- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Refund Filed 3/4/21, Says ‘Accepted’ via TurboTax but IRS Says ‘Processing’ as of 6/9/21

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Filed 3/4/21, Says ‘Accepted’ via TurboTax but IRS Says ‘Processing’ as of 6/9/21

Title is my question.

I’ve used TurboTax since I’ve gotten W2s.

For 2020, I made sure to submit my taxes well within time. I submitted on 3/4/21 and both returns were ‘Accepted’ within 48 hours, state and federal. My state return has processed and what I owed was debited.

My federal return is listed as pending on the IRS website with no updates at all since I submitted it.

What is going on with that? I’ve never waited this long and every time I contact the IRS I cannot speak to a live person as it will take me that route but the call drops. I’ve tried morning, afternoon, evening and with more than 3 phones.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Filed 3/4/21, Says ‘Accepted’ via TurboTax but IRS Says ‘Processing’ as of 6/9/21

TurboTax gives you an estimated date for receiving your refund based on a 21 day average from your date of acceptance, but it can take longer. “21 days” is not a promise from TurboTax or the IRS. Many refunds are taking longer during the pandemic. The IRS is backlogged —-they are still trying to process millions of 2019 returns; they received millions of e-filed on the day they opened for 2020 returns, and now they are burdened with sending out another round of stimulus checks.

Some delays are resulting from incorrect amounts that folks entered for stimulus checks they received. Many people have been confused by the recovery rebate credit and completed it incorrectly. The IRS may delay your refund while they cross-check to see what you received. Some refunds are delayed because of the tax law changes that went into effect recently. If your return has unemployment or the premium tax credit on it, that may be delaying it.

First, check your e-file status to see if your return was accepted:

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

Once your federal return has been accepted by the IRS, only the IRS has any control. TurboTax does not receive any updates from the IRS. Your ONLY source of information about your refund now is the IRS.

You need your filing status, your Social Security number and the exact amount (line 34of your 2020 Form 1040) of your federal refund to track your Federal refund:

To track your state refund:

https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

https://ttlc.intuit.com/questions/1901548-why-do-some-refunds-take-longer-than-others

If you chose to have your TurboTax fees deducted from your federal refund, that will take some extra time, while the third party bank handles the refund processing.

https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

https://ttlc.intuit.com/questions/2840013-does-accepted-mean-my-refund-is-approved

From this IRS website - https://www.irs.gov/newsroom/irs-operations-during-covid-19-mission-critical-functions-continue

As of May 15, 2021, we had 300,000 individual tax returns received prior to 2021 in the processing pipeline. Including current year returns, as of May 15, 2021, we had 16.4 million unprocessed individual returns in the pipeline. Unprocessed returns include those requiring correction to the Recovery Rebate Credit amount or validation of 2019 income used to figure the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC). This work does not require us to correspond with taxpayers but does require special handling by an IRS employee so, in these instances, it is taking the IRS more than 21 days to issue any related refund. If, as a result, a correction is made to any RRC, EITC or ACTC claimed on the return, the IRS will send taxpayers an explanation. Taxpayers are encouraged to continue to check Where’s My Refund? for their personalized refund status and can review Tax Season Refund Frequently Asked Questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Filed 3/4/21, Says ‘Accepted’ via TurboTax but IRS Says ‘Processing’ as of 6/9/21

TurboTax gives you an estimated date for receiving your refund based on a 21 day average from your date of acceptance, but it can take longer. “21 days” is not a promise from TurboTax or the IRS. Many refunds are taking longer during the pandemic. The IRS is backlogged —-they are still trying to process millions of 2019 returns; they received millions of e-filed on the day they opened for 2020 returns, and now they are burdened with sending out another round of stimulus checks.

Some delays are resulting from incorrect amounts that folks entered for stimulus checks they received. Many people have been confused by the recovery rebate credit and completed it incorrectly. The IRS may delay your refund while they cross-check to see what you received. Some refunds are delayed because of the tax law changes that went into effect recently. If your return has unemployment or the premium tax credit on it, that may be delaying it.

First, check your e-file status to see if your return was accepted:

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

Once your federal return has been accepted by the IRS, only the IRS has any control. TurboTax does not receive any updates from the IRS. Your ONLY source of information about your refund now is the IRS.

You need your filing status, your Social Security number and the exact amount (line 34of your 2020 Form 1040) of your federal refund to track your Federal refund:

To track your state refund:

https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

https://ttlc.intuit.com/questions/1901548-why-do-some-refunds-take-longer-than-others

If you chose to have your TurboTax fees deducted from your federal refund, that will take some extra time, while the third party bank handles the refund processing.

https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

https://ttlc.intuit.com/questions/2840013-does-accepted-mean-my-refund-is-approved

From this IRS website - https://www.irs.gov/newsroom/irs-operations-during-covid-19-mission-critical-functions-continue

As of May 15, 2021, we had 300,000 individual tax returns received prior to 2021 in the processing pipeline. Including current year returns, as of May 15, 2021, we had 16.4 million unprocessed individual returns in the pipeline. Unprocessed returns include those requiring correction to the Recovery Rebate Credit amount or validation of 2019 income used to figure the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC). This work does not require us to correspond with taxpayers but does require special handling by an IRS employee so, in these instances, it is taking the IRS more than 21 days to issue any related refund. If, as a result, a correction is made to any RRC, EITC or ACTC claimed on the return, the IRS will send taxpayers an explanation. Taxpayers are encouraged to continue to check Where’s My Refund? for their personalized refund status and can review Tax Season Refund Frequently Asked Questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Filed 3/4/21, Says ‘Accepted’ via TurboTax but IRS Says ‘Processing’ as of 6/9/21

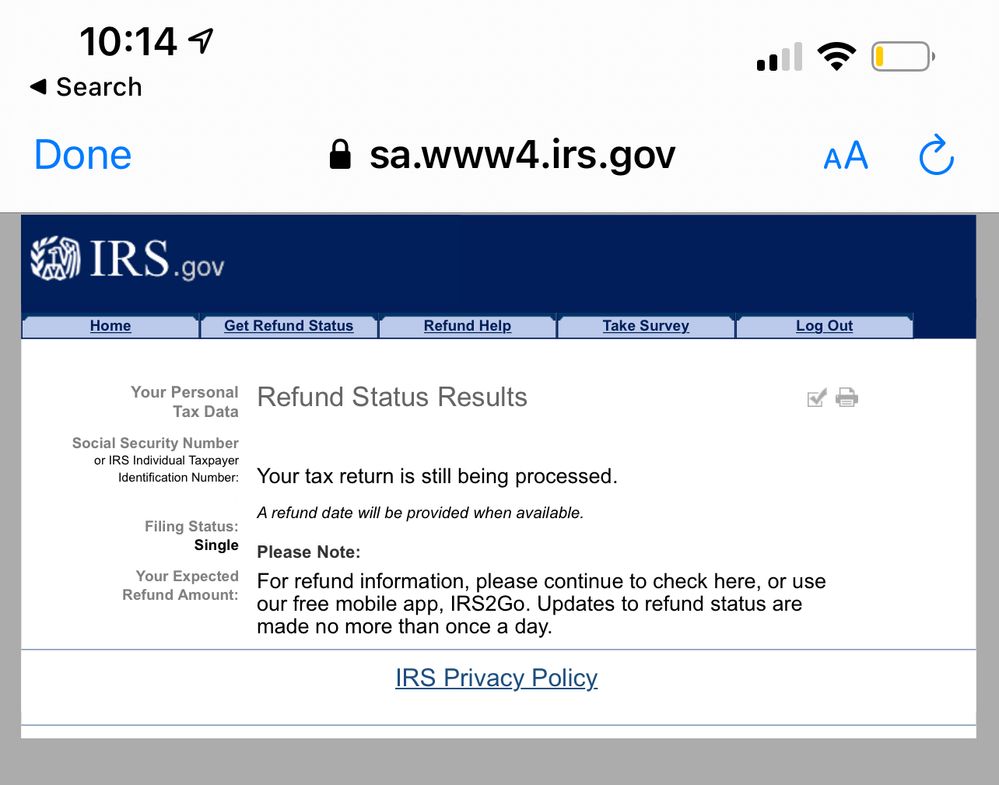

Just to clarify terms ... you send your return and it will be in a PENDING status until the IRS accepts or rejects it ... then if it gets ACCEPTED for processing and it will remain as RECEIVED on the IRS site until they process it and APPROVE the refund when a date is posted for the release of the refund. Please use the correct terms in the future so a proper answer can be rendered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Filed 3/4/21, Says ‘Accepted’ via TurboTax but IRS Says ‘Processing’ as of 6/9/21

Thank you for trying to correct me. You are incorrect.

I used the correct terms and I do not appreciate the lecture as I made no insults or placed blame on anyone at all. I simple asked, “what is going on?”.

I made sure to list the status of both what TurboTax says and what the IRS says.

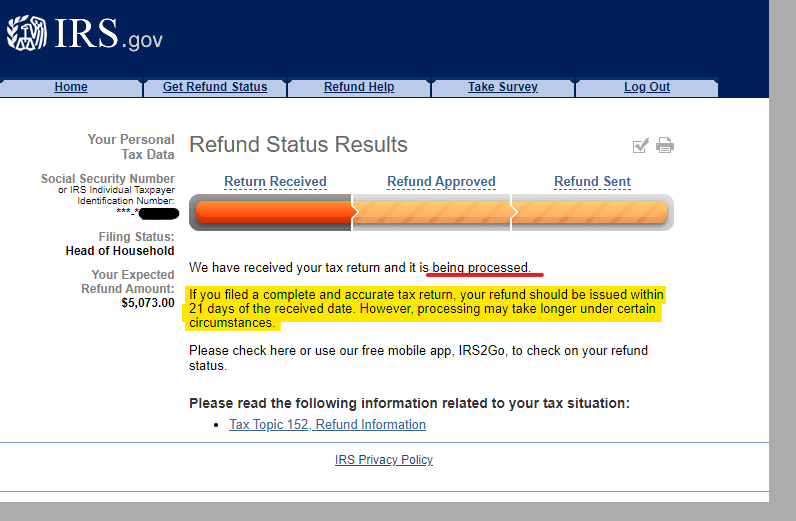

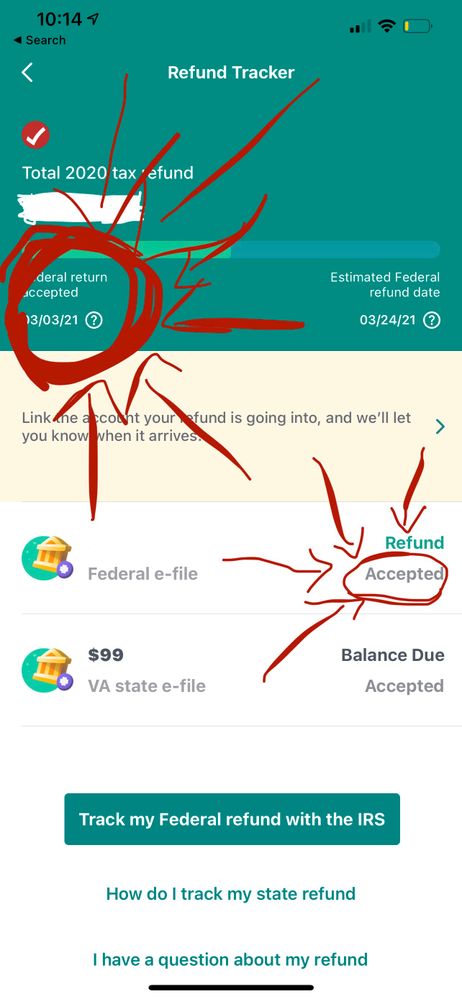

TurboTax lists my Federal refund as ACCEPTED as of 3/4/21. Please see attached picture.

The IRS website lists my refund as PROCESSING. I very much apologize for using the word PENDING instead of PROCESSING when I directly listed the IRS status independent from the what TurboTax

says. Please see attached picture.

Have a good day and would appreciate if you leave it at that. I will find another route for assistance other than this Intuit forum which I’ve posted and am responding to you know.

Very Respectfully,

Evan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Filed 3/4/21, Says ‘Accepted’ via TurboTax but IRS Says ‘Processing’ as of 6/9/21

Thank you very much for all of the information and links you provided. I understand they are overwhelmed and have a backlog but I don’t understand how it has been over 3 months since acceptance with no update whatsoever. More specifically, it has been 97 days. I would think if there were issues or questions regarding my return someone would have reached out.

Unfortunately, TurboTax has notified me that I will be charged via my Debit Card for the fees associated with their service even though I did and have always had them deducted from my return. If you know how I can get that remedied, please let me know. You’ve already provided a wealth of great information so I do not expect you to offer anymore help as I am grateful for what you have already provided.

Thanks again and have a great rest of your day.

Best Regards,

Evan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Filed 3/4/21, Says ‘Accepted’ via TurboTax but IRS Says ‘Processing’ as of 6/9/21

Once again it was Accepted for PREOCESSING ... the return was not APPROVED when you filed. Approval comes later after the return has finished being processed. What you posted shows acceptance only ... in the future your IRS bar will eventually show Approved like the screenshot I sent.

I was just trying to educate you on the correct verbiage so you can communicate better in the future and for all those who read this post in the future. I did not mean to insult but simply educate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Filed 3/4/21, Says ‘Accepted’ via TurboTax but IRS Says ‘Processing’ as of 6/9/21

If you chose to pay your TurboTax fees out of your Federal refund, and if your Federal refund has been delayed unusually long at the IRS (or if it's been reduced), TurboTax will want to be paid. They likely started sending you emailed bills to pay. If you don't respond by either paying or asking for a deferment, they will ultimately debit your bank account. If you can't pay now and wish to ask for a deferment, you need to do so quickly.

See this FAQ that explains the process. The first paragraph of the FAQ has a special phone number if you have a question or have a hardship and need to ask for a deferment.

Hours are 5AM-5PM Pacific (8AM-8PM Eastern), Mon-Fri

If you need to ask for a deferment, you should call them as soon as possible. Once they actually start the debit process, they say they can't stop it.

FAQ: Why was my bank account auto-debited for the TurboTax fees?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Filed 3/4/21, Says ‘Accepted’ via TurboTax but IRS Says ‘Processing’ as of 6/9/21

Again, I’m not sure why you think I am incompetent.

Can you find the word APPROVED anywhere in my original post or any comments unless replying to yourself?

My common sense tells me that ACCEPTED and APPROVED are two different things. I explicitly used the EXACT verbiage listed on the TurboTax website and IRS website.

Thank you for the information on the deferment of fee payment. Although in regards to my choice of vocabulary used in my posts, I am not sure why I am being told to not use words I didn’t and to use “correct” words. If you reread my post you can see I’ve never stated the returns were approved, only listed as accepted.

Thank you,

Evan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Filed 3/4/21, Says ‘Accepted’ via TurboTax but IRS Says ‘Processing’ as of 6/9/21

Refund Filed 3/4/21, Says ‘Accepted’ via TurboTax but IRS Says ‘Processing’ as of 6/9/21

Title is my question.

I’ve used TurboTax since I’ve gotten W2s.

For 2020, I made sure to submit my taxes well within time. I submitted on 3/4/21 and both returns were ‘Accepted’ within 48 hours, state and federal. My state return has processed and what I owed was debited.

My federal return is listed as pending on the IRS website with no updates at all since I submitted it.

What is going on with that? I’ve never waited this long and every time I contact the IRS I cannot speak to a live person as it will take me that route but the call drops. I’ve tried morning, afternoon, evening and with more than 3 phones.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Filed 3/4/21, Says ‘Accepted’ via TurboTax but IRS Says ‘Processing’ as of 6/9/21

Thank you for making an already stressful situation even more stressful and continuing to reply and correct me when I’ve politely asked you to not do so.

I had already apologized for using the word PENDING instead of PROCESSING. Does PENDING mean ACCEPTED in your vocabulary?

Quote of my apology to you for mistaking the word PENDING with PROCESSING;

“The IRS website lists my refund as PROCESSING. I very much apologize for using the word PENDING instead of PROCESSING when I directly listed the IRS status independent from the what TurboTax states.”

Thank you,

Evan

😔

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Filed 3/4/21, Says ‘Accepted’ via TurboTax but IRS Says ‘Processing’ as of 6/9/21

@Albrechtej Contact TT asap to request a deferral for the debit for the fees.

Turbo Tax says......

We understand that these are unprecedented times and we’re committed to helping our customers who are experiencing hardships. If you’re in need of assistance, call us by the Tuesday prior to your debit date at 1-888-808-1723 to speak with a trained specialist and mention “auto-debit”, or visit TurboTax Support.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

zsbprice456

New Member

sunninewill

New Member

kripsi

Returning Member

jpax456

New Member

user17647773072

New Member