- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Home & Business should be an option if you first pick the...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I on a MFJ file a separate Sch C for each spouse - different business?

I'm using TT Home and Business (not an option under the product drop down).

I'm a minister filing MFJ. I had a small amount of outside income which I must file on Sch C. My wife also had a small amount of income from a different business.

Haven't been able to discern how to file 2 separate Schedule Cs on one return.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I on a MFJ file a separate Sch C for each spouse - different business?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I on a MFJ file a separate Sch C for each spouse - different business?

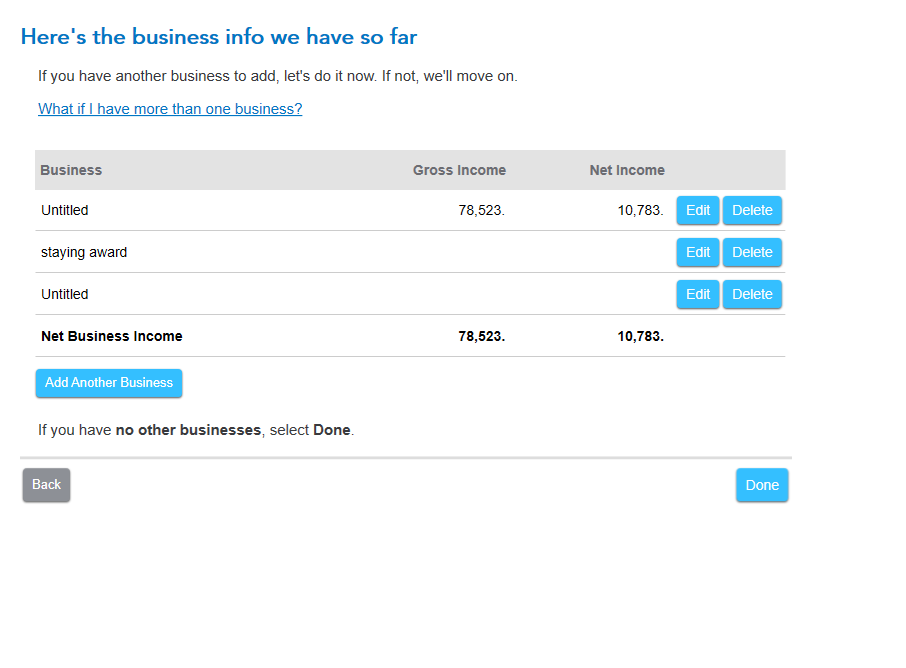

Go to Business tab-Continue

Business Income and Expenses

Profit or Loss from Business, click Start or Update.

You should see the Business Summary page that lists your businesses, right below the list you can Add Another Business.

Be sure to add it under the right spouse if you are married.

See the screenshot on this post

https://ttlc.intuit.com/questions/4503320-which-forms-should-i-use-for-deductible-expenses-when-i-m-...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I on a MFJ file a separate Sch C for each spouse - different business?

This is what I'm looking for!!! But there's not much info on this-- I guess that's why we're looking at posts from 5+ years ago. Is this still good info?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I on a MFJ file a separate Sch C for each spouse - different business?

If you need to file a Schedule C for you and your spouse, then all you need to do is after you enter your business information and income and expenses, select Add Another Business. When you do so, you will be asked who the business is owned by, there you will select either you or your spouse depending on who the owner is.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jetblackus

New Member

amyonghwee

Level 4

emberrbiss

New Member

MaxRLC

Level 3

MaxRLC

Level 3