- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Filing W-2s early due to closure of S Corp

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

I have filed W-2s for S Corp through TurboTax Business. Our S Corp is now closed and I need to file W-2s for 2021. It is only June 2021. What is the best way to file W-2s early and online?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

And you can get the RED forms by mail now for free : https://www.irs.gov/businesses/online-ordering-for-information-returns-and-employer-returns

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

Complete all the things on the IRS list that is applicable : https://www.irs.gov/businesses/small-businesses-self-employed/closing-a-business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

I previously checked out that website, https://www.irs.gov/pub/irs-pdf/fw2.pdf and the site does not allow 2021 W-2s to be filed online.

The following restrictions apply specifically to Forms W-2/W-3 Online:

- Do not use Forms W-2/W-3 Online if you are filing for a tax year other than 2017, 2018, 2019 or 2020.

Apparently, I will have to download the forms, fill out and mail. I was hoping to avoid the mailing step.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

You cannot efile 2021 forms until mid Jan 2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

I'm getting the run around with the SSA and IRS. According the IRS 2021 General Instructions for Forms W-2 and W-3, page 13 states:

Terminating a business. If you terminate your business,

you must provide Forms W-2 to your employees for the

calendar year of termination by the due date of your final

Form 941, 944, or 941-SS. You must also file Forms W-2

with the SSA by the due date of your final Form 941, 944,

or 941-SS. If filing on paper, make sure you obtain Forms

W-2 and W-3 preprinted with the correct year. If e-filing,

make sure your software has been updated for the current

tax year.

I have filed our FINAL Form 941, Employer's Quarterly Federal Tax Return

On page 14:

Failure to file correct information returns by the due

date. If you fail to file a correct Form W-2 by the due date

and cannot show reasonable cause, you may be subject

to a penalty as provided under section 6721. The penalty

applies if you:

• Fail to file timely,

• Fail to include all information required to be shown on

Form W-2,

• Include incorrect information on Form W-2,

• File on paper forms when you are required to e-file,

• Report an incorrect TIN,

• Fail to report a TIN, or

• Fail to file paper Forms W-2 that are machine readable.

The amount of the penalty is based on when you file

the correct Form W-2. Penalties are indexed for inflation.

The penalty amounts shown below apply to filings due

after December 31, 2021. The penalty is:

• $50 per Form W-2 if you correctly file within 30 days of

the due date; the maximum penalty is $571,000 per year

($199,500 for small businesses, defined in Small

businesses).

• $110 per Form W-2 if you correctly file more than 30

days after the due date but by August 1; the maximum

penalty is $1,713,000 per year ($571,000 for small

businesses).

• $280 per Form W-2 if you file after August 1, do not file

corrections, or do not file required Forms W-2; the

maximum penalty is $3,426,000 per year ($1,142,000 for

small businesses).

However, the SSA states I cannot file 2021 W-2s until December 15, 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

Terminating a business. https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

If you terminate your business,

you must provide Forms W-2 to your employees for the

calendar year of termination by the due date of your final

Form 941, 944, or 941-SS. You must also file Forms W-2

with the SSA by the due date of your final Form 941, 944,

or 941-SS. If filing on paper, make sure you obtain Forms

W-2 and W-3 preprinted with the correct year. If e-filing,

make sure your software has been updated for the current

tax year.

https://www.irs.gov/pub/irs-pdf/fw3.pdf

https://www.irs.gov/pub/irs-pdf/fw2.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

This tells me NOTHING. If you follow your links, the SSA doesn't have 2021 W-2 forms available yet. I called SSA and they will not be ready until December 15, 2021. However, I need to file in the next 30 days or risk a penalty from the IRS. I attempted to order the form W-2 through the IRS website and it is not available for order.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

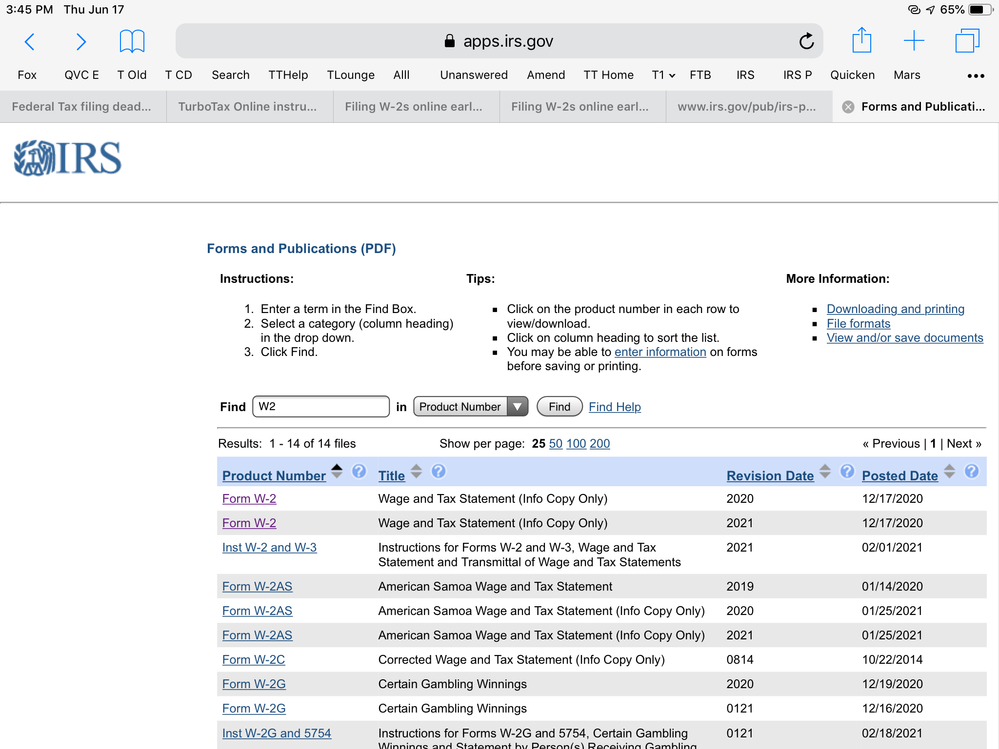

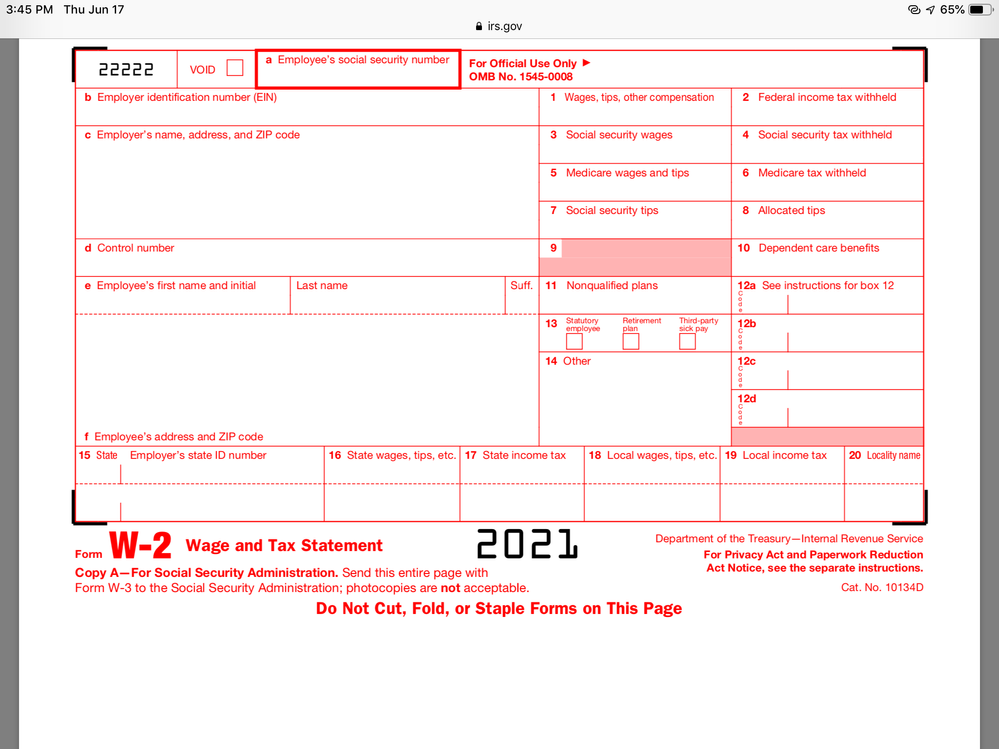

The IRS has it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

I'm sorry to tell you, the IRS does not have it. If you follow the link, you will see it is not there for 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

And you can mail regular Black & white forms ... I do it all the time without any reprisal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

Obviously, the links must be corrupted. As the link does not take me to 2021 W-2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

And you can get the RED forms by mail now for free : https://www.irs.gov/businesses/online-ordering-for-information-returns-and-employer-returns

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing W-2s early due to closure of S Corp

Looks like 2021 to me

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ahkhan99

New Member

aptcat93

New Member

resplendent

New Member

shikhiss13

Level 1

PadillaFam

Level 1