- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- What do I do if Intuit TurboTax made a mistake on my taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if Intuit TurboTax made a mistake on my taxes?

I have the same question. I just filed today. My taxable income was $57,000. Turbo Tax said my federal income tax was $2,000, getting me a large refund. However, the IRS tax tables show the tax should have been $6,500. I can see no possible reason for the lower tax. I believe it is an error that will come back to haunt me with penalties and interest in the future. How do I deal with this?? Thanks.

Rich W.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if Intuit TurboTax made a mistake on my taxes?

Did you have any qualified dividends or capital gains? Or did you claim the Stimulus on 1040 line 30 that you already got? Look at your return. What lines don't you understand?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if Intuit TurboTax made a mistake on my taxes?

I am replying to VolvoGirl. Yes, I have qualified dividends and capital gains, but all that happens before taxable income. Taxable income is the final bottom line of which your tax is determined. You simply go to the table and post the tax. I am a CPA and very experienced and I cannot imagine anything that would come between taxable income and what the table says your tax is? Anyone have a clue other than a Turbo Tax error??

Rich W.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if Intuit TurboTax made a mistake on my taxes?

If you are a CPA then you already know this.............

If you have capital gains or qualified dividends the tax is not taken from the tax table but is calculated separately from schedule D. The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet. It does not get filed with your return. In the online version you need to save your return as a pdf file and include all worksheets to see it.

For the Desktop version you can switch to Forms Mode and open the worksheet to see it. Click Forms in the upper right (upper left for Mac) and look through the list and open the Qualified Dividends and Capital Gain Tax Worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if Intuit TurboTax made a mistake on my taxes?

You can spin your wheels for a long time before you finally get to their link about Accuracy Guarantee. After reading their language you find out that their only obligation is to help you if you get audited or fined by IRS. If you get to a customer representative you will probably be reminded that YOU approved the return, and are therefore responsible for catching any mistakes... I may not have all the wording correct, but the bottom line is that you are SOL. One huge mistake that Turbotax made this year was entering $1200 in Line 30 on many returns in error. The customer did nothing wrong. Those returns are being delayed for weeks or months by IRS and the refund amount is being adjusted downward by $1200. Turbotax is being very slippery with its responses to this error. They must have made this mistake on a lot of returns and don't want to lose the revenue. If you happen to be lucky and pin someone down, they may agree to giving you a refund - once they have been payed out of your Federal return (which is delayed because of their mistake). Be patient and be persistent. Making an honest mistake is one thing. Trying to deny responsibility is crooked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if Intuit TurboTax made a mistake on my taxes?

Trust me, they did that to a lot of people this year. I hope they finally admit their mistake. I can accept honest mistakes. I hate dishonesty and cover-ups, especially when it pertains to finances.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if Intuit TurboTax made a mistake on my taxes?

As it turns out as suspected,for some reason they gave me a $600 recovery rebate/Stimulus credit on line 30 which I didn't claim. I said I received all recovery checks. That's a credit if you didn't. Or receive one or part of one. Thing is I never did. It gave me credit anyway.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if Intuit TurboTax made a mistake on my taxes?

I suspect this is a really large issue. I hope Turbotax comes clean and does the right thing. Cheers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if Intuit TurboTax made a mistake on my taxes?

@montanaokie1 wrote:

You can spin your wheels for a long time before you finally get to their link about Accuracy Guarantee. After reading their language you find out that their only obligation is to help you if you get audited or fined by IRS. If you get to a customer representative you will probably be reminded that YOU approved the return, and are therefore responsible for catching any mistakes... I may not have all the wording correct, but the bottom line is that you are SOL. One huge mistake that Turbotax made this year was entering $1200 in Line 30 on many returns in error. The customer did nothing wrong. Those returns are being delayed for weeks or months by IRS and the refund amount is being adjusted downward by $1200. Turbotax is being very slippery with its responses to this error. They must have made this mistake on a lot of returns and don't want to lose the revenue. If you happen to be lucky and pin someone down, they may agree to giving you a refund - once they have been payed out of your Federal return (which is delayed because of their mistake). Be patient and be persistent. Making an honest mistake is one thing. Trying to deny responsibility is crooked.

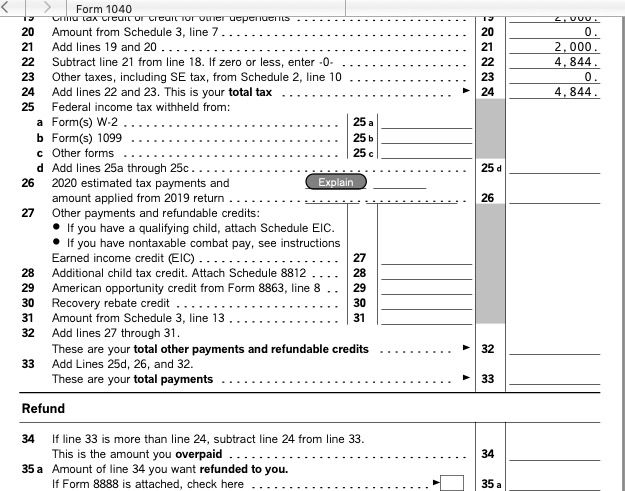

After entering all information TurboTax calculates the first and second stimulus and adds it to your refund, then it asks how much of the first and second stimulus you received and subtracts that. If you received all the stimulus then line 30 will be zero. TurboTax can only enter what you tell it, it has no way to know if you received it or not. The accuracy guarantee only covers calculation errors, not user entered data.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if Intuit TurboTax made a mistake on my taxes?

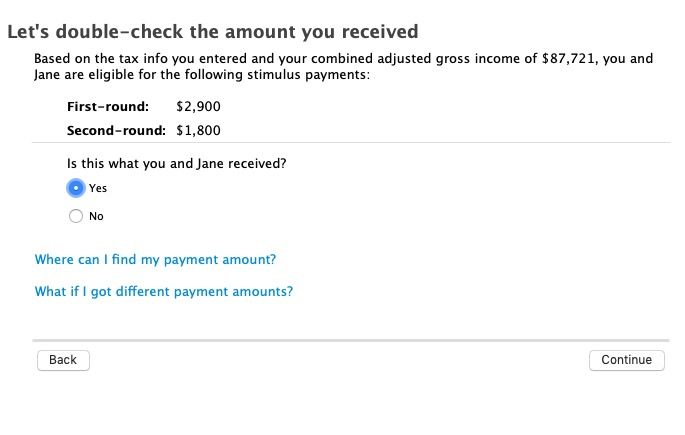

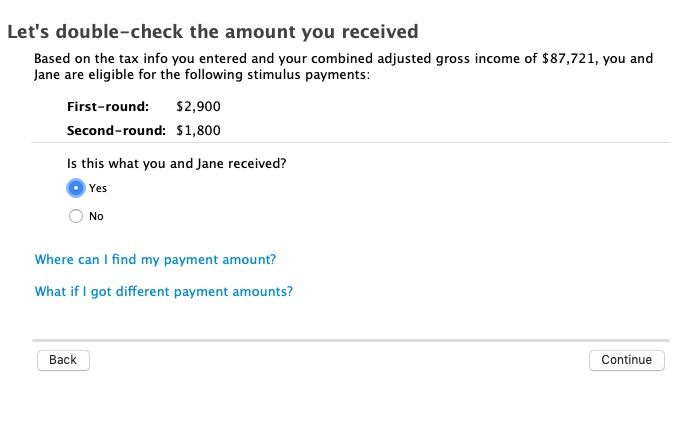

Hey, Macuser-22. Are you part of the cover-up? First of all, I am only talking about Turbotax Online. So, in response to your post, here's what I just did: I logged in and followed the Add Another State link to Federal Review. After you look at all your income you eventually come to the statement: "It looks like you qualified for the stimulus, did you get any payments?" I answered Yes. The next step says "Let's double-check the amounts you received.

First Round $1200

Second Round $600

Is this what you received? I answered Yes

That is the only input the customer can or does enter. That's an exact transcript of how I answered the questions. So, how did Line 30 get $1200 entered? Turbotax did it. Please get that into your skull. Turbotax made this mistake on a lot of returns. You can't shove the blame on the customer. I already have two Case numbers after talking to two different customer representatives. They both agreed with me, however, in one case they sent me a link to Accuracy Guarantee Dept. and dumped me. In the second case, she explained that Turbotax could only refund me when their payment from the IRS hit their books. (I opted to pay my fees from my Federal return vs. paying with a credit card). She gave me a case number and told me to follow up after I received my Federal return. She said she empathized with me and put notes in to have my refund approved.

Do you think I am making this up? I would love to hear your rebuttal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if Intuit TurboTax made a mistake on my taxes?

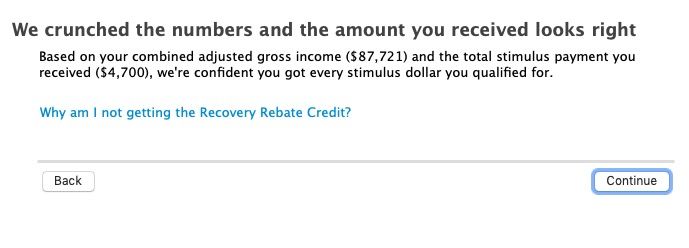

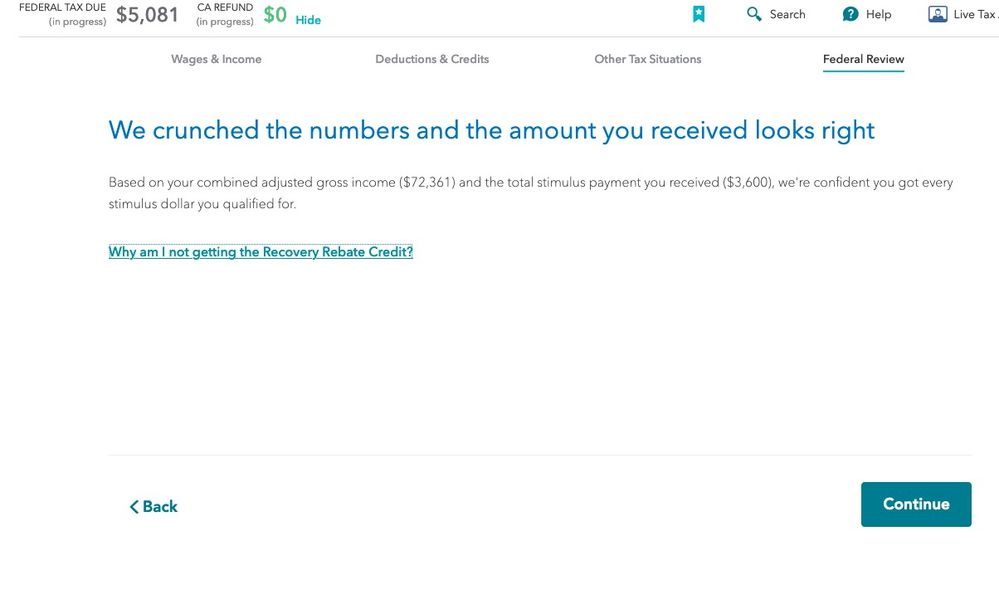

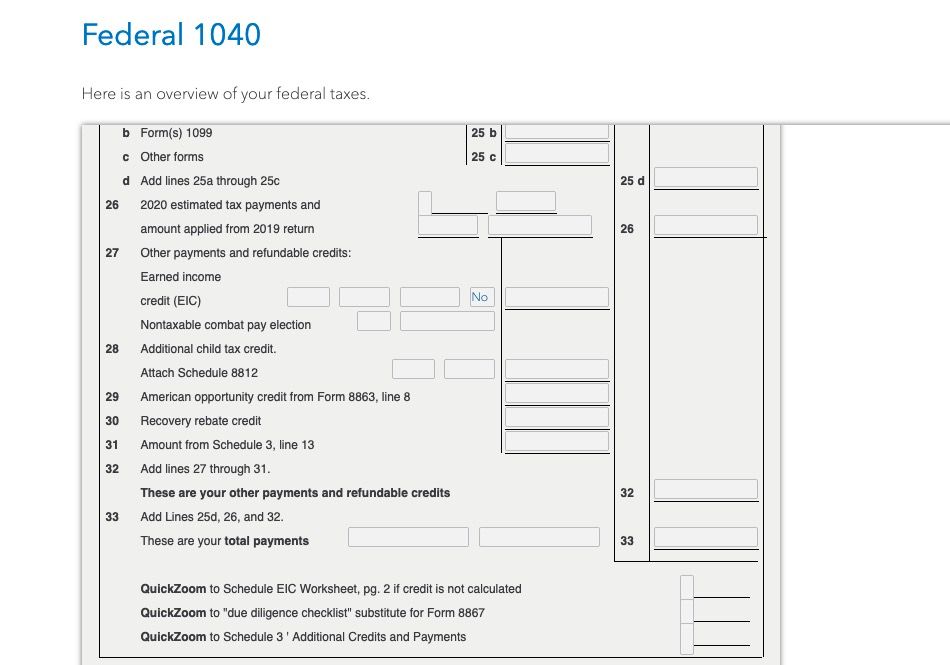

This is what I get. Line 30 is zero.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if Intuit TurboTax made a mistake on my taxes?

This is the online version:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if Intuit TurboTax made a mistake on my taxes?

Hey, macuser_22, You got lucky. Lots of us didn't. I would send you screen shots of my filing, but I have already stated my case accurately. In your case, I would say Turbotax does NOT owe you a refund. In my case and many others, Turbotax should refund their filing fees. Does anyone question my logic?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if Intuit TurboTax made a mistake on my taxes?

Mine was a calc error this year - When the federal pulled in last year it doubled last years state refund applied to this years tax. I'm a non resident to the taxing state so I do not have taxes withheld. I was promised a refund but never received it. Tech support said they could not fix it. I will not be using this product going forward as it will continue carrying over the mistake.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if Intuit TurboTax made a mistake on my taxes?

TurboTax guarantees the accuracy of the calculations on the tax return. It cannot and does not guarantee that the tax data entered by the user OR imported to the software is accurate.

You always owe your correct income tax. At most, the accuracy guarantee would cover any penalties and interest due to a program mistake. You must file your claim within 30 days of receiving the IRS notice.

See this TurboTax support FAQ for the Accuracy Guarantee - https://ttlc.intuit.com/community/charges-and-fees/help/what-is-the-turbotax-100-accurate-calculatio...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Pooda1234

New Member

sailorsj

New Member

mikefalknernd

Level 2

user17633958806

New Member

roginawm

New Member