- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

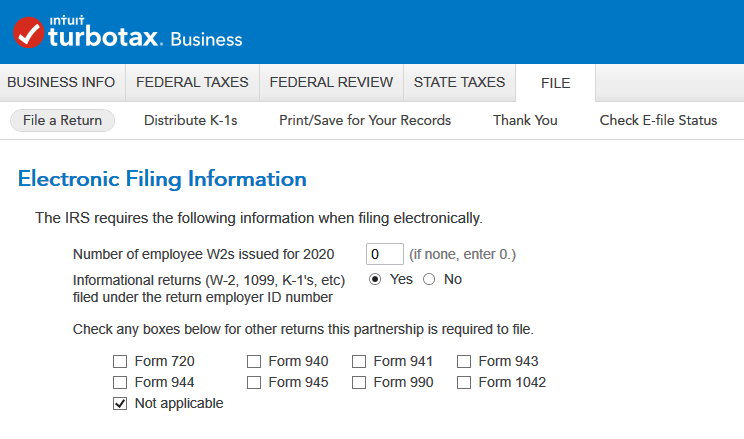

Do I select yes or no to "informational returns filed under the return employer ID number"?

- Multi-member LLC

- For tax purposes, considered a partnership

- Initial filing year (2020) for the LLC

- Operating at a loss this year

- No salaries or wages paid to partners (no W2's)

On the last question before e-filing, there is a question that asks about informational returns, not entirely sure what this means? I plan on generating and distributing K-1's to all 3 partners (including myself).

Topics:

April 6, 2021

10:03 PM