in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: I need to find the "allowable loss" on my 2020 tax return. Turbo Tax says line its on schedule D but I can't see it. Can you help me locate it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find the "allowable loss" on my 2020 tax return. Turbo Tax says line its on schedule D but I can't see it. Can you help me locate it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find the "allowable loss" on my 2020 tax return. Turbo Tax says line its on schedule D but I can't see it. Can you help me locate it?

I would like to file my 2020 tax return. Please help.

Thanks.

Email:[email address removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find the "allowable loss" on my 2020 tax return. Turbo Tax says line its on schedule D but I can't see it. Can you help me locate it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find the "allowable loss" on my 2020 tax return. Turbo Tax says line its on schedule D but I can't see it. Can you help me locate it?

If you are unable to locate it on your return, please follow the instructions here to contact us by phone, as we we are unable to view the return here in this public forum. @blackpot123

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find the "allowable loss" on my 2020 tax return. Turbo Tax says line its on schedule D but I can't see it. Can you help me locate it?

I too am looking for where "allowable loss" is on my 2022 tax transcript

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find the "allowable loss" on my 2020 tax return. Turbo Tax says line its on schedule D but I can't see it. Can you help me locate it?

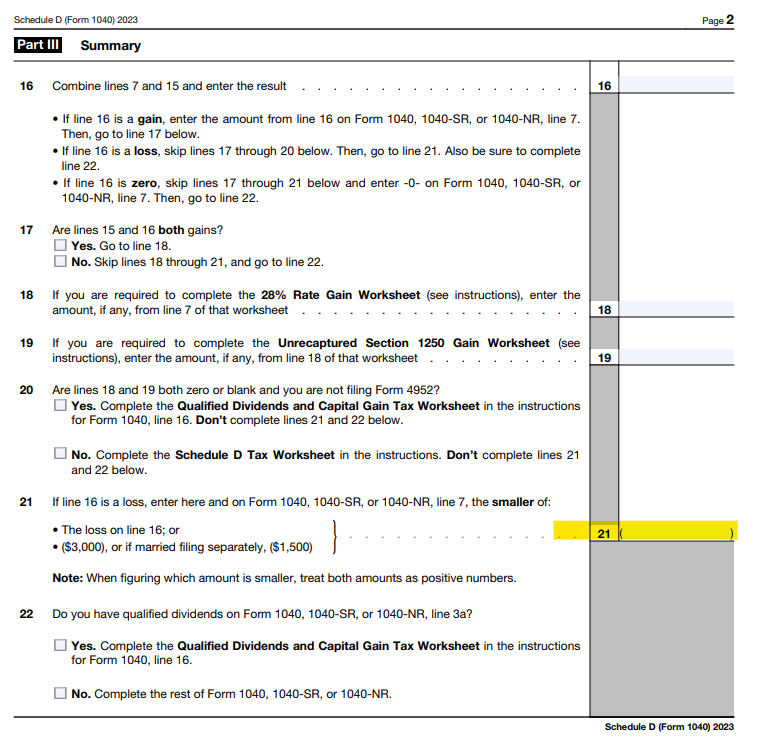

Your allowed loss is line 21 of Sch D. Capital loss is limited to $3,000 per year and you will carryover the rest. See:

- What is a capital loss carryover?

- What is a capital gain or loss?

- How can I tell if I'm entitled to a carryover loss from last year?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tbduvall

Level 4

dlz887

Returning Member

ripepi

New Member

fkinnard

New Member

oreillyjames1

New Member