- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

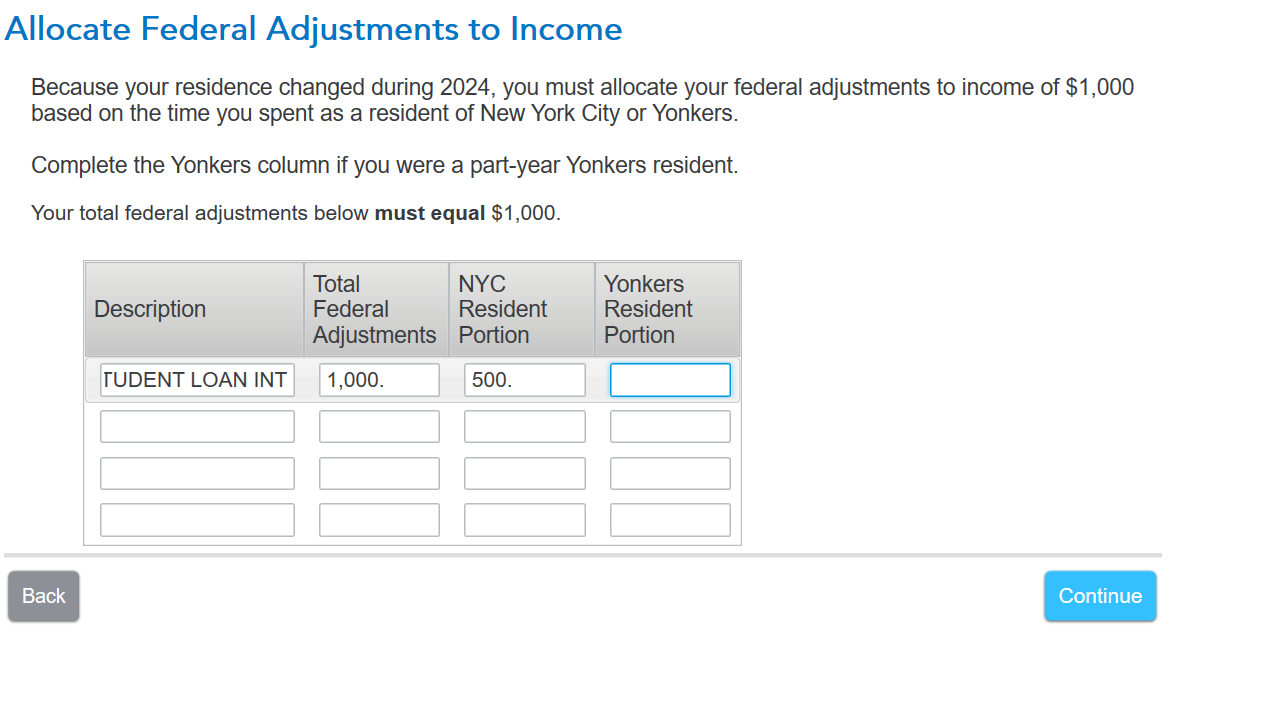

Your adjustment to income is $1000 in student loan interest per your IT-203. Since you were a NYC resident for approximately half of the year, I allocated $500 as the NYC resident portion. If your payments were not made evenly throughout the year, you should instead enter the amount of student loan interest paid while you were a NYC resident.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

May 20, 2025

4:22 PM