- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- K1 Imcome line 14

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Imcome line 14

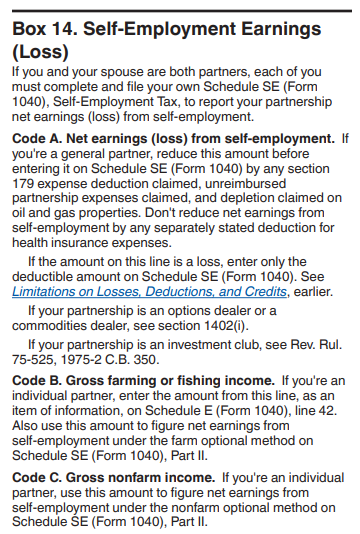

My L14 "A" income mathces the ordinary $ BUT line "C" shows a much bigger $$$

--why and what is "C" used for?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Imcome line 14

I assume you are referring to Schedule K-1 Form 1065.

Line 14 C is the gross nonfarm income that was reported on the Form 1065. Since 14 A is your net self-employment income, that is generally the amount on which you pay tax.

The exception is if you use the nonfarm optional method on Schedule SE (Form 1040), Part II. Click here for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Imcome line 14

I assume you are referring to Schedule K-1 Form 1065.

Line 14 C is the gross nonfarm income that was reported on the Form 1065. Since 14 A is your net self-employment income, that is generally the amount on which you pay tax.

The exception is if you use the nonfarm optional method on Schedule SE (Form 1040), Part II. Click here for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Imcome line 14

what is the number for on line 14 b

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Imcome line 14

Assuming you are also referring to Schedule K-1 from a 1065 tax return, line 14B represents the self-employment earnings or (loss) from a farming or fishing business.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

driverxxv

New Member

user17555657897

New Member

DavidRaz

New Member

dalibella

Level 3

Stevie1derr

New Member

in Education