- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Form 1099-NEC 2020 Nonemployee Compensation Worksheet Double click to link to: Schedule C I have no idea what this is or how to move past the issue. What does it want?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC 2020 Nonemployee Compensation Worksheet Double click to link to: Schedule C I have no idea what this is or how to move past the issue. What does it want?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC 2020 Nonemployee Compensation Worksheet Double click to link to: Schedule C I have no idea what this is or how to move past the issue. What does it want?

There is a known issue when using TurboTax Online that is related to the program asking you to double-click to link to Schedule C. Take a look at the TurboTax article below and use the link in the article to enter your email address to be notified once this is resolved.

Why can't I link my 1099-NEC in TurboTax Online?

Alternatively, take a look at the additional information below for a possible series of steps to solve the issue. If you do try to solve it, please let me know if these steps worked for you.

Since income reported on Form 1099-NEC needs to be reported on Schedule C, the program is trying to tie these two forms together to be sure that it is reported correctly and on the right form.

Try going back to the section where you entered the Form 1099-NEC if you entered it on its own and delete that entry. Use these steps:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “1099-NEC” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to 1099-NEC”

- Click on the blue “Jump to 1099-NEC” link

This will bring you to the summary of all Form 1099-NEC that you have entered. Click Delete or the trash can icon next to each one.

Next, you will re-enter the Form 1099-NEC as part of the Schedule C so that the income is reported directly as part of your Business Income and Expenses.

Use these steps to go to the Schedule C section of your return. If you do not have a Schedule C yet, follow the steps on the screen to get started.

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “schedule c” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to schedule c”

- Click on the blue “Jump to schedule c” link

If you already have a Schedule C in your return, edit it and go to the section to Add Income. This is where you will re-enter the Form 1099-NEC.

If you do not already have a Schedule C in your return, follow the prompts and enter the information about your work/business for which you received the Form 1099-NEC. Then continue through that section to Add Income and enter the Form 1099-NEC plus any other income you received for that self-employed business.

Don't forget you can also claim expenses related to your business.

After you are finished, the error condition should be eliminated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC 2020 Nonemployee Compensation Worksheet Double click to link to: Schedule C I have no idea what this is or how to move past the issue. What does it want?

This helped a lot thank you!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC 2020 Nonemployee Compensation Worksheet Double click to link to: Schedule C I have no idea what this is or how to move past the issue. What does it want?

When searching for 1099-NEC and "Schedule C", there is no option to remove. I'm using Turbo Tax Deluxe 2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC 2020 Nonemployee Compensation Worksheet Double click to link to: Schedule C I have no idea what this is or how to move past the issue. What does it want?

See How to Delete

@dwpkdavis21

The NEC must be entered after you in the sch C in order for it to properly link. The 1099-NEC is new this year. If it was a 1099MISC for 2019 and now hava a 1099NEC for the same company this is what you need to do:

- it asks you if you have a 1099MISC OR a 1099NEC for any of the businesses you had last year.

- You delete the 1099MISC shown and it should also give the choice of going forward with a 1099NEC for the same businesses

- you click "ok" for that one

- enter any 1099NEC's that are new for 2020.

- If you continue down that path it deletes the old 1099MISC and continues on to link the NEC's with the existing Sch C.

The changes:

The 1099-NEC is for each person to whom the taxpayer has paid at least $600 during the course of a business for the following.

•Services performed by someone who is not an employee, including parts and materials (box 1),

•Cash payments for fish (or other aquatic life) purchased from anyone engaged in the trade or business of catching fish (box 1), or

•Payments to an attorney for legal services (box 1).

The Form 1099-MISC is for each person to whom the taxpayer has paid the following during the course of a trade or business.

•At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest,

•At least $600 in rents (box 1), prizes and awards (box 3), other income payments (box 3), the cash paid from a notional principal contract to an individual, partnership, or estate (box 3), any fishing boat proceeds (box 5), medical and health care payments (box 6), crop insurance proceeds (box 9), payments to an attorney (box 10), IRC section 409A deferrals (box 12), or nonqualified deferred compensation (box 14).

•Any payment from which federal income tax has been withheld (box 4) under the backup withholding rules

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC 2020 Nonemployee Compensation Worksheet Double click to link to: Schedule C I have no idea what this is or how to move past the issue. What does it want?

I am having this same issue and have tried to delete and re-add the 1099 NEC-Multiple times. Does anyone know when this will be fixed? This is the only thing preventing me from filing my return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC 2020 Nonemployee Compensation Worksheet Double click to link to: Schedule C I have no idea what this is or how to move past the issue. What does it want?

If double-clicking the box that shows Schedule C does not work, then your return may not have a Schedule C included yet. There is not something you can type in that box to fix the problem, you have to enter a Schedule C.

Income reported on Form 1099-NEC is not reportable directly on your tax return. Just entering the information on that form is only one step. Since it is self-employment or 'non-employee compensation' it must be associated with a Schedule C, even if there are no expenses being claimed.

The information required for the Schedule C will include the type of business, the business name (or your name if there is no specific business name), the business address (or your address), etc.

Since income reported on Form 1099-NEC needs to be reported on Schedule C, the program is trying to tie these two forms together to be sure that it is reported correctly and on the right form.

Try going back to the section where you entered the Form 1099-NEC if you entered it on its own and delete that entry. Use these steps:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “1099-NEC” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to 1099-NEC”

- Click on the blue “Jump to 1099-NEC” link

This will bring you to the summary of all Form 1099-NEC that you have entered. Click Delete or the trash can icon next to each one.

Next, you will re-enter the Form 1099-NEC as part of the Schedule C so that the income is reported directly as part of your Business Income and Expenses and within the correct form and section of your return.

Use these steps to go to the Schedule C section of your return.

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “schedule c” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to schedule c”

- Click on the blue “Jump to schedule c” link

If you already have a Schedule C in your return, edit it and go to the section to Add Income. This is where you will re-enter the Form 1099-NEC.

If you do not already have a Schedule C in your return, follow the prompts and enter the information about your work/business for which you received the Form 1099-NEC. Then continue through that section to Add Income and enter the Form 1099-NEC plus any other income you received for that self-employed business.

Don't forget you can also claim expenses related to your business.

After you are finished, the error condition should be eliminated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC 2020 Nonemployee Compensation Worksheet Double click to link to: Schedule C I have no idea what this is or how to move past the issue. What does it want?

Getting the same error using the mobile app. Any fixes using the app rather than the desktop version?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC 2020 Nonemployee Compensation Worksheet Double click to link to: Schedule C I have no idea what this is or how to move past the issue. What does it want?

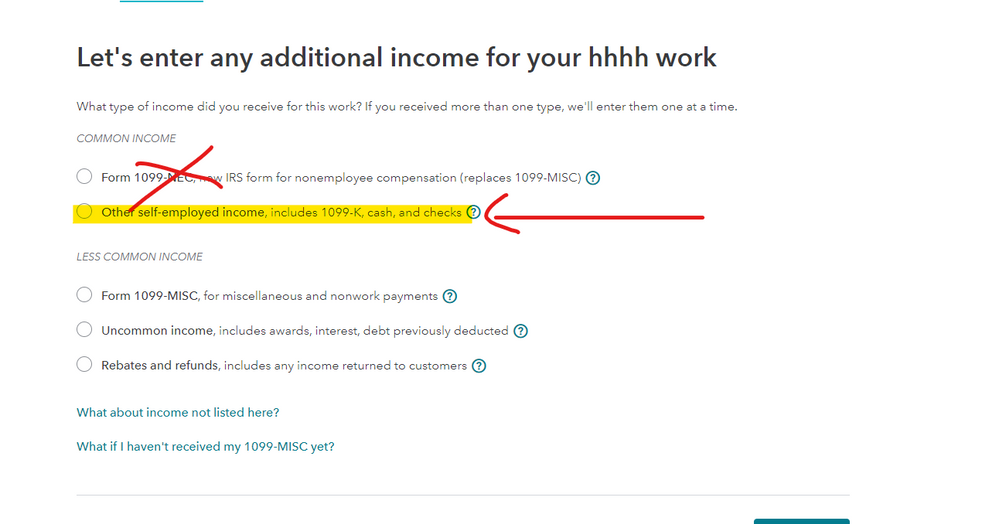

If you received the Form 1099-NEC for a nonemployee compensation, you should enter the information in both Form 1099-NEC and Schedule C sections. I will suggest you to add the Schedule C. See below for instructions.

You would start from the 1099-NEC section under "1099-MISC and Other Common Income". You would then follow prompts to tell the program you are filing a Schedule C. As it creates a Schedule C for you, you will need to go to the Schedule C portion separately to confirm your income amount, add related expenses and complete required information.

In TurboTax online, here are the steps:

- Sign into your account, select Pick up where you left off

- From the upper right menu, select Search and type in 1099nec and Enter

- Select the Jump to 1099nec

- Follow prompts to complete the section

Then

- From the upper right menu, select Search and type in schedule c and Enter

- Select the Jump to schedule c

- Next screen, "Your 2020 work summary" under your self employed business, select Review

- Continue to enter related expenses and other required information

When you received a nonemployee compensation, the IRS treats you as self employed and requires you to pay self employment taxes. The net profit amount will show on line 8 of your Schedule 1 and Form 1040.

If you are using mobile app, try to follow instructions from above. If it does not work, please move it a non-mobile device.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC 2020 Nonemployee Compensation Worksheet Double click to link to: Schedule C I have no idea what this is or how to move past the issue. What does it want?

Hi there, I am experiencing this issue, too. It says "A link to Schedule C and a link to either Schedule F, Form 8918 (Wages) or the Other Income Statement have been selected to report nonemployee compensation. Only one may be selected. You must remove the link that is not applicable."

Is this what you are referring to when you say there is a known issue? I am not able to access the link you shared to sign up for email updates, it says access denied when I try to setup a username.

Thank you for confirming.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC 2020 Nonemployee Compensation Worksheet Double click to link to: Schedule C I have no idea what this is or how to move past the issue. What does it want?

We'd love to help you complete your tax return, but need more information. Can you please clarify your question?

What was the reason for the 1099-NEC? If you are self-employed, then you link it to the business Schedule C.

If the 1099-NEC was from farming, then it gets linked to 1099-F.

If the 1099-NEC was issued for another reason, let us know and we will help you to enter it correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC 2020 Nonemployee Compensation Worksheet Double click to link to: Schedule C I have no idea what this is or how to move past the issue. What does it want?

Mary, thank you so much for following up. Yes, I am self-employed and have a handful 1099-NEC forms that I've put into Turbo Tax. I understand linking these forms to Schedule C, however I'm hitting a roadblock in the process.

When I'm doing the "Federal Review" step in Turbo Tax, I have one item that needs review named "Check This Entry" - what I see here is the Form 1099-NEC Worksheet. It says:

"Form 1099-NEC Worksheet (client name): A link to Schedule C and a link to either Schedule F, Form 8919 (Wages) or the Other Income Statement have been selected to report nonemployee compensation. Only one can be selected. You must remove the link that is not applicable."

And when I scroll through the worksheet that is displayed, it looks like it wants me to "Double click to link to Schedule C" - however there is nowhere to click.

If you could help me figure out how to move past this, I would be so grateful! This is the only thing preventing me from filing my taxes. Many thanks!!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC 2020 Nonemployee Compensation Worksheet Double click to link to: Schedule C I have no idea what this is or how to move past the issue. What does it want?

Mary, please ignore my message from a half hour ago - I got it to work! Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC 2020 Nonemployee Compensation Worksheet Double click to link to: Schedule C I have no idea what this is or how to move past the issue. What does it want?

May I suggest you stop hitting your head against the wall and do this instead ... DELETE all the 1099-NEC forms you entered already and then go to the Sch C section and SKIP the 1099 section and simply enter ONE total amount of ALL your SE income from ALL sources in the OTHER income section ... the IRS only gets one total on the Sch C income line and it is not required you enter all those 1099 forms into the program individually ... so if you can add up your income yourself please do this method instead.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC 2020 Nonemployee Compensation Worksheet Double click to link to: Schedule C I have no idea what this is or how to move past the issue. What does it want?

Ohh! Okay. I actually got it to work the other way, but entering all the 1099-NEC forms into Schedule C. Thank you for sharing this, though - it would have been simpler than the way I did it. MANY THANKS 🙂

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jjgsix

New Member

tt40disme40

New Member

Kiki15

Returning Member

lily32

New Member

in Education

kitnkboodl

New Member