- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Form 8915F-T for TY 2022 filing in 2023 -recent post

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Delete the disaster form & the 8915. The Disaster Form is right above the 8915 form. Then you will re-input your information. After I did this I was able to successfully submit my forms & they no longer were rejected by the IRS.

(You find the forms listed on the far left)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Thank you! I will try deleting and reenter...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

I am paying a lot to federal this year. Should I talk to a live expert? Can a live expert see something I am not seeing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

A live expert is a good option. A live tax expert can review your tax return with you and answer any questions you may have.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

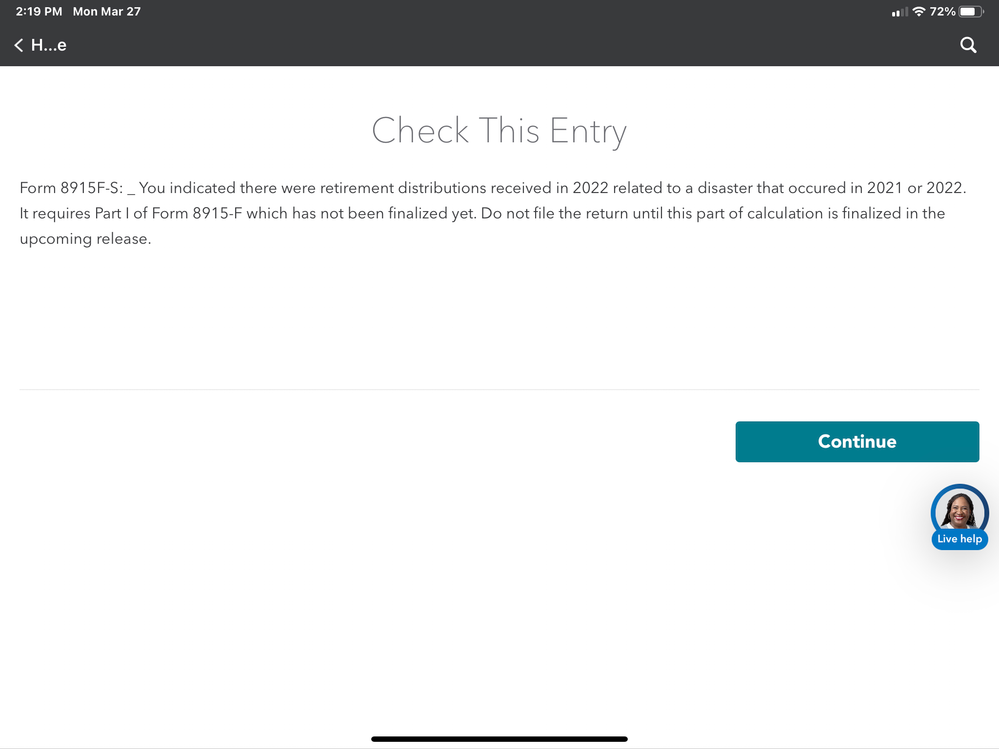

How do you delete the form? When I tried deleting it, it doesn't delete. This is message I keep getting.

You'll need to visit the form 1099-R retirement topic

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Yes, once you have deleted both Form 8915-F and the Qualified 2020 Disaster Retirement Distribution Worksheet then you will have to go back to the retirement section to report the 3rd portion of the 2020 Covid distribution.

If you didn't take any Covid distribution or other disaster distribution then answer "No" when TurboTax asks about it.

If you use TurboTax Online then please use the steps below to delete both "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and then go back to the retirement section and reenter the information:

- Open or continue your return in TurboTax.

- In the left menu, select "Tax Tools" and then "Tools".

- In the pop-up window Tool Center, select "Delete a form".

- Select "Delete" next to "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and follow the instructions.

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here", enter your information from your 2021 Form 9815-F, and then continue.

If you use TurboTax Desktop:

- Please switch to Form Mode (on the top)

- Scroll down and select "8915E Wks" (the worksheet will open)

- Select "Delete Form" at the bottom

- Switch to "Step-by-Step" (on the top)

- Click "Federal Taxes" on the top and select "Wages & Income"

- Click "I'll choose what to work on"

- Scroll down and click "Start/Edit" next to "IRA, 401(k), Pension Plan (1099-R)"

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here", enter your information from your 2021 Form 9815-F, and then continue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Just tried to finish my taxes again and still getting messages that 8915f is still not available.

Can you please advise as to when it will be ready for use?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

TurboTax is not going to fix this. From what I’ve read the issue existed last year as well. I was using the desktop version. After several weeks of waiting I entered my taxes in the Online version without issue and received my return last week.

I submitted a request to get a refund for the desktop version and was denied by TurboTax. I presented all receipts and documentation as requested. I got to pay twice and they don’t care. They kept my money. I had been a returning customer for 9 years straight.

Plan to use a different tool next year just like me! NO MORE TURBOTAX!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Please try to clear your cache, and delete the cookies on the browser. Once both are done, please close the browse and reopen it, and try once more.

Please let us know if this does not resolve the issue. @PacoakaJT

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

My forms were not rejected by the IRS I just enddd up paying several thousand more than was actually due. The weird part is that it was correct when I verified my forms but TurboTax changed the amount during filing. Then it showed this new amount in the amount due box but when I sent back to it a couple of months after paying 2021 taxes it showed the amount that should have been paid. I have filed an amended return so now I will see how long that takes. I printed the forms and mailed them because Tutbotax failed to efile an amendment as they said it would on their site. I won’t even try to explain the transitions of screens in trying to do that task! It was messed up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Thanks Carissa but am using it with IOS app on my iPad and just confirmed it's up to date.

Keep getting this message:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

I don’t know if it makes much difference. Every year for these last 3 years our taxes have gone up noticeably. There isn’t much said in the news. I think politicians try to cover it up by creating smoke screens around topics that really aren’t relevant to us although they may be sensational.

the government keeps printing money and this is the bigger cause of our economic woes but they have to have it to fund what their powerful constituents want. They keep raising interest rates which is killing investment spending and new business. Inflation continues so we behave according to the very definition of stupidity - doing the same thing and expecting different results. They talk about new jobs but never about how many old jobs have gone away.

Expect taxes to continue to rise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Agreed. Turbotax is no longer responsive to customer needs. They answer every question with another question or send you to the link where you just read what raised the question you are asking. They tell you to talk to someone else. It’s as if they hired a bunch of new people that they don’t have to pay much because they didn’t train them. They have them using the same knowledge base that we have direct access to mso they are literally the “no help whatsoever help desk.”

I’m going to get HR Block and compare the outputs and then decide what to do in the future. I think HR Block will refund what you paid for TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

@CarissaM - can you please advise?

Or do i need to scrap using TurboTax (9 years running now) and just go to H&R Block or whatever to get them done?

Please advise as so far support has been underwhelming and frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Don't wait, unless you want to try a bunch of hacked up manual solutions like clearing your cache and deleting forms only to find out those don't work either. Wouldn't make sense for TurboTax to fix the software wich they developed. Isn't that what we paid for?

Don't forget TurboTax F@@cked me and made me pay 2X to get my taxes complete. Once for the Desktop version (That software didn't work) and then the online version. Now they refuse to refund the cost of the desktop version even though it's broke!

FIX YOUR SOFTWARE TURBOTAX. Go elsewhere and finish up your taxes.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rodjan1970

New Member

redennis35

New Member

gildedbeeslc

New Member

kbarbs

New Member

CSeisert

Level 2