- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Do I select yes or no to "informational returns filed under the return employer ID number"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

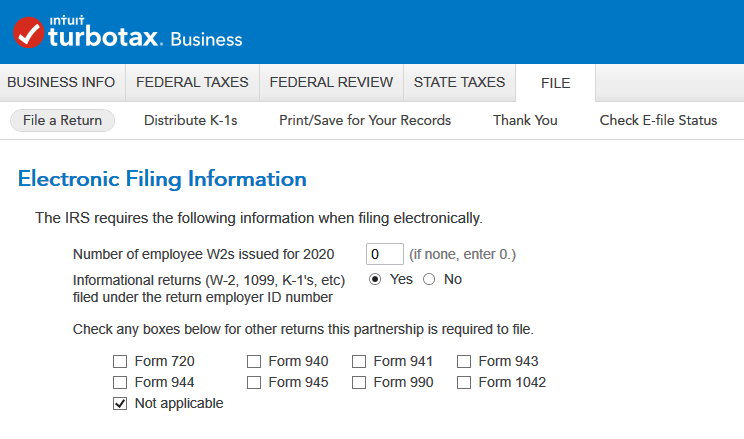

Do I select yes or no to "informational returns filed under the return employer ID number"?

- Multi-member LLC

- For tax purposes, considered a partnership

- Initial filing year (2020) for the LLC

- Operating at a loss this year

- No salaries or wages paid to partners (no W2's)

On the last question before e-filing, there is a question that asks about informational returns, not entirely sure what this means? I plan on generating and distributing K-1's to all 3 partners (including myself).

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I select yes or no to "informational returns filed under the return employer ID number"?

Partners are NEVER issued W-2 or 1099 forms so unless you have employees or sub contractors the # of W-2 forms is zero and then you did not file payroll tax forms. You should be issuing K-1 forms so your screen shot is correct as is.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I select yes or no to "informational returns filed under the return employer ID number"?

Partners are NEVER issued W-2 or 1099 forms so unless you have employees or sub contractors the # of W-2 forms is zero and then you did not file payroll tax forms. You should be issuing K-1 forms so your screen shot is correct as is.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I select yes or no to "informational returns filed under the return employer ID number"?

Awesome, thanks! In what situation would I select NO to that question? I am bit confused with the wording.

Would the answer be NO if I didn't provide any K-1's as well?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I select yes or no to "informational returns filed under the return employer ID number"?

That exact set of questions are used for all non personal returns and on occasion the form 1041 will not produce K-1 forms but a 1065 will always produce a K-1 for each partner.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I select yes or no to "informational returns filed under the return employer ID number"?

The question was perfectly asked and never answered. Does a 2 person LLC with no employees that only files 1065 each year reply Yes or No? Personally, I don't care much what the reason is. There is a lot of new vocabulary in TT for for this question and no help how to understand it. And the answer listed here does not address the question.

Part of the confusion is I never considered filing separate K-1 for husband/wife LLC. I complete 1065 and efile before deadline and of course there are two K-1s in the return. Then complete 1040 before deadline and the two K-1 info is transferred into that before efiling. So did I ever "File Informational Returns"? Should I check yes or no? I don't think the IRS cares that I did this vs efiling the K-1s separately but I don't want to tell them I did if I didn't, nor do I want to say I didn't if filing 1065 with K-1 is filing K-1 as far as IRS is concerned. In 10yrs of TT 1065 filing I've never considered this. I have no idea what the situation is.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I select yes or no to "informational returns filed under the return employer ID number"?

It depends on whether informational returns, like W-2s or 1099s, were filed under the Employer Identification Number (EIN) linked to the return. If your partnership or entity issued such forms to employees or subcontractors, you would select "Yes." However, if no such forms were filed, you would select "No."

For example, if your partnership only issued K-1 forms to partners and did not file W-2s or 1099s, the answer would typically be "No." Here are examples of information returns you may have filed.

- Form W-2: If you have employees, you'll need to file W-2 forms to report wages, tips, and other compensation paid to them.

- Form 1099: If you made payments to independent contractors, freelancers, or other non-employees, you may need to file 1099 forms (e.g., 1099-NEC for non-employee compensation or 1099-MISC for miscellaneous income).

- Schedule K-1 (Form 1065): Partnerships must provide Schedule K-1 to each partner, detailing their share of the partnership's income, deductions, and credits.

- Form 1042-S: If you made payments to foreign persons, such as interest, dividends, or other income, you may need to file this form.

- State-Specific Forms: For Connecticut, you might need to file forms like Schedule CT K-1 to report members' shares of Connecticut-specific items.

- Form 941. Reporting a Employer's Federal Quarterly Tax Return if you have employees.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I select yes or no to "informational returns filed under the return employer ID number"?

Sorry, all you've done is repeat ambiguity of question. I know what I did, probably the same as many others. Husband/wife LLC filed 1065 near March 15 every year for 10yrs. There are two K1s in the filing, 40-60% ownership each.

Is the answer Yes or No?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I select yes or no to "informational returns filed under the return employer ID number"?

It depends if you filed any of these forms. If you haven't the answer is 'no".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I select yes or no to "informational returns filed under the return employer ID number"?

I'm not trying to be difficult. I only sent (IRS likes to use word "issued") K1s via filing 1065 timely every year. I have never Filed K1s before January 30 deadline. IRS doesn't seem to care and honestly I never considered it until this year. And is there a Return Employer ID Number? There's no employer, right? Typical help leans towards Yes but this is a verification question, did you do it. How could any 1065 type partnership not "File" Informational Returns if filing simply means by some method the info got to IRS. All 1065 have some variety of those forms, that's the whole point of it not being a Schdl C sole proprietorship.

So, if your knowledgeable about this, read my tax filing info above and tell me if my answer is Yes or No?

IRS hungup on my today with excuse it is a TT question but TT says IRS requires the answers to verify for Efiling.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I select yes or no to "informational returns filed under the return employer ID number"?

You have no W2s. Put zero in that space.

You issued K1s. Answer "yes" to the question of whether you issued K1s.

You don't have any of the other informational returns. Answer 'not applicable' for the information returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lteget

New Member

bansalp

New Member

ashraf-yacoub6

New Member

mmcdv

New Member

rntaxQs

Returning Member

Want a Full Service expert to do your taxes?