- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Third stimulus

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Third stimulus

Would I still get the Third stimulus (EIC) if I just claimed it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Third stimulus

If you never received the 3rd stimulus payment (EIP3) it will be entered on your federal tax return Form 1040 Line 30 as a Recovery Rebate Credit. Assuming you indicted in the TurboTax program, Federal Review, that you did NOT receive the stimulus payment.

The credit would be included in the federal tax refund or it would reduce the amount of taxes owed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Third stimulus

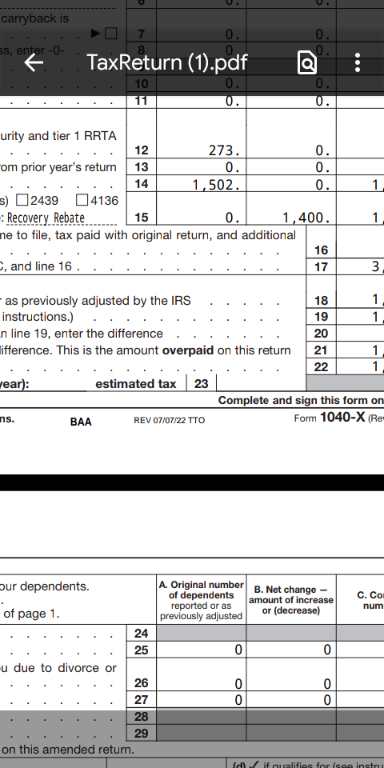

I just claimed it by amending my 2021 return and it's already been accepted I just was worried It was too late and I had to wait for next tax time

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Third stimulus

It wasn't automatically on your original return on line 30? When you filled out the first return did you say you had already got it? What is on line 30?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Third stimulus

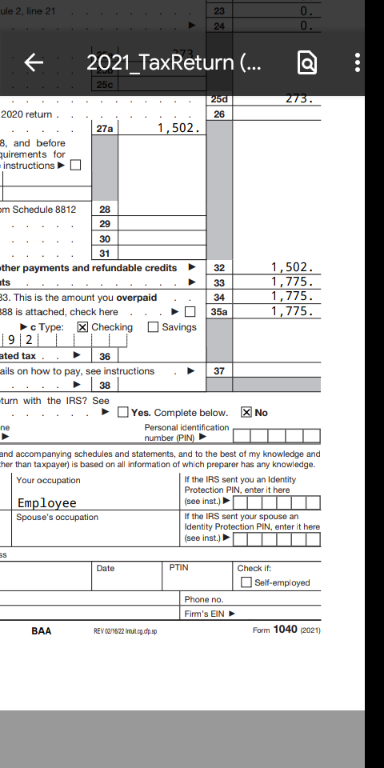

I filed my 2021 tax return in February with TurboTax autofile and I guess it never claimed it and I was never aware of it until now so I amended my taxes today and it was claimed as rebate credit and refiled and had already been accepted and had said it'd be sent by mail I know I'm getting the payment I just don't know if I have to wait till next tax season for them to actually send it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Third stimulus

"Accepted" just means that the amended return is ready for the IRS to process it. But the IRS is severely backlogged this year. Amended returns are taking 6 months or more to be processed. It's not because it has to wait for the next tax season. It's just because the backlog is that long.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Third stimulus

I just wanted to know if they'll still send it I just did it today

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Third stimulus

They will eventually mail you a check if they agree with your amended return. But it might take a very long time like over 9 months. Did you wait to amend until the first return was fully processed and you got the first refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Third stimulus

Yes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Third stimulus

@JoshuaPierce77 - agreed you'll be waiting 9-12 months for the amendment to be processed

one thing to check - while you state you did not receive the 3rd stimulus, and that is the purpose of the amendment, it would be worth checking your transcript. even though you didn't receive it, that doesn't mean the IRS hasn't sent it. if you see the $1400 credit on your transcript, then what is going to occur is the IRS will adjust the amendment and then you'll have to submit for a trace.

if you decide the trace is the way to go, don't worry about the amendment, the IRS will remove the $1400 once they process it.

https://www.irs.gov/pub/irs-pdf/f3911.pdf

Status of Processing Form 1040-X, Amended Individual Tax Return: As of July 23, 2022, we had 2 million unprocessed Forms 1040-X. We are processing these returns in the order received and are working hard to get through the inventory. The current timeframe can be more than 20 weeks instead of up to 16. Please don't file a second tax return or contact the IRS about the status of your amended return. Taxpayers should continue to check Where's My Amended Return? for the most up to date processing status available.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Walkernate

Level 2

woodywayme

New Member

theseedbarakaat

New Member

338683jmb

New Member

casla0563

New Member