- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Why does my amended return show a large refund when I owed to begin with?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my amended return show a large refund when I owed to begin with?

I owed several thousands of dollars. A corrected 1099 form came with just a few hundred off the original form. When I log on to amend my return, I now have over a thousand dollars of refund owed to me. Why is this the case?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my amended return show a large refund when I owed to begin with?

When you start an amend the refund meter sets to zero. Then it changes to reflect the items that you amend.

To cancel the amend that seems to have errors, just click the cancel amend option.

Then start the amend again and change your two 1099-NEC entries. The number that will come up in the refund/owe meter is the amount of change from your original return. A change of a few hundred dollars on 1099-NEC's would not result in thousands of dollars in refund. Somethng went wrong in the amend.

The amend meter assumes that you have already paid the amount on your original return. Then the IRS will send you back the overpayment if there is one or you will owe the additional taxes from the refund if there is an amount owed when you complete the amend.

How to Amend

@tklavender2017

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my amended return show a large refund when I owed to begin with?

Did you report a 1099-G for unemployment comp on your original return? TT has updated the Federal program to reflect the new $10,200 deduction for that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my amended return show a large refund when I owed to begin with?

It's was a 1099-NEC for both. But now my TT amend says $0 and can't get back the original amended file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my amended return show a large refund when I owed to begin with?

When you start an amend the refund meter sets to zero. Then it changes to reflect the items that you amend.

To cancel the amend that seems to have errors, just click the cancel amend option.

Then start the amend again and change your two 1099-NEC entries. The number that will come up in the refund/owe meter is the amount of change from your original return. A change of a few hundred dollars on 1099-NEC's would not result in thousands of dollars in refund. Somethng went wrong in the amend.

The amend meter assumes that you have already paid the amount on your original return. Then the IRS will send you back the overpayment if there is one or you will owe the additional taxes from the refund if there is an amount owed when you complete the amend.

How to Amend

@tklavender2017

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my amended return show a large refund when I owed to begin with?

Thank you for your reply. Unfortunately, I am unable to find anywhere that allows me to cancel amend on my desktop. And every time I try to fix it, it screws up my original filed form. They should consider this for those of us that use CD's and desktops. Not everyone uses the online function.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my amended return show a large refund when I owed to begin with?

In the desktop version, you create a new file for your amend, so it does not affect your original file. Here are the complete directions to amend with the desktop version.

- Make sure you’ve e-filed or mailed your original return and that you’ve either received your refund or the IRS has taken payment out of your account. (The IRS will only accept a 1040X, or amended return, if your original 1040 was accepted.)

- Open TurboTax.

- Select Amend a filed return.

- Select the return you want to amend, and follow the instructions to make your changes.

- Now, make an "amend" copy your return by selecting Save As (Mac: select Duplicate) from the File menu. This preserves the originally-filed return.

- Name the copy to distinguish it from the original, like 2020 Amended Smith B Form 1040 Return.

- You should now be working inside the copy you'll be amending. Inside your program, search for amend and then click the Jump to link.

- Select Continue on the We'll help you change (amend) your return screen.

- On the following screen, Did you already file your return? select Yes, I've already filed my return and then select I need to amend my 2020 return.

- Select Continue and then carefully follow the instructions to amend.

You generally must file an amended return within three years of the date you filed the original return or within two years after the date you paid the tax, whichever is later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my amended return show a large refund when I owed to begin with?

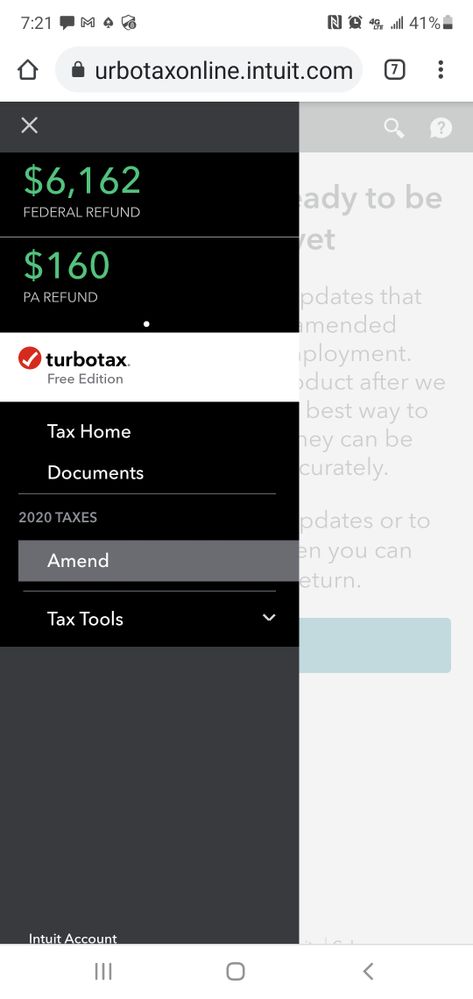

I filed 2020 taxes in February. My refund was $4698 and I got them back few weeks ago. However when I wanted to amend them due to being paid unemployment I click amend and it says I am unable to amend them due to IRS handling the unemployment tax break for those that already submitted taxes. I did however notice for some reason the federal amount on turbotax shows a higher number then the $4698. It shows $6162. The state tax still shows the same amount I originally received. I didn't touch anything so not sure why it shows a different number. Does anyone know why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my amended return show a large refund when I owed to begin with?

Did you enter the unemployment 1099G on your original return? Turbo Tax has been updated for the new 10,200 exclusion.

If you already filed and didn't get the 10,200 unemployment exclusion you do not need to amend. The IRS will be adjusting it for you. See,

You can log back into your return and it should automatically update your return and show you the new refund. But the updated return won't be sent. The IRS will adjust it for you.

If you have unemployment you can exclude up to 10,200 for each person if your income is under $150,000. Your unemployment compensation will be on Schedule 1 line 7. The exclusion will be on Schedule 1 Line 8 as a negative number. The result flows to Form 1040 Line 8.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my amended return show a large refund when I owed to begin with?

Hi and thank you for responding. I checked my 1040 it shows $22,894 under line 8 which is the unemployment total I had entered when I filed. There is no other number and no negative sign. Does this mean it was not adjusted and they will correct it? I am wondering if the number the federal amount shows when I click amend is the amount they came up with if exclusion was corrected. It's the only thing I can honestly think. When I deduct the amount I received from that number It's a little over a grand difference which would make sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my amended return show a large refund when I owed to begin with?

Yes if you didn't get the 10,200 exclusion the IRS will automatically adjust your return and send you a bigger refund or send it later. Unless your income is too high to qualify for it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lmunoz101923

New Member

ajahearn

Level 1

matto1

Level 2

jeremy-v12

New Member

lauraso

New Member