- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- form SE line 12

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form SE line 12

for some reason my K1 income is not showing up in the SE form (it did last year)

--the impact is I'm not paying any self-employment taxes

Did the law change regarding qualified income?

Did I select the incorrect income category?

The system is telling me I get a big refund and I know that not true

HELP

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form SE line 12

As you seem to be aware of, If you and your spouse are both partners, each of you must complete and file your own Schedule SE (Form 1040), Self-Employment Tax, to report your partnership net earnings (loss) from self-employment. You are both general partners (not necessarily the managing partner). If you indicate your wife is a limited partner, the software will not treat her share of income as self-employment income and will not generate a Schedule SE. In the business software you should indicate that your wife is a general partner so it will properly flow through to your personal return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form SE line 12

No, there has not been a change in the rules around self-employment tax this year.

I am assuming you are referring to a Form 1065 partnership K-1?

If you have a positive number in box 14 of your K-1, that should flow to Schedule SE,

First I suggest checking your copy of the K-1 form. If you have a positive number there, but no SE tax, you should check the K-1 input to make sure it was entered correctly.

If the number is there and was entered correctly, please respond back to this thread and we can explore further.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form SE line 12

i have checked everything you suggested -- no luck

--pls follow up, thanks

Jim

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form SE line 12

have checked everything -- no luck

pls suggest a plan

thanks

Jim

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form SE line 12

Let's review the steps to the entry and if you are a general partner, your income will be subject to self employment tax, as it should be.

I also am assuming you are entering a Form 1065-K1 for your partnership share of income. Some questions are very important to determine whether the pass through income is subject to self employment tax.

- You must check that you are a 'General Partner'

- Describe the Partnership - None of these apply

- Type of Activity - Business-Box 1

- Did you Participate? - Yes

- Box 1 = Income

- Select Box 14

- Code = A-Net Earnings (Loss) From Self Employment / Amount should equal box 1 or the amount from your K1

- All of my investment in this activity is at risk - Check box if only you have investment in the business and/or loans you are responsible to repay. In other words your investment what is at risk, no money from parents or spouse that you are not liable for.

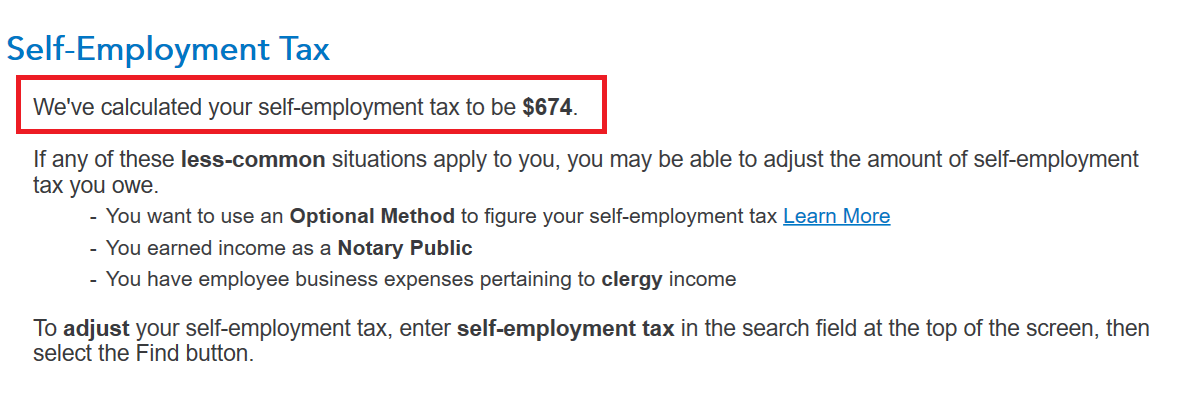

The self employment tax will be calculated and displayed at the end of the 1065-K1 entry. See image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form SE line 12

i do not see such a box on the 1065 form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form SE line 12

i found the entry on the detailed form -- it shows $ on line 14 A and C

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form SE line 12

its on my form but not my wife's

and although its on my form it's not flowing through to my 1040

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form SE line 12

You need to go back through the entries you made when you entered your K-1 into the TurboTax system. If you have positive numbers in box 14 then you should have self-employment tax.

If you can't figure out where the error is you are probably better off having someone walk through the return with you to look at your entries so I recommend getting live expert help.

Here is a link to finding a TurboTax expert.

However, that requires upgrading your product which may be an expense you don't want. In that case you can call an expert and ask questions over the phone.

Here is a link to the TurboTax Phone Number

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form SE line 12

thanks you from your response --id like to go back to one of the fundamental questions listed before

1) in the business version I have partner self emp income in box 14A and 14C, my wife has none?

I answered a question not asked last year -- were the partners married, I ck yes -- could have affected the box 14 for my wife?

thnakz

Jim

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form SE line 12

to your questions all were entered correctly -- I believe the basic problem flows from the K1

--I have SE income and my wife shows none, even though she is a 50% partner

RobertB4444 has also picked up the thread --but if you have ideas pls help

Jim

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form SE line 12

Please clarify the following info:

- What type of business provided the Schedules K-1 for you and your wife?

- Who prepared Form 1065 for this business?

- Are you both general members/partners in that business?

In general, if you are both general partners who actively participate in the partnership and have paid self-employment taxes in the past, both Sch K-1's should reflect GP status and report income on Line 14. Entering these details for your personal tax return (married, filing jointly) should result in SE earnings that may be subject to SE tax.

You might check with whomever prepared Form 1065 to be sure both Schedules K-1 are correct.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form SE line 12

I prepared the K1 -- Business Turbo Tax

we have a consulting business (15 yrs at this point) 50/50% with my wife

have used TT 2018,19 -- now 2020

does it matter that one is the general and the other a regular partner?? the GP shows SE income the other no income

--the first problem I encountered was the partner share info did NOT transfer over from 2019

--three TT experts tried to fix it and all failed -- finally told me to reenter manually

Now the K1's are wrong -- any connection?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form SE line 12

As you seem to be aware of, If you and your spouse are both partners, each of you must complete and file your own Schedule SE (Form 1040), Self-Employment Tax, to report your partnership net earnings (loss) from self-employment. You are both general partners (not necessarily the managing partner). If you indicate your wife is a limited partner, the software will not treat her share of income as self-employment income and will not generate a Schedule SE. In the business software you should indicate that your wife is a general partner so it will properly flow through to your personal return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form SE line 12

Jackpot -- this was very helpful

I knew it was an entry I made -- will try this tomorrow and let you know

thanks

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dabbsj58

New Member

melinamoukory

New Member

jgilmer78

Returning Member

zenmster

Level 3

stefaniestiegel

New Member