also assuming the business use is more than 50% business or less than 50% personal use) as Section 179 expense.

You may want to talk to a tax professional depending on the size of your 2 businesses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computer Purchase

You would have to prorate the usage between the two businesses and personal use. For example, you might use it 20% for one business, 30 percent for the other and % personal use. You can depreciate over 5 years 20% of the cost and 30% of the cost, but he 50% personal use is not an expense.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jwatkins

New Member

msargent

Level 2

myersmechanical

New Member

P22Mamma

New Member

profchoudhry

New Member