- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: 1099-NEC from another State

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

It depends.

Do you know what the 1099-NEC was issued for?

Please provide this information and we can try to assist you.

If your 1099-NEC was unrelated to a business, you will need to report it as follows to ensure it isn't treated as self-employment income.

- Select Income & Expenses

- Go to the All Income section and select Other Common Income

- Select Form 1099-NEC

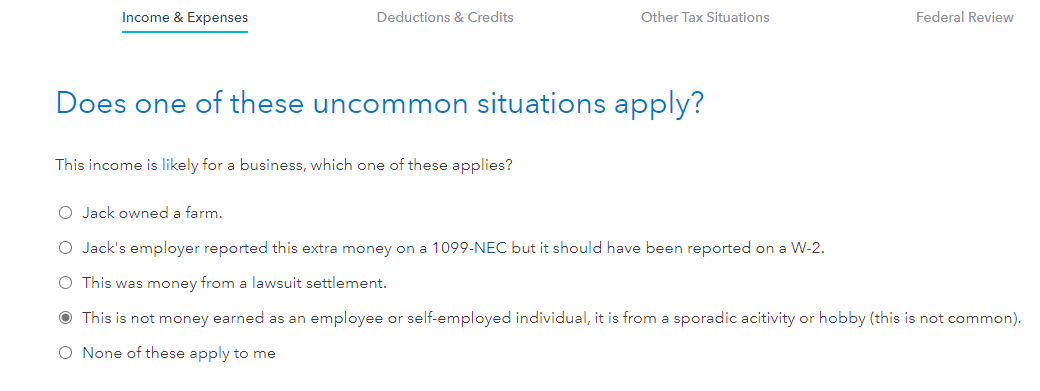

- You will then be prompted to enter your information as reported on Form 1099-NEC. Be sure to mark that it was not earned as part of business on the screen titled Does one of these uncommon situations apply?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

I was reimbursed for my cellphone bill. I am part of a non-profit organzation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

I did use, it was not earned as part of business on the screen titled Does one of these uncommon situations apply?

But I was still asked to fill out questions and forms. Schedule C? and if there was a profit or loss.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

If you are an employee and you received a reimbursement from your company on Form 1099-NEC, the income was improperly reported to you. You will have to enter it on Schedule C to avoid problems with the IRS and then expense it with the description of reimbursement to zero it out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

I input my two 1099-NEC incomes under the "business Income and expenses" tab (Home and Business) but when I do the review, I am told "one of your 1099-NEC forms does not include enough info for us to know where to report the income on your return. In this 1099-NEC form I have doubled checked the payers tax ID, there is only one box, 1) non employee compensation on my form with data, it contains what I was paid. I can't "jump" anywhere within my CD/download version to the "Form-NEC topic to finish answering questions for the form that is missing info?? I have done searches for Form-NEC topic searches but don't get any answers. What is up? Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

I didn't have houses to rent or nothing like that it was doordashing delivering food from restaurants and stores

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

Your 1099-NEC from Doordash is considered self-employment income. To enter your 1099-NEC please follow these steps:

- Open or continue your return in TurboTax

- Search for self employed income (use this exact phrase, don't add a hyphen) and select the Jump to link at the top of the search results

- Answer Yes on the Did you have any self-employment income or expenses? screen

- If you land on the Your 2021 self-employed work summary page, select Review next to the work you're adding income for

- Answer the questions on the following screens until you arrive at Let's enter the income for your work

- Select the form that applies to your situation and Continue

- You can enter the info from your 1099 form on the following screens

Then check out What self-employed expenses can I deduct? for ways to reduce your taxable income from self-employment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

Do you have to pay a self employment tax for both a 1099 MISC and a 1099 NEC.

I did some surveys and got a 1099 MISC from one company and 1099 NEC from another company.

I try to do turbo tax and looks like 1099 MISC, calculates a self employment tax whereas a 1099 NEC, there is no self employment tax

please advise, I tell me how to get around having to avoid pay more taxes with 1099 MISC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

It depends. If you received the 1099-Misc as part of your business doing surveys, the income is subject to self-employment tax regardless of whether the income is reported on Form 1099-Misc or 1099-NEC.

To report self-employment income:

-

Your self-employment income and expenses will be entered in the Income and Expenses section under the federal taxes tab of TurboTax Online.

- After you sign in to your TurboTax account, open or continue your return

- Search for schedule c and select the Jump to link

- Answer Yes to Did you have any self-employment income or expenses? And answer the questions on the following screens regarding your business activity.

- When asked to enter your income, follow these steps:

- 1099-NEC - If you have a Form 1099-NEC, select and enter the information on the form

- Other self-employed income - Select and enter the total of the following:

- If you have a 1099-K, the amount in Box 1 Gross amount of payment//third party network transaction

- If you don't have a 1099-K or 1099-NEC, report your Gross Earnings amount.

You can also deduct related expenses from the self-employment income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

Hello,

Please advise whether I need to report 1099-NEC on both the Business and Personal income sections or not?

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

No, you will only enter your 1099-NEC once. If you already accounted for it as part of your business income, then you would not need to enter it at all. If you did not, then you will simply enter it when prompted to enter your 1099-NEC.

If you enter it in both sections, you would duplicate your income and increase your taxes due.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

I live in CT and received a 1099-NEC from a company in NJ for less than 5K, do I need to file a NJ state income taxes separately or the federal and CT state is OK? I already put the info for 1099-NEC in the Turbotax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

Yes. Even If you were not physically present working in New Jersey (NJ) but you have income from NJ sources, then you must file the NJ nonresident return. You must file your federal and Connecticut (CT) resident return.

The credit for taxes paid to another state on the same income is used on your resident state because they do not want you to pay taxes twice on the same income. As the resident state all worldwide income must be included.

The credit for tax paid to another state on the same income will be the lesser of:

- the tax liability actually charged by the nonresident state, OR

- the tax liability that would have been charged by your resident state

@Stock Investing

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

Please advise, where should enter income from the business which doesn't have 1099 NEC or 1099 MISC.

under Business "Other income" or on the Federal Sch.1?

Thank you very much!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

peanutbuttertaxes

New Member

Greenemarci2

New Member

michelleroett

New Member

jrosarius

New Member

warrenjen

New Member