- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- I need help completing this entry IT-360.1

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help completing this entry IT-360.1

If you are having an issue with a rejection from line 17, adjustments to income, of the New York Return, you can follow these steps:

- Click Edit next to New York

- Click Adjustments to Income

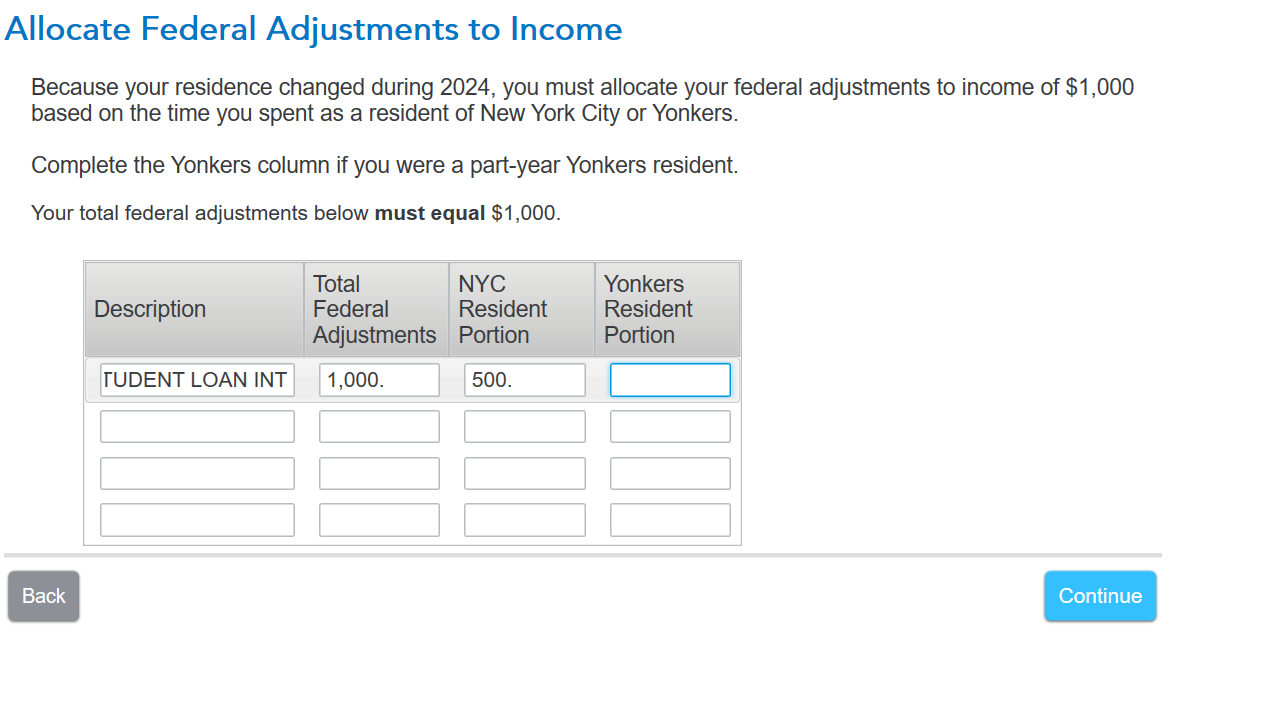

- On the Allocate Federal Adjustments to Income the first column is the total federal Adjustments. The full amount from your rejection should go in Column A. However, if any amount is for New York City you would allocate that portion to Column B, and Column C would be for Yonkers. The total of all 3 columns should equal the full adjustment amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help completing this entry IT-360.1

Hello-- thank you for describing perfectly the same problem I am encountering this year. Going in circles, and the form always revises my numbers after I correct them. Were you able to figure this out? I am hesitant to pay for help if the "experts" are unable to address this bug.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help completing this entry IT-360.1

To help you better, it would be helpful to have a TurboTax token. The token provides a sanitized version of your return. We will be able to see the numbers but not any personal information such as your name, SSN, or address.

If you would like to do this, here are the instructions:

In TurboTax Online, go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen, and you will get a Token number.

In TurboTax CD/Download versions, go to the black panel on your screen and select Online.

- Scroll down and select Send tax file to Agent.

- You will see a message explaining what the diagnostic copy is. Click send through this screen, and you will get a Token number.

Reply to this thread with your Token number.

We will then be able to see precisely what you are seeing, and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help completing this entry IT-360.1

I'm facing the same error as well. Here is my Token number 1108525

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help completing this entry IT-360.1

The rejection you are receiving is due to the amount allocated to New York City is greater than the amount allocated to the state of New York. To fix you need to follow these steps:

- Click Edit Next to New York

- Click Edit next to New York wage allocations and verify the amount is accurate for the whole state

- Click Edit next to New York City and Yonkers info and allocations

- Click Edit next to Employer and verify the income listed is correct

The New City allocation can not be greater than the New York State allocation. If the New York City is correct, the New York State needs to be edited to reflect the accurate amount for allocation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help completing this entry IT-360.1

Hello,

I'm having issues completing NY state tax return. The error that I'm getting is attached as a screenshot below. I've also shared my file with an agent and my token number is 1175587. Need some help please.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help completing this entry IT-360.1

Yes, this message means that the amount you have allocated to New York City is greater than the amount allocated to the state of New York. To fix you need to follow these steps:

- Click Edit Next to New York

- Click Edit next to New York wage allocations and verify the amount is accurate for the whole state

- Click Edit next to New York City and Yonkers info and allocations

- Click Edit next to Employer and verify the income listed is correct

The New City allocation can not be greater than the New York State allocation. If the New York City is correct, the New York State needs to be edited to reflect the accurate amount for allocation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help completing this entry IT-360.1

1291625

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help completing this entry IT-360.1

This thread is over a year old @NathanielRDeJesus - You will need to provide some details regarding your issue so someone can help..

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help completing this entry IT-360.1

my token number is 1311891

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help completing this entry IT-360.1

Your adjustment to income is $1000 in student loan interest per your IT-203. Since you were a NYC resident for approximately half of the year, I allocated $500 as the NYC resident portion. If your payments were not made evenly throughout the year, you should instead enter the amount of student loan interest paid while you were a NYC resident.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help completing this entry IT-360.1

My token number is 1330030

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need help completing this entry IT-360.1

To clear your error, you must allocate your scholarship or grant money received based on how much of it you received while a NYC resident. If it was all received while a NYC resident, enter the entire amount in the NYC Resident Portion box on the screen Allocate Other Income. If half was received while a resident, enter half of the total federal amount in the NYC box. If received equally throughout the year, calculate the total months you were a NYC resident divided by 12 months, and multiply this by the total scholarship amount. This will clear your error.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Wagabe

New Member

Jimbo25

New Member

MPBreese

Level 2

Viejo303

Level 2

raz7149

New Member