- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- I am using Turbo Tax, imputing K1, and entering my 179 deductions. The allocation is to a different state. It will not let me change it to delete it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am using Turbo Tax, imputing K1, and entering my 179 deductions. The allocation is to a different state. It will not let me change it to delete it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am using Turbo Tax, imputing K1, and entering my 179 deductions. The allocation is to a different state. It will not let me change it to delete it.

I recommend reviewing your input in a couple of sections to help narrow down the state issue.

- First, log back into TurboTax and select Personal Info.

- Review your input by selecting the down arrow to the right of your name and selecting edit.

- Proceed through the screens and make sure everything is correct.

- On the screen titled "Let's check for some other situations,", be sure to make sure the state of residence is entered correctly.

- There is also an option below the State of residence box where you could have possibly checked I lived in another state in 2023. If you only lived in one state during 2023, make sure this box is not checked.

- Next, for every section where you have income, be sure to go through each interview screen and make sure you have selected the correct state.

- For example, if you have wages, go to the Wages & Income section, select edit to the right of Job (W-2), click the arrow to the right of any W-2 entries and select Edit.

- On the screen titled "Now, let's update the rest" scroll down to the State taxes section and make sure Box 15 shows the correct state.

- If all of these entries are correct, go back to Wages & Income and scroll down to the Schedule K-1 screen. Select update.

- Select edit to the right of the applicable Schedule K-1.

- Review the address on the screen asking for the company's information to ensure the correct state is selected.

Please comment back if this does not help to narrow down where the state message is coming from.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am using Turbo Tax, imputing K1, and entering my 179 deductions. The allocation is to a different state. It will not let me change it to delete it.

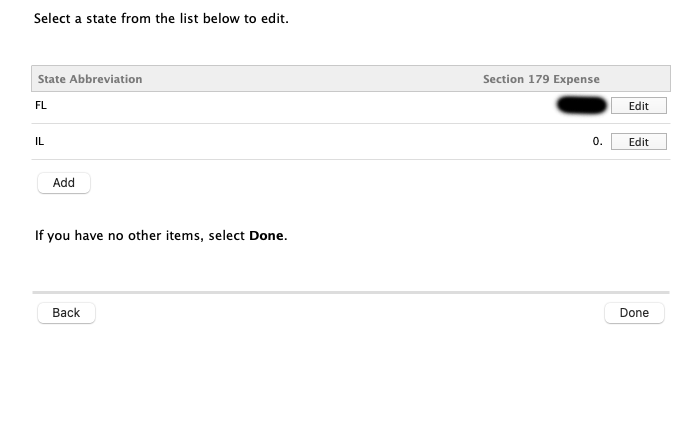

Thank you. I checked everything, and everything says Florida. What I ended up doing was adding Fl and allocating the amount to FL, then putting IL at 0. I have a screenshot so you can see I blanked out the number for privacy but I can't even delete IL. I don't have any state from loaded on the software either.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am using Turbo Tax, imputing K1, and entering my 179 deductions. The allocation is to a different state. It will not let me change it to delete it.

Are you using TurboTax desktop or are you using TurboTax Online?

If you are online, I recommend contacting us using this link for support so an agent can see your return and help determine what the issue is.

If you are using the desktop version, you can try the steps provided in this link as it may help resolve the state program issues and essentially help reset the state program so you can proceed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am using Turbo Tax, imputing K1, and entering my 179 deductions. The allocation is to a different state. It will not let me change it to delete it.

Thank you

I am using the desktop version, and I was going to try the method you suggested I did download this but I am on a mac and not a PC so the exe file doesn't work. I also don't have any states added.

Susan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am using Turbo Tax, imputing K1, and entering my 179 deductions. The allocation is to a different state. It will not let me change it to delete it.

You may want to get your states downloaded and your program updated.

To download your state program for TurboTax for Mac:

- Open or continue to your return in TurboTax.

- Select TurboTax from the menu bar, then Download State.

- In the pop-up window, select your state and then choose Next.

- Follow the on-screen instructions to complete the installation.

Since you need to download additional state programs, you can repeat these steps again.

In addition, here is a link to troubleshoot some common Mac issues. This link includes instructions on forcing an update on a Mac.

If the above steps do not work for your issue, then you should contact us using this link.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am using Turbo Tax, imputing K1, and entering my 179 deductions. The allocation is to a different state. It will not let me change it to delete it.

Thank you, but I live in Florida I don't need to file state income tax that is why I don't have it loaded. and why this issue is so confusing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am using Turbo Tax, imputing K1, and entering my 179 deductions. The allocation is to a different state. It will not let me change it to delete it.

In that case, please try updating your Mac program to see if that fixes the error for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rogersdan164

Level 1

KarenL

Employee Tax Expert

Rprincessy

New Member

asrogers

New Member

Ninaya1

New Member