- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Yes, you can override based on the following steps:

- In the Wages & Income sectiion, scroll down to "Other Common Income" and then click on what should be "Start" or "Revisit" at the "Refunds Received for State and Local Tax Returns".

- Your information previously entered should appear showing the State/Locality of the refund; click edit

- The refund information for amount and year should now show. Make sure they are correct and then click Continue

- Answer the remaining questions including that you took the Standard deduction in 2021

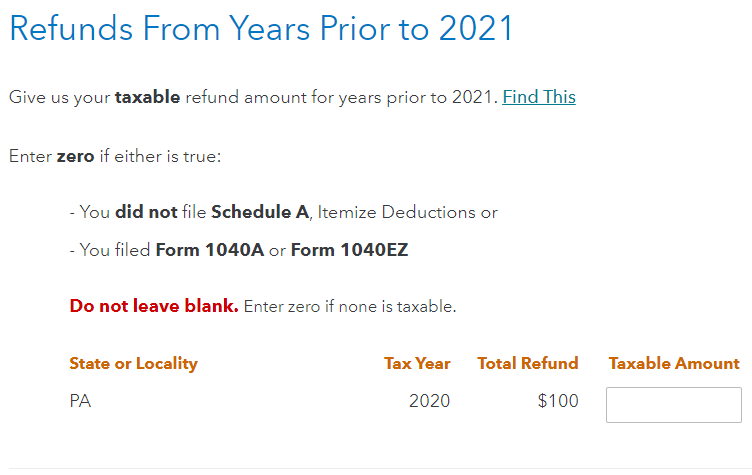

- That should eliminate the refund from being taxable. In some cases the following screen will appear. If this screen appears, simply delete the entry in the box for "Taxable Amount" if there is an entry in it:

I used the above state and numbers simply for example purposes. You should see your own numbers on the screens you access.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 14, 2023

7:54 AM