- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- What do I do? I got an IRS letter: Sec. 2302 of the CARES act- deferred due dates for SS Taxes, now I owe. It says I reported in schedule H, but don't remember doing so.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do? I got an IRS letter: Sec. 2302 of the CARES act- deferred due dates for SS Taxes, now I owe. It says I reported in schedule H, but don't remember doing so.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do? I got an IRS letter: Sec. 2302 of the CARES act- deferred due dates for SS Taxes, now I owe. It says I reported in schedule H, but don't remember doing so.

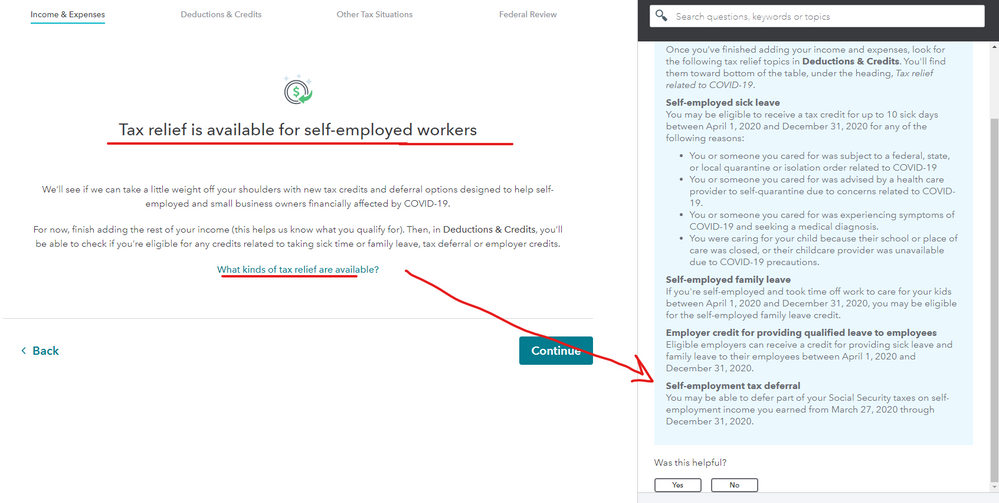

The page to defer SS came up when you filed your self-employment return. It was a checkbox that you needed to check if you wanted to defer. If you agreed to defer, then you need to pay that deferred amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do? I got an IRS letter: Sec. 2302 of the CARES act- deferred due dates for SS Taxes, now I owe. It says I reported in schedule H, but don't remember doing so.

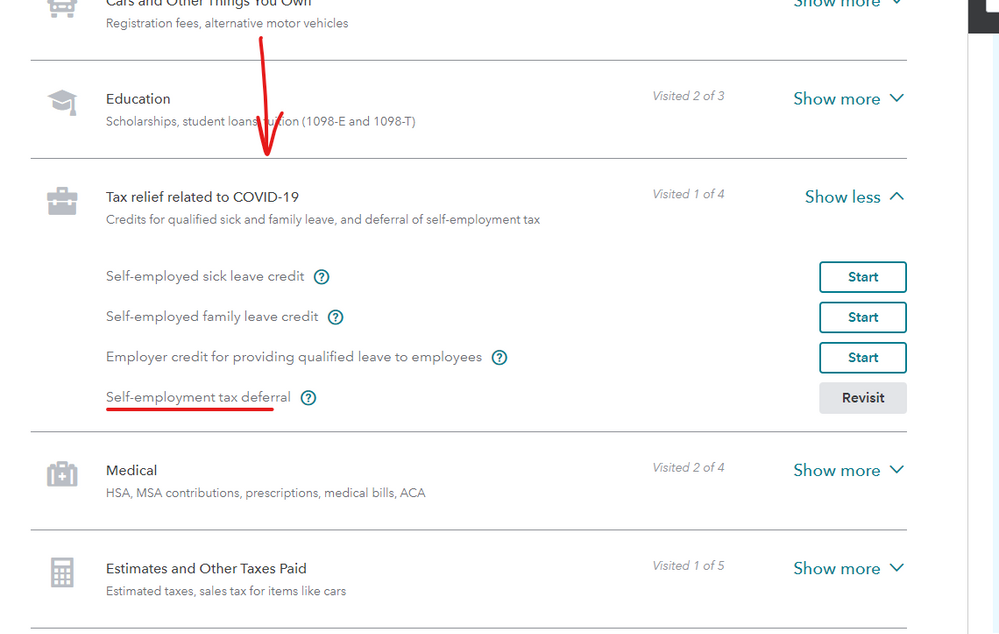

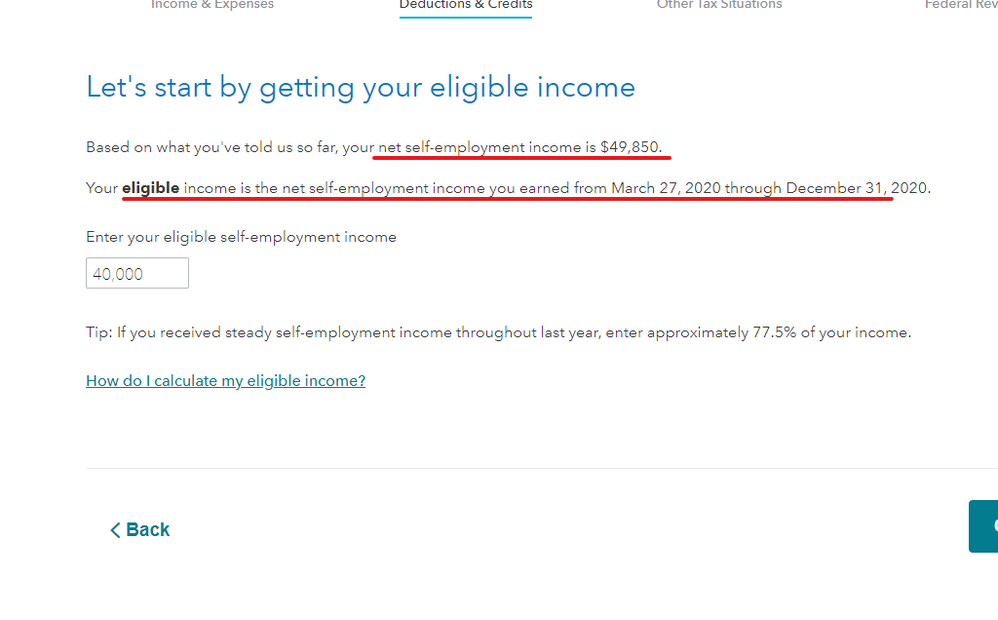

It could have been on the Sch SE if you were self employed and/or the Sch H if you had household employees. These are the screens you would have seen for the Sch C path ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do? I got an IRS letter: Sec. 2302 of the CARES act- deferred due dates for SS Taxes, now I owe. It says I reported in schedule H, but don't remember doing so.

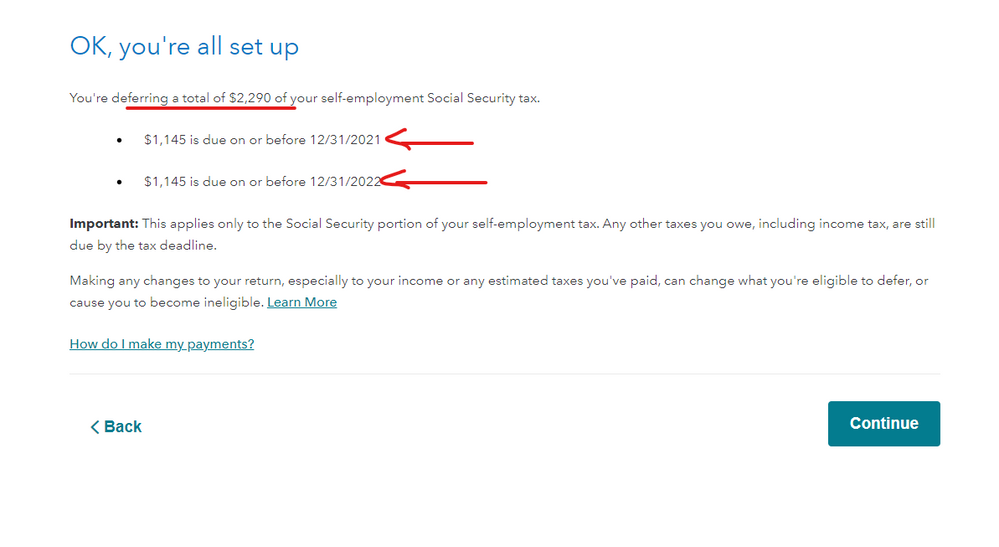

The CARES Act allows you to defer paying part of the Social Security tax for your household employee, if certain requirements are met. The deferral appears as a refundable credit on Schedule 3 line 12e. It was subtracted from the tax you had to pay with your tax return. Half the deferred tax is due December 31, 2021, and the remainder is due December 31, 2022. The deferral is only allowed for 2020.

The IRS letter is about the self-employment tax on your tax return, not Social Security tax that is withheld from your wife's pay by her employer. If any of her Social Security tax was deferred, it was done by her employer, not by you. If the employer deferred any of the Social Security tax, the employer will collect the deferred tax in 2021.

See the following IRS notice for instructions to pay the deferred tax for your household employee.

How self-employed individuals and household employers repay deferred Social Security tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do? I got an IRS letter: Sec. 2302 of the CARES act- deferred due dates for SS Taxes, now I owe. It says I reported in schedule H, but don't remember doing so.

look at schedule SE part III. I think Turbotax did a very poor job of informing taxpayers with self-employment tax how answering certain questions would affect their taxes. without realizing it you probably requested that a portion of your SE tax not be paid with the 2020 return but rather 50% of the deferral be paid by 12/31/2021 and the other 1/2 by 12/31/2022

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do? I got an IRS letter: Sec. 2302 of the CARES act- deferred due dates for SS Taxes, now I owe. It says I reported in schedule H, but don't remember doing so.

So schedule SE Part III line 26 is the total owed? I did not even realize that it was filled out like that. They did a very poor job.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do? I got an IRS letter: Sec. 2302 of the CARES act- deferred due dates for SS Taxes, now I owe. It says I reported in schedule H, but don't remember doing so.

@sill wrote:

So schedule SE Part III line 26 is the total owed?

No. Schedule 3 line 12e is the total amount owed. Half of it is due December 31, 2021, and the remainder is due December 31, 2022. Schedule 3 line 12e might not be the same as Schedule SE line 26.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do? I got an IRS letter: Sec. 2302 of the CARES act- deferred due dates for SS Taxes, now I owe. It says I reported in schedule H, but don't remember doing so.

See my other post with the 5 screenshots that explained the deferral option that you had to agree to ... this was something brand new for 2020 only so the user is responsible for reading the information presented. If you had questions then asking them before you file would have been the correct thing to do in a DIY program. And reviewing the entire return for accuracy is also the user's obligation when using a DIY program since it is reliant on the user's entries.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do? I got an IRS letter: Sec. 2302 of the CARES act- deferred due dates for SS Taxes, now I owe. It says I reported in schedule H, but don't remember doing so.

I personally read everything and clearly remember answering the question saying I did NOT want to defer. Turbotax apparently did it without letting me know. I followed all the screenshots shared in this chat, my summary of credits and deductions does not show any amount being deferred. And when I completed my taxes and printed them, TurboTax did not say anything about an amount still being due by the end of the year. THAT is a mistake on Turbax's part and I am disappointed to say the least. Not only that, but the IRS letter states that we should find the deferral amount on our Schedule SE. TurboTax shows it on a completely different form, Schedule III. Why is that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do? I got an IRS letter: Sec. 2302 of the CARES act- deferred due dates for SS Taxes, now I owe. It says I reported in schedule H, but don't remember doing so.

Check Schedule SE, line 18.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do? I got an IRS letter: Sec. 2302 of the CARES act- deferred due dates for SS Taxes, now I owe. It says I reported in schedule H, but don't remember doing so.

@JanSal I don't know what the IRS letter says about Schedule SE, or why it even refers to Schedule SE. Schedule SE line 26 is a cap on the amount of tax that you might be able to defer, but you might not be able to defer that full amount. The amount that you can actually defer is calculated on a worksheet. The amount that you actually did defer is on Schedule 3 line 12e. TurboTax shows it on that line because that's where the IRS instructions say to put it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do? I got an IRS letter: Sec. 2302 of the CARES act- deferred due dates for SS Taxes, now I owe. It says I reported in schedule H, but don't remember doing so.

Thank you. That does help explain it.

I guess my one suggestion for Turbo Tax would be that when taxes are deferred, TurboTax should put that on the summary page that is always printed before the rest of the return is printed. Mine shows that I paid everything and doesn't say anything about the deferral.

I just wish TurboTax did not automatically defer. I specifically said I didn't want to defer, and it still does not show an amount as being deferred in my TurboTax summary of Deductions and Credits. However, now that my TurboTax updated, it does say that the deferral "needs to be revisited." So now I know that when it says that, TurboTax has done something that I need to review to be sure it isn't doing something that I didn't want.

Thanks for helping clarify things and for help locating what actually happened inside TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do? I got an IRS letter: Sec. 2302 of the CARES act- deferred due dates for SS Taxes, now I owe. It says I reported in schedule H, but don't remember doing so.

Ok, let's cut to the chase. I also received the mysterious IRS letter declaring that I had $230 deferred from my SE tax. I also did not authorize making a deferral of "employer portion of FICA", as I am self employed and have no employees. (I seriously doubt that the option was explained and made clear, it it was offered at all.) The current updates of the package do not operate the same as they did in April when I filed.

However, it is clear to me that Intuit and TurboTax have made a serious error in calculation of my taxes, specifically regarding SE deferral. Please note the following:

1. I filed my taxes in April. I save the return as it was filed, both in .pdf format and the native TT .tax2020 format.

2. Line 12e of Schedule 3, as filed, reads $632.

3. As of 08/27/2021, after software update Line 12e of Schedule 3, reads, $0. (ie no deferral calculated, same .tax2020 file). Apparently I did not request deferral after all!

4. Furthermore, while my letter from the IRS states that my deferral was for $230. Nowhere in my return is there line that contains a value of $230. This part of the mystery is truly confusing as the amounts do not correspond to anything on my return, regardless of whether I "elected" for deferral or not.

Regardless, it is clear that TT has changed their software to operated diferrently when calculating deferrals for SE taxes. The result is that my tax estimate for 2021 is incorrect, and other parts of the return are also incorrect. And I still have a pending expectation from the IRS that I will "pay the deferred amount".

I would like Intuit to acknowledge their error and acknowedge that they have not done or said anything to advise users who have been mislead by their errors.

I would also like guidance as to how I should respond. Do I send the IRS the ($230) amount stipulated in their letter, or should it be that the amount on Line 12e of Schedule 3 of my filed return ($632)? Or, do I submit an amended return, recalculate my outstanding SE vouchers, and wait for a response? Or just amend the return and ignore the letter?

I have been relying on TT for Many years. Can I trust them going forward?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do? I got an IRS letter: Sec. 2302 of the CARES act- deferred due dates for SS Taxes, now I owe. It says I reported in schedule H, but don't remember doing so.

Also, so much for "Taxes Done Right".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do? I got an IRS letter: Sec. 2302 of the CARES act- deferred due dates for SS Taxes, now I owe. It says I reported in schedule H, but don't remember doing so.

I agree with this. I did not defer payments; I would have noticed if I had as I am very in tune with what I am doing when working on my taxes. TurboTax obviously deferred them on my behalf or disguised them without my knowledge. I am beginning to think this was done on purpose by TT with ulterior motives.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kh52

Level 1

Liangtwn

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

ripepi

New Member

rhartmul

Level 2

johntheretiree

Level 2