in Events

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Why is my 2020 state tax refund being counted as taxable income if I didn't itemize in 2020?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my 2020 state tax refund being counted as taxable income if I didn't itemize in 2020?

I received a state tax refund in 2022 for the 2020 tax year because of an amended state return. TurboTax Deluxe is treating it as taxable income even though I did not itemize deductions for 2020. It is not giving me the option to say that I took the standard deduction like it does for my 2021 state refund. Can I override this ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my 2020 state tax refund being counted as taxable income if I didn't itemize in 2020?

Yes, you can override based on the following steps:

- In the Wages & Income sectiion, scroll down to "Other Common Income" and then click on what should be "Start" or "Revisit" at the "Refunds Received for State and Local Tax Returns".

- Your information previously entered should appear showing the State/Locality of the refund; click edit

- The refund information for amount and year should now show. Make sure they are correct and then click Continue

- Answer the remaining questions including that you took the Standard deduction in 2021

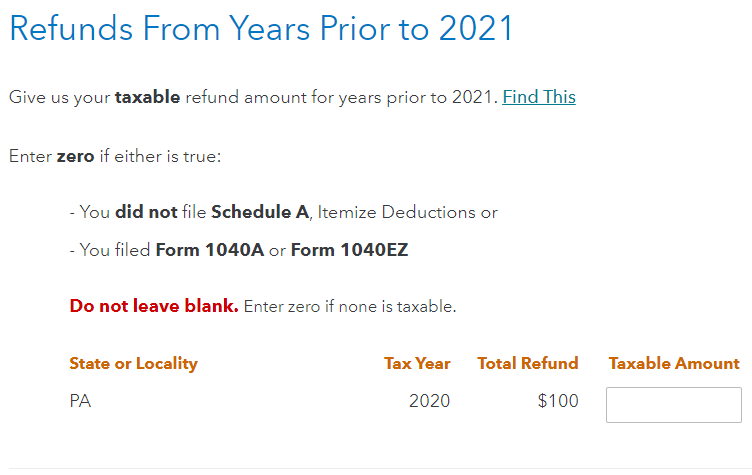

- That should eliminate the refund from being taxable. In some cases the following screen will appear. If this screen appears, simply delete the entry in the box for "Taxable Amount" if there is an entry in it:

I used the above state and numbers simply for example purposes. You should see your own numbers on the screens you access.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my 2020 state tax refund being counted as taxable income if I didn't itemize in 2020?

I would just delete it and leave it off if you took the Standard Deduction and know it's not taxable. Do you also have a 2021 refund to enter?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my 2020 state tax refund being counted as taxable income if I didn't itemize in 2020?

JosephS1, It does let me indicate I took the Standard deduction in 2021, but not for 2020 or prior years. I do not get the screen you show for either year, but I do see the data if I switch to the forms view. Can I enter zero for the taxable amount directly on the form ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my 2020 state tax refund being counted as taxable income if I didn't itemize in 2020?

VolvoGirl, That's my plan if I cannot get an override to work, but my concern would be leaving it off the return if the state reports this amount to the IRS. I don't want to raise any flags.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my 2020 state tax refund being counted as taxable income if I didn't itemize in 2020?

You need not worry about just leaving it off. Your history with the IRS will show the standard deduction was taken in 2020. Even if it does result in a notice asking for additional information, you can simply state in the response that you took the standard deduction for which the refund is applicable and it would be over at that point, other than perhaps a thank you for your explanation from the IRS (just don't hold your breath waiting for it).

Also, should a notice ever come, which is highly doubtful, enclose a copy of the page of your 2020 return showing the standard deduction taken that would add evidence to your reply.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my 2020 state tax refund being counted as taxable income if I didn't itemize in 2020?

thank you

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Raph

Community Manager

HollyP

Employee Tax Expert

user17621099375

Returning Member

ashleebreid

New Member

anonymouse1

Level 5

in Education