- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Federal return decreased

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal return decreased

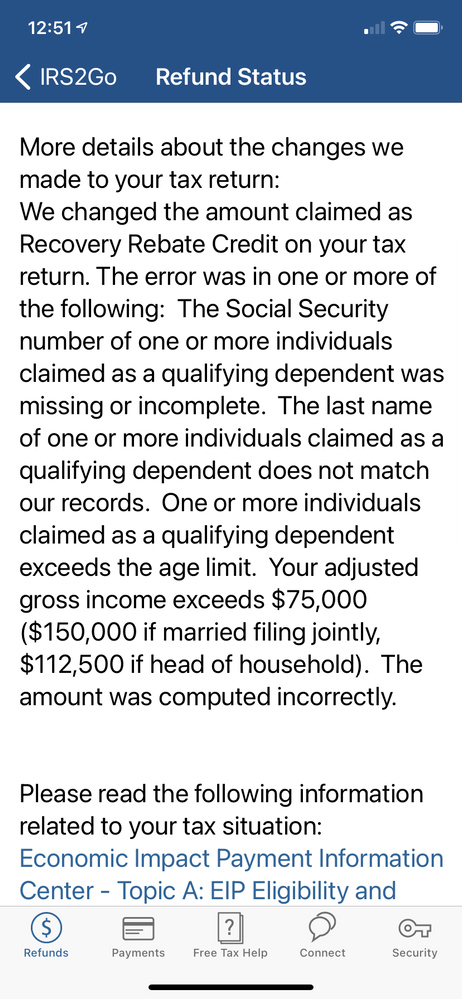

I just received that my federal tax refund has been adjusted, this year is the first time I’m filing married-filing jointly. We are also claiming my step son this year. I’ve always had my daughter as I’m a single parent to her….I’m so confused why they would do this we didn’t even make 150k someone please help before I have to call 🥺

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal return decreased

We cannot see your tax return. We know nothing about the ages of the children you claimed on your 2020 return. You cannot receive the first or second stimulus payment for a child who was over the age of 16 at the end of 2020. Was one of them over 16?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal return decreased

@xmasbaby0 @They were both 11 at the end of 2020. My daughter and my step son.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal return decreased

Okay---that message you posted gave you kind of a "menu" of reasons why one of the kids did not qualify. Have you double-checked the dates of birth and Social Security numbers you entered? Did you say that both of them lived with you for at least 7 months of 2020? You will have to wait for a letter they will send that may be more explicit about the reason for the reduction in your refund. TurboTax gets no information when the IRS reduces your refund. The IRS does make mistakes so when you see what the exact reason is you may be able to call and get it corrected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal return decreased

@xmasbaby0 thanks! I just have never been through this haha I checked the ssn and they are correct I’ll double verify the bdays are correct and yes my daughter is 100% with me and my

step son was 7 months with us. Again thank you for the help!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lindajbyrne1

New Member

Snorkeling4

New Member

laura_borealis

Level 4

TheMotorCity

New Member

bradyrhatch

New Member