- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Let's review the steps to the entry and if you are a general partner, your income will be subject to self employment tax, as it should be.

I also am assuming you are entering a Form 1065-K1 for your partnership share of income. Some questions are very important to determine whether the pass through income is subject to self employment tax.

- You must check that you are a 'General Partner'

- Describe the Partnership - None of these apply

- Type of Activity - Business-Box 1

- Did you Participate? - Yes

- Box 1 = Income

- Select Box 14

- Code = A-Net Earnings (Loss) From Self Employment / Amount should equal box 1 or the amount from your K1

- All of my investment in this activity is at risk - Check box if only you have investment in the business and/or loans you are responsible to repay. In other words your investment what is at risk, no money from parents or spouse that you are not liable for.

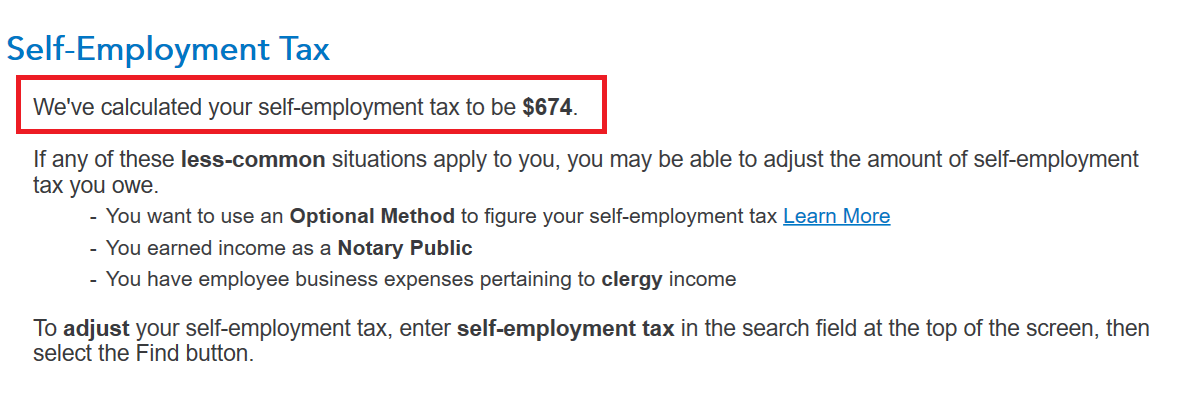

The self employment tax will be calculated and displayed at the end of the 1065-K1 entry. See image below.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 7, 2022

9:52 AM