- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Form 8915F-T for TY 2022 filing in 2023 -recent post

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Please be advised that Turbo Tax has no intention of ever releasing this freaking form on time...EVER. It's been three delays this year and at least 17 days the last two years. I swear they have Steve Wonder programming from a treadmill while a person with poor English reads the requirements. Here's a simple statement to help you guys:

Case when taxyear in (2020,2021,2022) then 'do the same thing as prior' else 'do nothing else' end as form8915

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Seems to be true about the delays, however I feel that the blame rests on the IRS. I was given a 2/23/23 date for the 8915F-T form, then on 2/23/23 I received a notice of 3/2/23. Today I see it has been pushed out to 3/9/23. This smells like big government in 100% fashion. It's amazing that the IRS/federal government has all year to hash things out, but always finds a way to disappoint.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Please ensure the software is up to date by following the instructions here.

Please let us know if the issue is still ongoing after the update. @TravisTractor

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

CarissaM,

I am not having issues getting the TT program to update, it updates when I ask it to. I am waiting on form 8915F-T to become available so I can file. Unless you know something I don’t??? If you know it’s available then tell TT to make it available to me when I update please.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Once a form is approved by the IRS, we must then incorporate that form into the software. This takes some time. There are instances when the projected availability date gets pushed back to ensure we've accurately incorporated the form into the TurboTax software. We apologize for any inconvenience this may cause. As of today, Form 8915-F (for taxpayer and spouse) is scheduled to be available on 03/09/2023. @GDAWGG

Reference: When will my individual tax forms be available in TurboTax?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

While we are waiting for Intuit to "release" the official form for TY22, it does appear there is an 8915F-T form in my current package (albeit the "unofficial" one); and the appropriate amount appears to copy over to row 5b on Form 1040.

So am I 'reasonable' safe to assume that that the amounted being calculated as owed/due is pretty close to accurate?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Not until the form is released for use in your version of TurboTax.

Forms availability says the form will be available for use on March 9.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Should be able to bypass K3 form and efile by going to your K-1 and removing the checkmark in Box 16.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

That is correct. If you do not need to report K-3 income then you do not check box 16. However, if you file your return and receive a K-3 for foreign income at a later date you will need to amend the return. To amend your return in TurboTax you can follow these steps:

- Sign in to TurboTax

- On the home screen, scroll down to Your tax returns & documents and select the year you want to amend

- Select Amend (change) return, then Amend using TurboTax Online

- If you're told to amend your return via TurboTax Desktop, follow the steps for TurboTax CD/Download below instead

- On the screen OK, let's get a kickstart on your amended return, select the reason(s) you're amending and Continue

- When you reach Here's the info for your amended federal return, select Start next to the info you need to change

- Continue through the screens, make the changes you need to make, and carefully answer the remaining questions to finish amending your return

For more information on amending returns, see the link below:

How do I amend my federal tax return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Yeah, I am in same boat (along with many others, I am sure). Today is 3/8. If I logon to TurboTax tomorrow and that 3/9/23 date changes and gets pushed back again, I am going to freak.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Yeah! As of midnight tonight the form is up! I successfully e-filed my return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

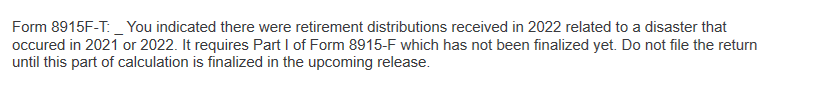

I updated turbo tax and now it has 8915-F but says Part 1 is not finalized yet. When will that be finalized?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

So, here is the deal. My Federal return was rejected because TurboTax messed up the coronavirus related code on form 8915-F, line C. I contacted help and a very nice rep (Thanks Tammy!) told me that ALL her calls this morning have been about this one form. According to Tammy, TurboTax is aware of the broken form and is working to fix it. They will send out an email when its fixed and I can re-file. No Timeline for the fix was given.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

Do not file 8915-F yet! Your return will be rejected. Turbo tax has some bug that is putting the word coronavirus on line C of the form when box D should be checked and line c should be blank. Tried to fix it manually and could not. $160 for turbo tax to file my taxes yeah ok, I know the issue but can’t fix it. $160 to do my taxes wrong.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915F-T for TY 2022 filing in 2023 -recent post

you know what's great.... the form is now available and i filled it out correctly and was on the phone with a rep

for 45 min and no one can find an issue yet i keep getting rejected due to this form when i file. so they're telling me to file by mail. literally the worst process every year

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rodjan1970

New Member

redennis35

New Member

gildedbeeslc

New Member

kbarbs

New Member

CSeisert

Level 2