- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

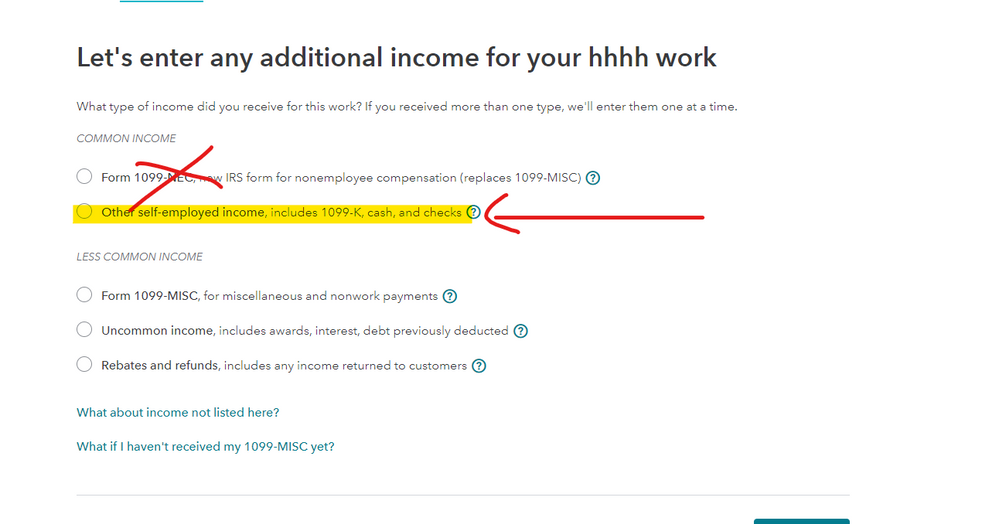

May I suggest you stop hitting your head against the wall and do this instead ... DELETE all the 1099-NEC forms you entered already and then go to the Sch C section and SKIP the 1099 section and simply enter ONE total amount of ALL your SE income from ALL sources in the OTHER income section ... the IRS only gets one total on the Sch C income line and it is not required you enter all those 1099 forms into the program individually ... so if you can add up your income yourself please do this method instead.

April 17, 2021

2:11 PM